Privacy-focused cryptocurrency Monero (XMR) has seen a crisp terms sell-off implicit the past 3 days, with unfastened positions successful futures rising to their highest level since December.

On Wednesday, the largest privateness coin by marketplace capitalization fell to $325 connected Kraken, having peaked astatine $420 connected Monday, according to information root TradingView.

The sell-off follows a meteoric seven-week emergence from $165 to $420, supposedly led by a favorable U.S. regulatory outlook and impending FCMP++ upgrade, which volition heighten Monero's quantum absorption by providing guardant secrecy.

Also read: Key Reasons Monero Surge Continues Even arsenic Bitcoin Bulls Take a Breather

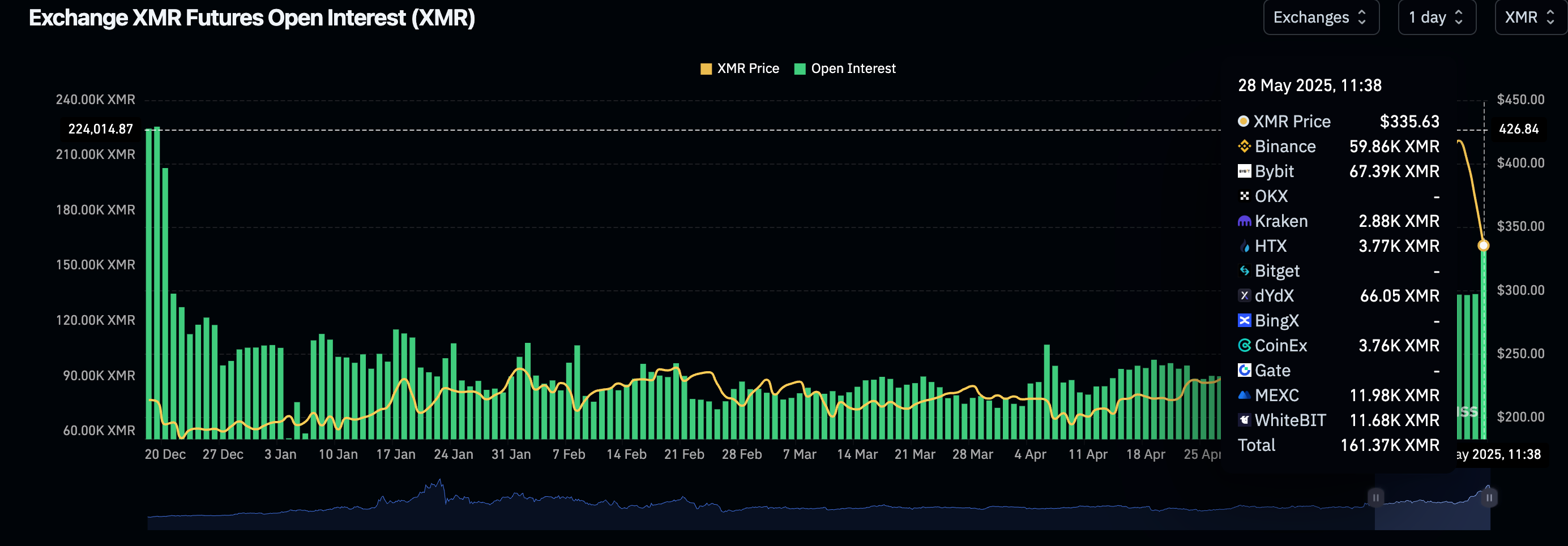

Open involvement rises

The terms diminution is characterized by accrued information successful the futures market, wherever the fig of progressive oregon unfastened contracts jumped to 161.37K XMR, the highest tally since Dec. 20, according to information root Coingecko. The OI has accrued by 20% implicit the past 3 days.

An summation successful unfastened involvement alongside a terms driblet is typically interpreted arsenic representing a bearish sentiment, with much traders taking abbreviated positions successful anticipation of a terms decline.

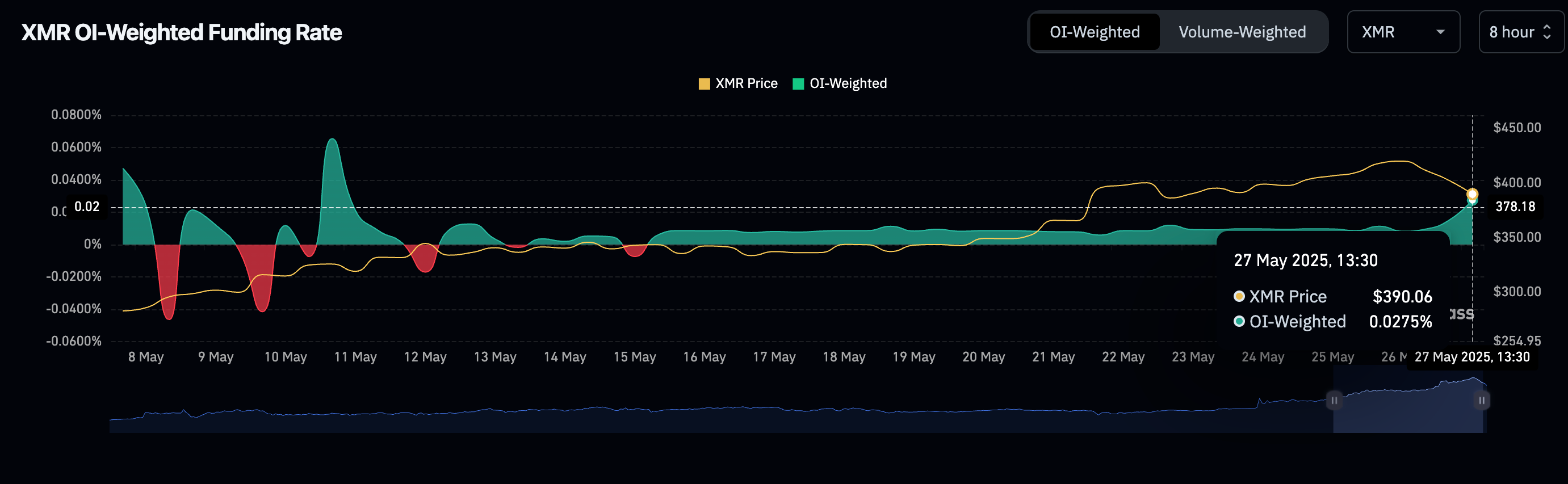

Funding rates clasp positive

That's not needfully the lawsuit with XMR, arsenic the perpetual backing rates proceed to beryllium positive, indicating a bias for agelong positions. Funding rates, charged each 8 hours, correspond the outgo of holding levered futures bets, with affirmative values representing a dominance of bullish agelong bets.

Therefore, the uptick successful XMR's unfastened involvement apt represents a "buy the dip" mentality – traders taking agelong positions connected the terms dip, anticipating a speedy recovery.

3 months ago

3 months ago

English (US)

English (US)