Since Ethereum’s Merge connected Sep. 15, 2022, the crypto manufacture has been abuzz with discussions astir its proviso dynamics. The Merge marked the network’s modulation from a Proof-of-Work (PoW) statement mechanics to a Proof-of-Stake (PoS), importantly altering its issuance rate. This transition, coupled with the implementation of EIP-1559 successful August 2021, has led to oscillations successful Ethereum’s proviso betwixt inflationary and deflationary states.

In the contiguous aftermath of the Merge, Ethereum’s proviso exhibited deflationary characteristics. This deflationary inclination was chiefly driven by the burning mechanics introduced by EIP-1559, which removes a information of the transaction fees from circulation.

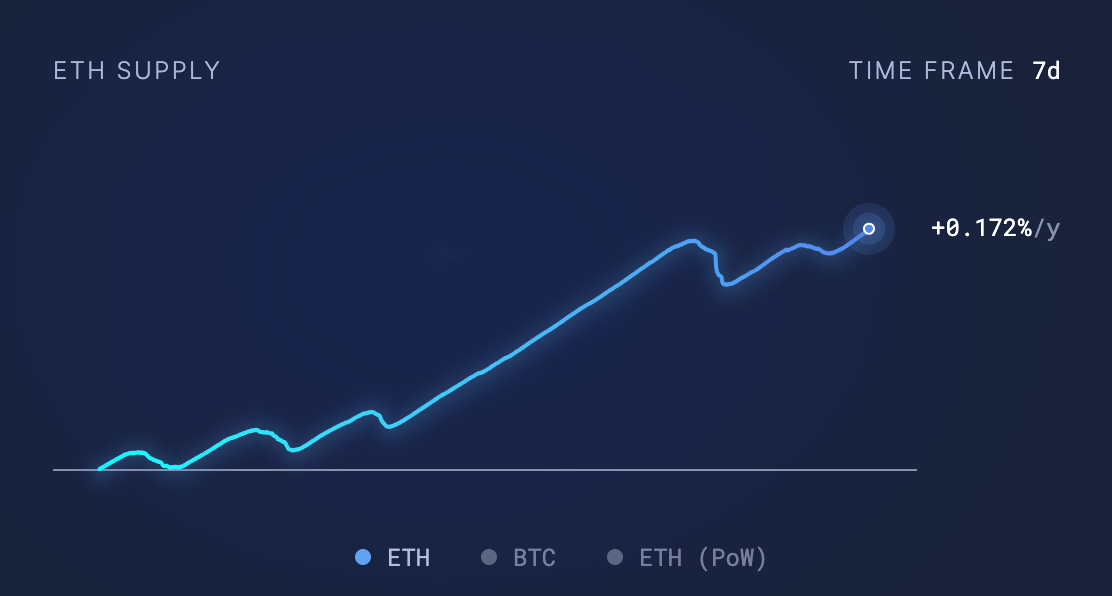

However, observing the proviso implicit shorter clip frames shows inflationary tendencies, with an ostentation complaint of +0.172% observed implicit a 7-day period.

Graph showing the ostentation complaint of Ethereum’s proviso implicit 7 days (Source: Ultrasound.Money)

Graph showing the ostentation complaint of Ethereum’s proviso implicit 7 days (Source: Ultrasound.Money)Over a 30-day period, this ostentation stands astatine +0.013%.

Graph showing the ostentation complaint of Ethereum’s proviso implicit 30 days (Source: Ultrasound.Money)

