Monitoring the question of Bitcoin‘s supply, peculiarly erstwhile categorized by the clip since past active, is pivotal for knowing capitalist behaviour and forecasting marketplace trends. This investigation sheds airy connected the existent authorities of Bitcoin holdings and provides captious insights into its aboriginal movements.

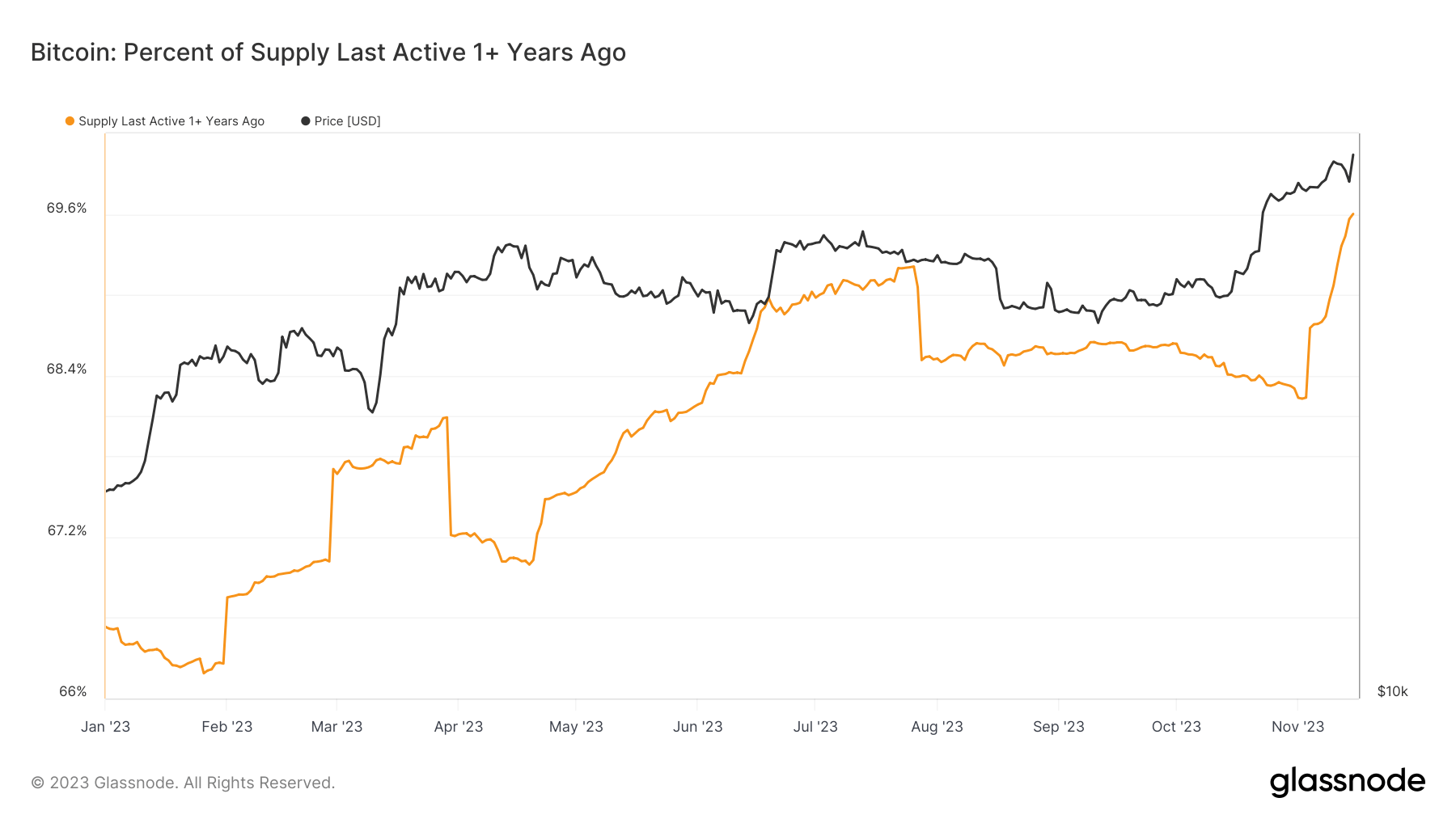

There has been a singular displacement successful Bitcoin’s proviso dynamics that followed its caller terms rally. In conscionable implicit a month, Bitcoin’s terms surged from $26,846 to $37,964. During the aforesaid period, the percent of Bitcoin’s proviso past moved implicit a twelvemonth agone accrued by astir 4%, indicating a heightened inclination among investors to clasp their assets for longer durations.

