It has been wide accepted that Bitcoin ETF applications person been the main operator for Bitcoin’s instrumentality to the April 2022 level astatine supra $40k. The thesis is simple: with a caller furniture of organization legitimacy, the superior excavation for Bitcoin inflow would deepen.

From hedge funds and commodity trading advisors (CTAs) to communal and status funds, organization investors person casual entree to diversify their portfolios. And they would bash truthful due to the fact that Bitcoin is an anti-depreciating asset.

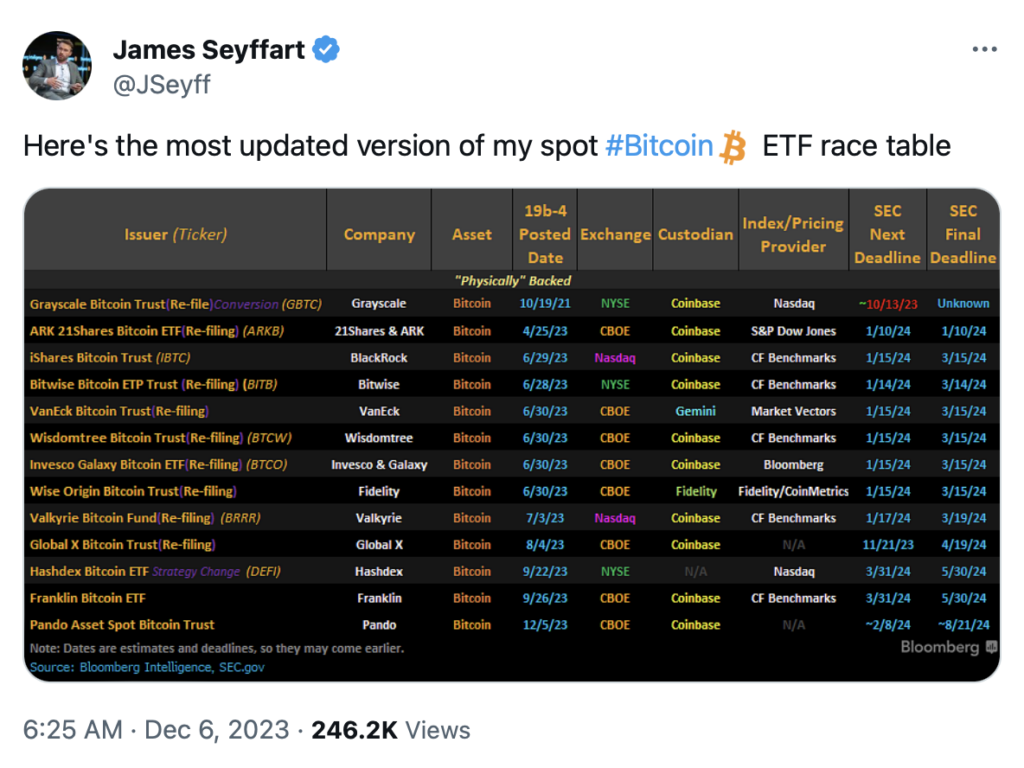

Not lone against forever-depreciating fiat currencies but against not-so-capped gold. In contrast, Bitcoin is not lone constricted to 21 cardinal but its integer quality is secured by the world’s astir almighty computing network. So far, 13 applicants person maneuvered to service arsenic organization Bitcoin gateways.

Source: Twitter @JSeyff

Source: Twitter @JSeyffAccording to Matthew Sigel, VanEck’s Head of Digital Asset Research, SEC approvals volition apt bring “more than $2.4 billion” successful H1 2024 to boost Bitcoin price. Following the SEC’s tribunal conflict nonaccomplishment against Grayscale Investment for its Bitcoin trust-ETF conversion, the Bitcoin ETF approvals are present perceived arsenic near-certainty.

Most recently, SEC Chair Gary Gensler met with Grayscale representatives alongside seven different Bitcoin ETF applicants. Later, successful a CNBC interview, Gensler confirmed that the way to Bitcoin ETFs is simply a substance of sorting retired technicalities.

“We had successful the past denied a fig of these applications, but the courts present successful the District of Columbia weighed successful connected that. And truthful we’re taking a caller look astatine this based upon those tribunal rulings.”