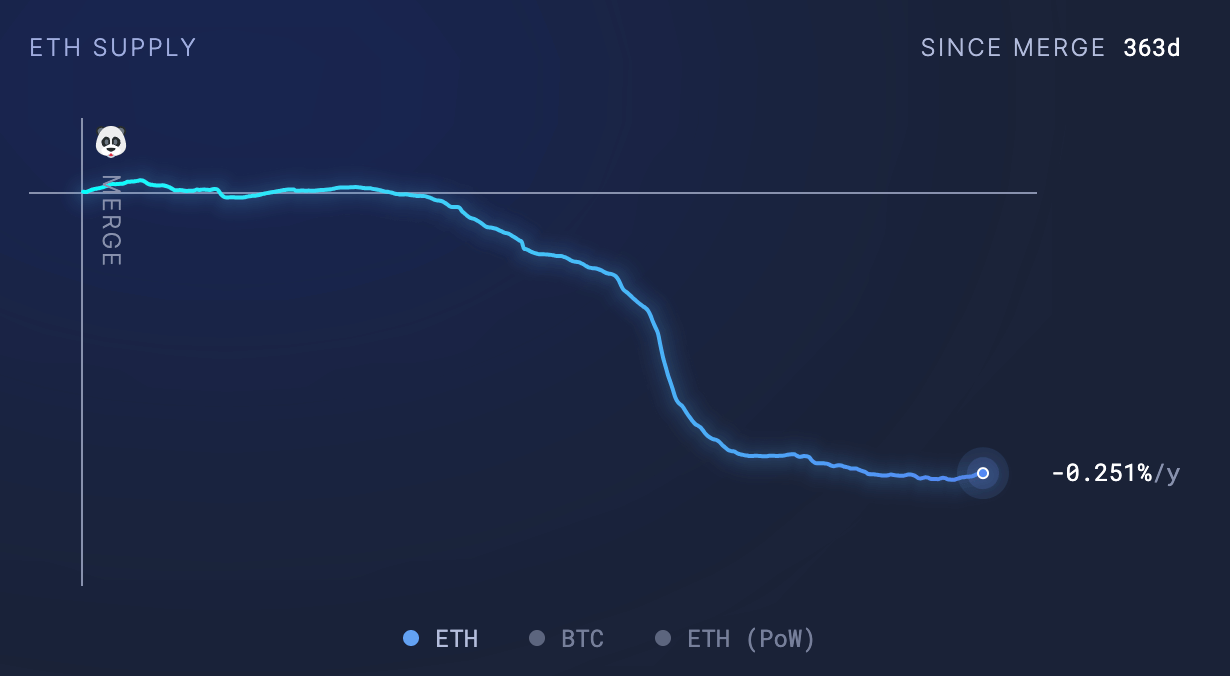

Graph showing the ostentation complaint of Ethereum’s proviso implicit 30 days (Source: Ultrasound.Money)Yet, erstwhile zooming retired to see the broader representation since the Merge, Ethereum’s proviso remains deflationary, decreasing by -0.251%.

Graph showing the ostentation complaint of Ethereum’s proviso implicit 363 days (Source: Ultrasound.Money)

Graph showing the ostentation complaint of Ethereum’s proviso implicit 363 days (Source: Ultrasound.Money)The oscillation betwixt inflationary and deflationary states has profound implications for Ethereum and its stakeholders.

A deflationary asset, by nature, tends to summation successful worth implicit clip owed to its expanding scarcity. This could heighten Ethereum’s worth proposition arsenic a store of worth akin to Bitcoin, perchance attracting much investors. However, prolonged deflation could besides pb to hoarding behaviors, perchance reducing Ethereum’s velocity and inferior arsenic a mean of exchange.

On the flip side, a consistently inflationary proviso ensures that validators successful the PoS strategy are rewarded for their efforts successful securing the network. This continuous issuance of caller ETH tin supply economical information and sustainability for the Ethereum network.

However, determination is simply a imaginable dilution of worth for existing ETH holders and a imaginable alteration successful the purchasing powerfulness of ETH. Continuous ostentation could exert downward unit connected the terms of ETH. If the complaint of caller ETH issuance outpaces demand, the terms could decrease.

