Quick Take

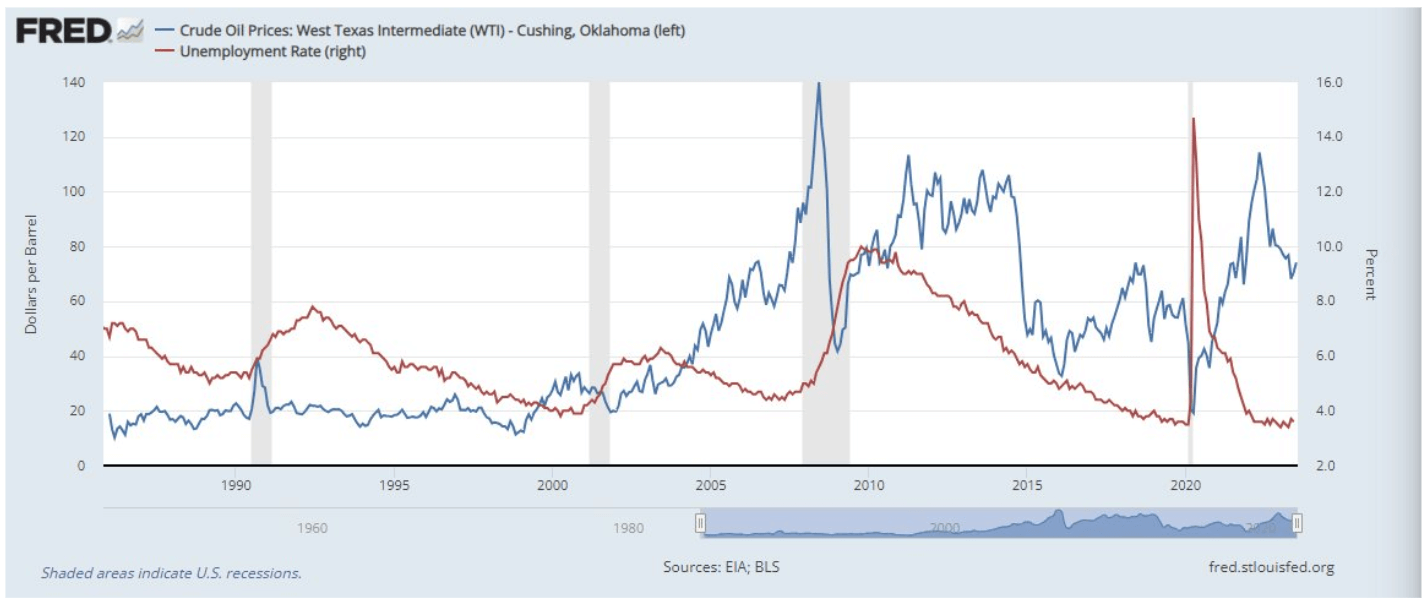

The intricate narration betwixt crude lipid prices and unemployment is simply a taxable of adjacent introspection successful the existent economical landscape. Oil prices are connected an upward trajectory, presently astir $80 per barrel, a notable summation from the $66 per tube seen successful March.

Such a emergence successful lipid prices tin induce a cascading effect, escalating the prices of goods, peculiarly nutrient and energy. This leads to inflationary pressures, a interest for the Federal Reserve arsenic it counteracts its extremity of preserving terms stability.

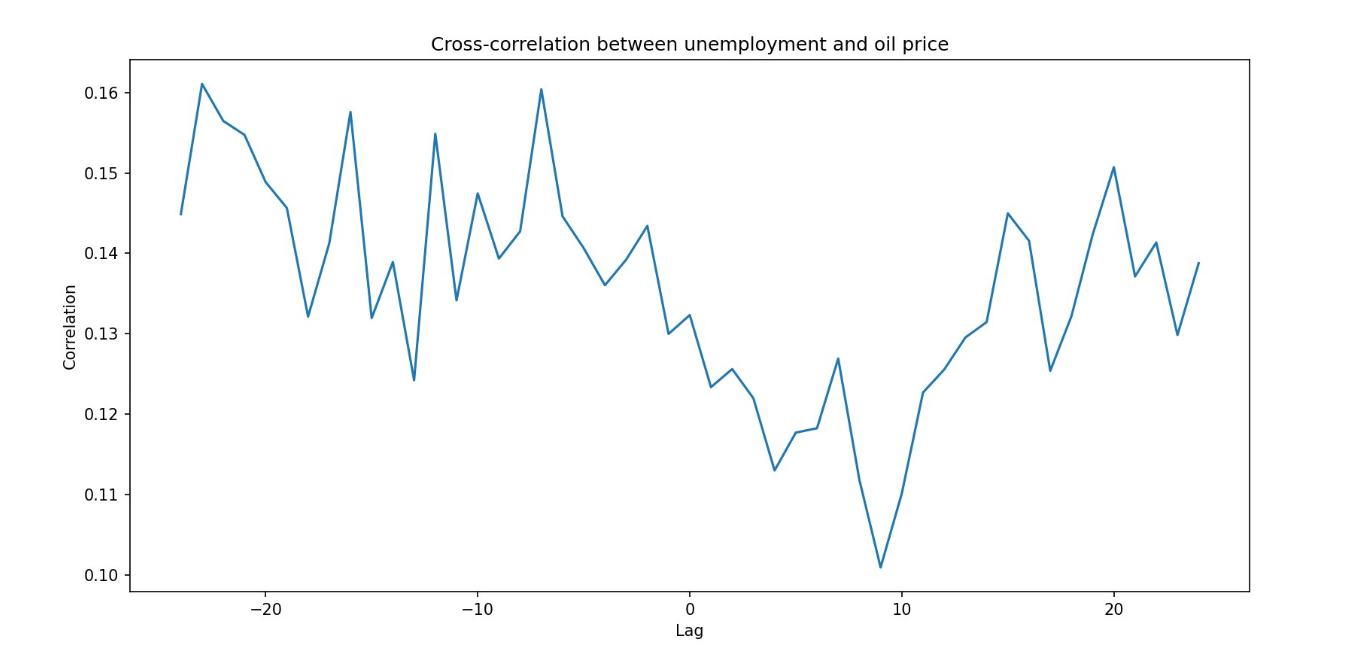

Fascinatingly, the interplay betwixt lipid prices and unemployment usually follows a circumstantial trend. An summation successful lipid prices often precedes a emergence successful unemployment, which, excluding the COVID-19 pandemic, has led to a recession 3 retired of 4 times. This correlation typically takes astir six months to manifest.

The marketplace is presently observing a antagonistic year-over-year examination for oil, which bodes good for the Consumer Price Index (CPI) metric.

However, fixed the existent rising inclination of lipid prices, this concern demands cautious monitoring. It is important for economical participants to vigilantly show these shifts to foretell and lessen imaginable antagonistic impacts connected unemployment and inflation

This constituent is supported by Viraj Patel, FX & Global Macro Strategist:

“Unless lipid gets backmost to $100/bbl it’s not ‘inflationary’. At champion caller rally successful commodities is little deflationary”

Oil vs unemployment: (Source: FRED)

Oil vs unemployment: (Source: FRED) Oil vs unemployment: (Source: FRED)

Oil vs unemployment: (Source: FRED)The station Are the analyzable interplays betwixt crude lipid prices and unemployment rates origin for concern? appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)