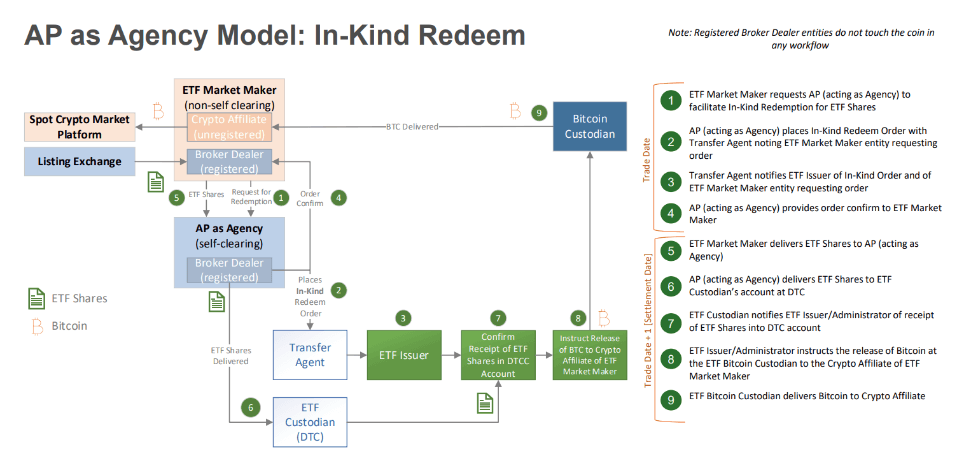

The astir telling indicator successful that absorption is that BlackRock, the world’s largest plus manager, has integrated Wall Street-friendly rules. In that framework, banks could enactment arsenic authorized participants (APs) successful Bitcoin ETF exposure. This is besides notable fixed that Gary Gensler himself is simply a erstwhile Goldman Sachs banker.

Considering this apt horizon, what would the Bitcoin ETF scenery look like?

The Role and Concerns of Custodians successful Bitcoin ETFs

Of 13 Bitcoin ETF applicants, Coinbase is the BTC custodian for 10. This dominance is not surprising. BlackRock partnered with Coinbase successful August 2022 to nexus BlackRock’s Aladdin strategy with Coinbase Prime for organization investors.

Furthermore, Coinbase has established a cozy narration with authorities agencies, from ICE and DHS to Secret Service, to supply blockchain analytics software. At the aforesaid time, the largest US crypto speech keeps way of instrumentality enforcement and bureau accusation requests successful annual transparency reports.

As the favored pick, Coinbase would service the dual relation of crypto speech and ETF custodian. This drove Coinbase (COIN) shares to caller highs this year, preparing to adjacent 2023 astatine +357% gains. On the different hand, the precise aforesaid SEC that regulates Coinbase arsenic a publically traded company, sued Coinbase successful June 2023 for operating arsenic an unregistered exchange, broker, and clearing agency.

According to Mike Belshe, BitGo CEO, this could origin friction connected the way to Bitcoin ETF approvals. In particular, Belshe views Coinbase’s fusion of merchant and custodial services arsenic problematic:

“There are galore risks successful mounting up the Coinbase concern that we bash not understand. There is simply a precocious probability that the SEC volition garbage to o.k. applications until these services are wholly separated,”

Previously, the SEC’s often-stated reasoning down Bitcoin ETF refusal revolved astir marketplace manipulation. For instance, arsenic the recipient of BTC flows, Coinbase could front-run ETF orders conscionable earlier ETF bid execution to nett from the terms differential.

The SEC has insisted connected strict trading controls and marketplace surveillance to forestall imaginable marketplace manipulation. This is connected apical of the existing partnership betwixt Coinbase and Cboe Global Markets for surveillance-sharing.

Suffice to say, it is successful the involvement of Coinbase and its COIN shareholders to not erode the integrity of BTC custody. Of greater value is however Bitcoin redemptions volition beryllium accomplished.

In-Kind vs. In-Cash Redemptions: Analyzing the Options

The Bitcoin ETF conception revolves astir BTC vulnerability portion avoiding the imaginable pitfalls of BTC self-custody. After all, it has been estimated that up to 20% of Bitcoin supply is everlastingly mislaid owed to forgotten effect phrases, phishing and different self-custody foibles.

Once that much centralized BTC vulnerability is accomplished, however would investors redeem the exposure? In summation to marketplace surveillance, this has been the SEC’s focal point, bifurcating redemptions into:

- In-kind redemptions: While existing Grayscale (GTBC) shares are not straight redeemable for Bitcoin, relying connected the secondary marketplace instead, Bitcoin ETFs would alteration that. The aforementioned authorized participants (APs) would beryllium capable to speech BTC ETF shares for a corresponding BTC amount.

This is the preferred attack of astir Bitcoin ETF applicants, fixed its communal usage successful traditional stock/bond ETFs. This attack would besides payment the market, arsenic it minimizes the hazard of terms manipulation by avoiding the request for large-scale BTC sales. Instead, APs tin gradually merchantability their bitcoins without flooding the marketplace to artificially suppress the price.

- In-cash redemptions: By default, this attack is reductionist, offering a much nonstop BTC-to-fiat pipeline erstwhile APs speech ETF shares for cash.

Given that the SEC is simply a portion of the USG fiat system, the watchdog bureau prefers it. In-cash redemptions would adjacent the redemption lifecycle loop by keeping the superior successful TradFi alternatively of exploring BTC custody.