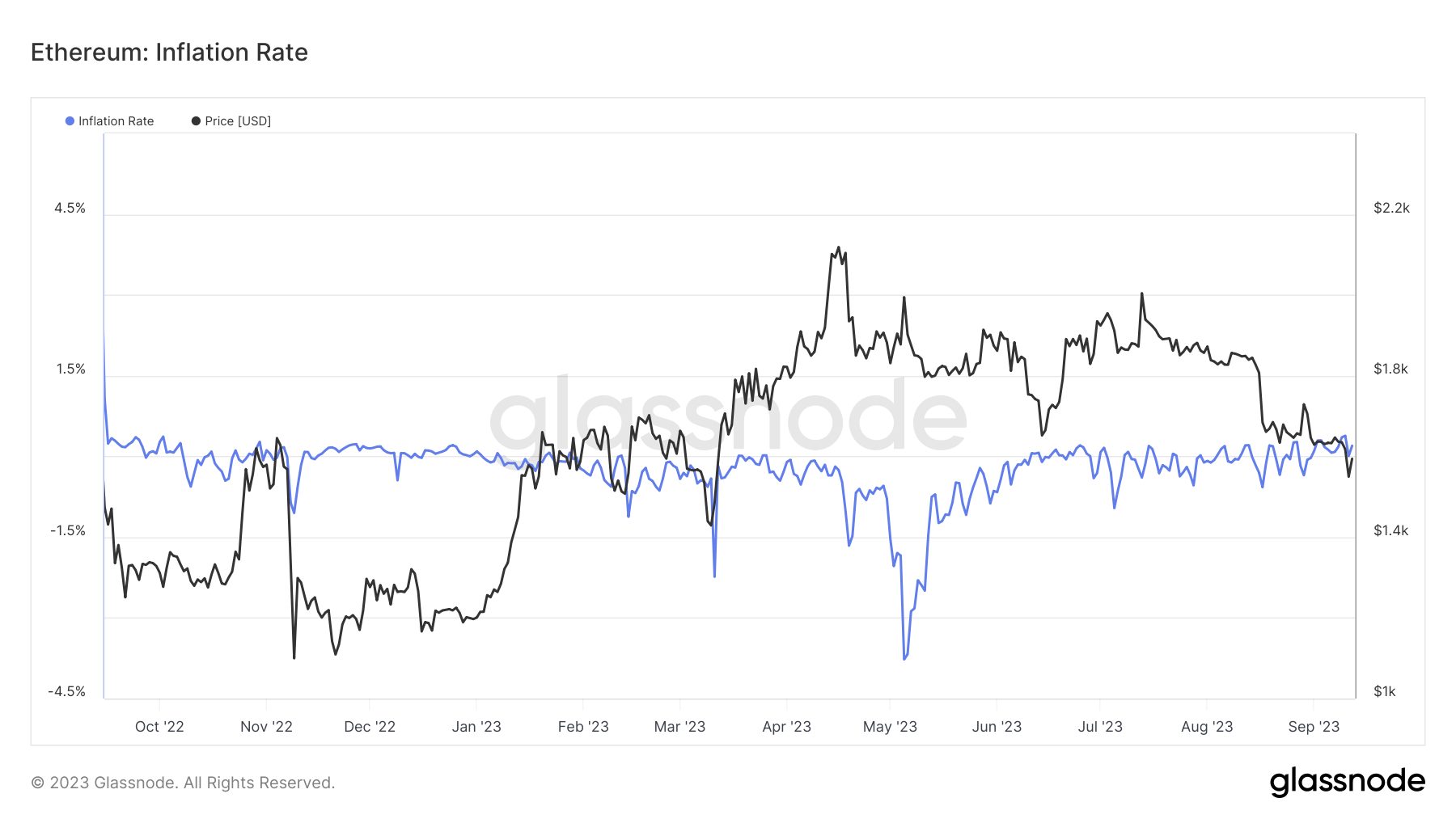

Graph showing the oscillation successful Ethereum’s proviso ostentation complaint from September 2022 to September 2023 (Source: Glassnode)

Graph showing the oscillation successful Ethereum’s proviso ostentation complaint from September 2022 to September 2023 (Source: Glassnode)For the broader cryptocurrency market, Ethereum’s proviso dynamics post-merge service arsenic a lawsuit survey successful balancing web information with economical incentives. Ethereum’s oscillations item the challenges and complexities of managing a cryptocurrency’s monetary argumentation successful a decentralized ecosystem.

Further, they tin marque it hard for investors and users to foretell its economical future, perchance starring to decreased request for the volatile asset.

Ethereum’s proviso dynamics since the Merge underscores the intricate interplay betwixt method upgrades, economical incentives, and marketplace forces.

The station Analyzing Ethereum’s inflationary and deflationary proviso trends appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)