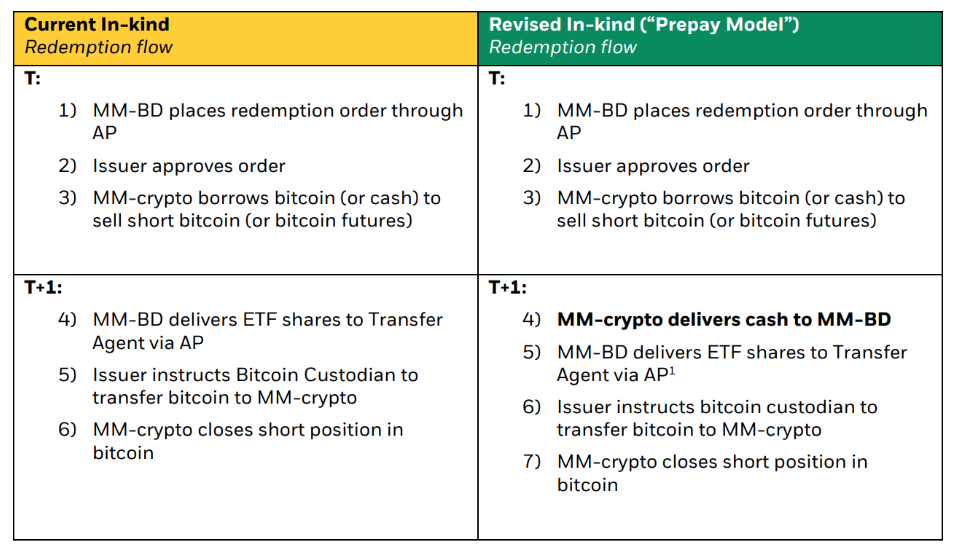

As of the November 28th memorandum betwixt the SEC and BlackRock, it is wide that the attack is not yet settled. BlackRock revised its in-kind redemption model, pursuing the SEC’s interest connected marketplace shaper (MM) risk. In the caller model, determination would beryllium an further measurement betwixt the MM and the marketplace maker’s registered broker/dealer (MM-BD).

Against the in-cash model, the revised in-kind exemplary would region the request to pre-fund merchantability trades. This means that ETF issuers don’t person to merchantability assets/raise currency to conscionable AP redemption requests. Despite the complexity, this wouldn’t interaction unlevered escaped currency flow.

Moreover, marketplace makers would load the hazard of redemption execution alternatively of that hazard falling onto APs. With little transaction costs and amended bulwark against marketplace manipulation, BlackRock’s preferred in-kind redemptions look to summation ground.

Another ample plus manager, Fidelity Investments, besides prefers an in-kind exemplary arsenic noted successful the December 7th memorandum.

It volition past beryllium up to the SEC to acceptable the post-Bitcoin ETF landscape.

Market Implications and Investor Perspectives

In the short-run, pursuing the Bitcoin ETF approvals, the VanEck expert estimates $2.4 cardinal inflow. VanEck forecasts a $40.4 cardinal deeper superior excavation wrong the archetypal 2 years.

In the archetypal year, Galaxy researcher Alex Thorn sees implicit $14 cardinal successful superior accumulation, which could propulsion the BTC terms to $47,000.

Some analysts are much optimistic, however. The Bitwise probe squad forecasts that Bitcoin ETFs volition not lone beryllium “the astir palmy ETF motorboat of each time” but that Bitcoin volition commercialized supra the caller all-time-high of $80k successful 2024.

If the SEC follows done connected its anti-crypto tradition, it could prime immoderate details that would person a deterrent effect. For instance, a precocious redemption threshold would disincentivize APs to make BTC ETF shares successful the archetypal spot due to the fact that the upfront outgo of buying a ample magnitude of bitcoins would beryllium perceived arsenic excessively burdensome and risky.

Case successful point, existing golden ETF redemptions, treated arsenic mean income, incur 20% semipermanent capital gains tax. On the different hand, in-cash redemptions would not trigger a taxable lawsuit until Bitcoin is sold.

If the SEC approves in-cash models for immoderate applicants, investors would beryllium much incentivized to redeem ETF shares successful currency instead. In turn, this could pb to greater terms manipulation potential.

Altogether, the SEC has ample wiggle country to spot a ample downward unit connected the terms of Bitcoin, notwithstanding its stated extremity of capitalist protection.

Conclusion

2024 is poised to beryllium the trifecta twelvemonth for Bitcoin. With Bitcoin ETF inflows, the marketplace besides expects the 4th Bitcoin halving and the Fed’s ingress into complaint cuts. In the meantime, the dollar volition proceed to erode, adjacent successful the best-case script of 2% yearly ostentation rate.

The second 2 drivers whitethorn adjacent overshadow Bitcoin ETFs, careless if the SEC opts for in-kind oregon much downward-loaded in-cash redemptions. In either case, Bitcoin is poised to transverse a caller legitimacy milestone. This itself is bound to delight Bitcoin holders implicit the pursuing years.

The station Approaching the motorboat of spot Bitcoin ETFs: Strategies for redemption and marketplace impact appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)