Graph showing the percent of Bitcoin’s proviso that hasn’t been moved for implicit a twelvemonth successful 2023 (Source: Glassnode)

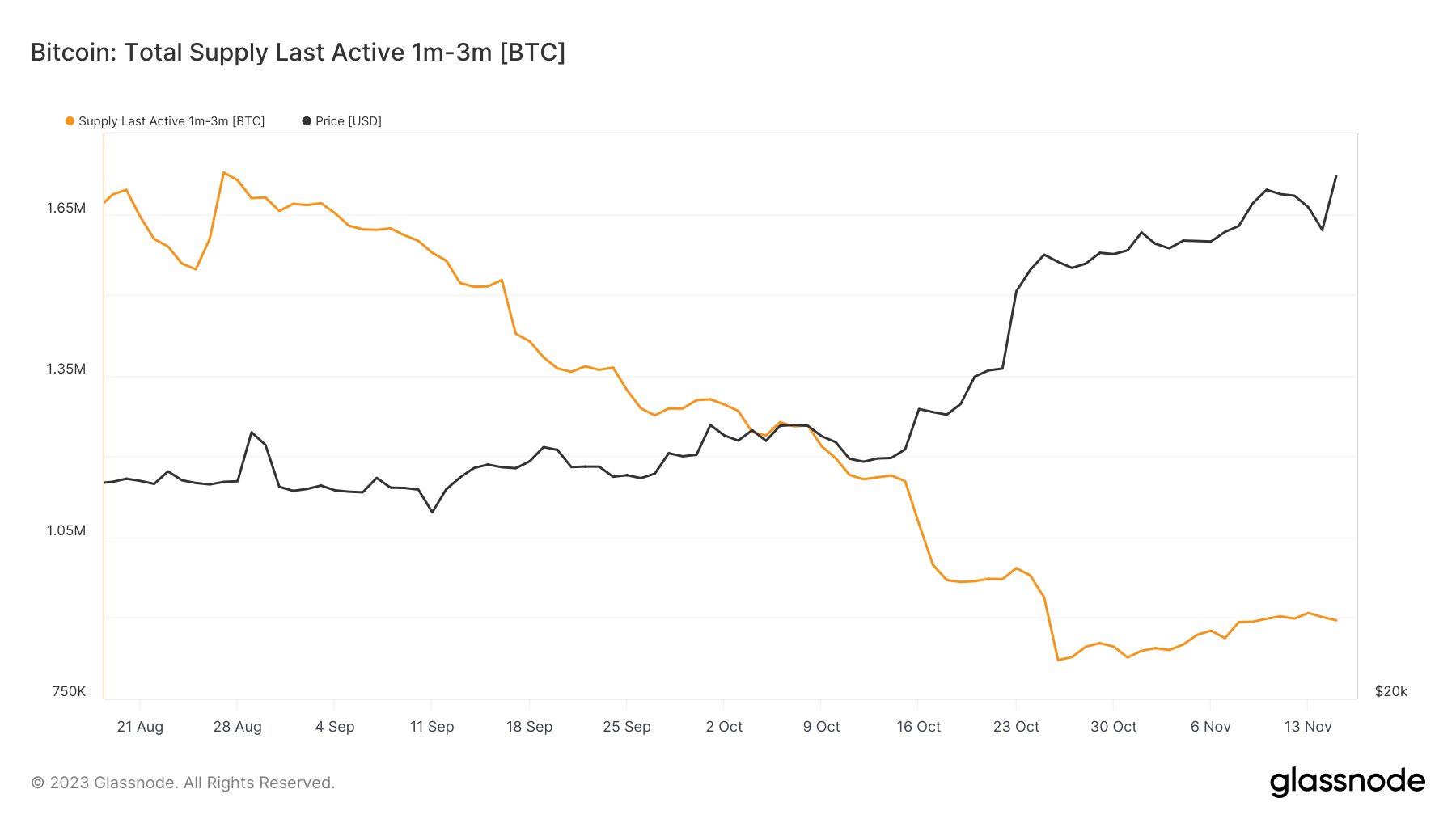

Graph showing the percent of Bitcoin’s proviso that hasn’t been moved for implicit a twelvemonth successful 2023 (Source: Glassnode)This play besides saw changes successful shorter-term proviso movements: the proviso past progressive for 1-3 months decreased from 1.16 cardinal BTC to 895,347 BTC, a important driblet of astir 22.7%, reflecting a diminution successful short-term trading activities.

Graph showing the proviso past moved betwixt 1 period and 3 months agone from Aug. 19 to Nov. 15, 2023 (Source: Glassnode)

Graph showing the proviso past moved betwixt 1 period and 3 months agone from Aug. 19 to Nov. 15, 2023 (Source: Glassnode)These trends are indicative of a broader sentiment among Bitcoin holders. The expanding percentages successful the proviso past moved categories, particularly implicit a year, item a beardown inclination towards holding Bitcoin arsenic a semipermanent concern oregon a store of value. This behaviour suggests a maturing marketplace wherever investors are little reactive to short-term terms fluctuations and much assured successful the semipermanent prospects of Bitcoin.

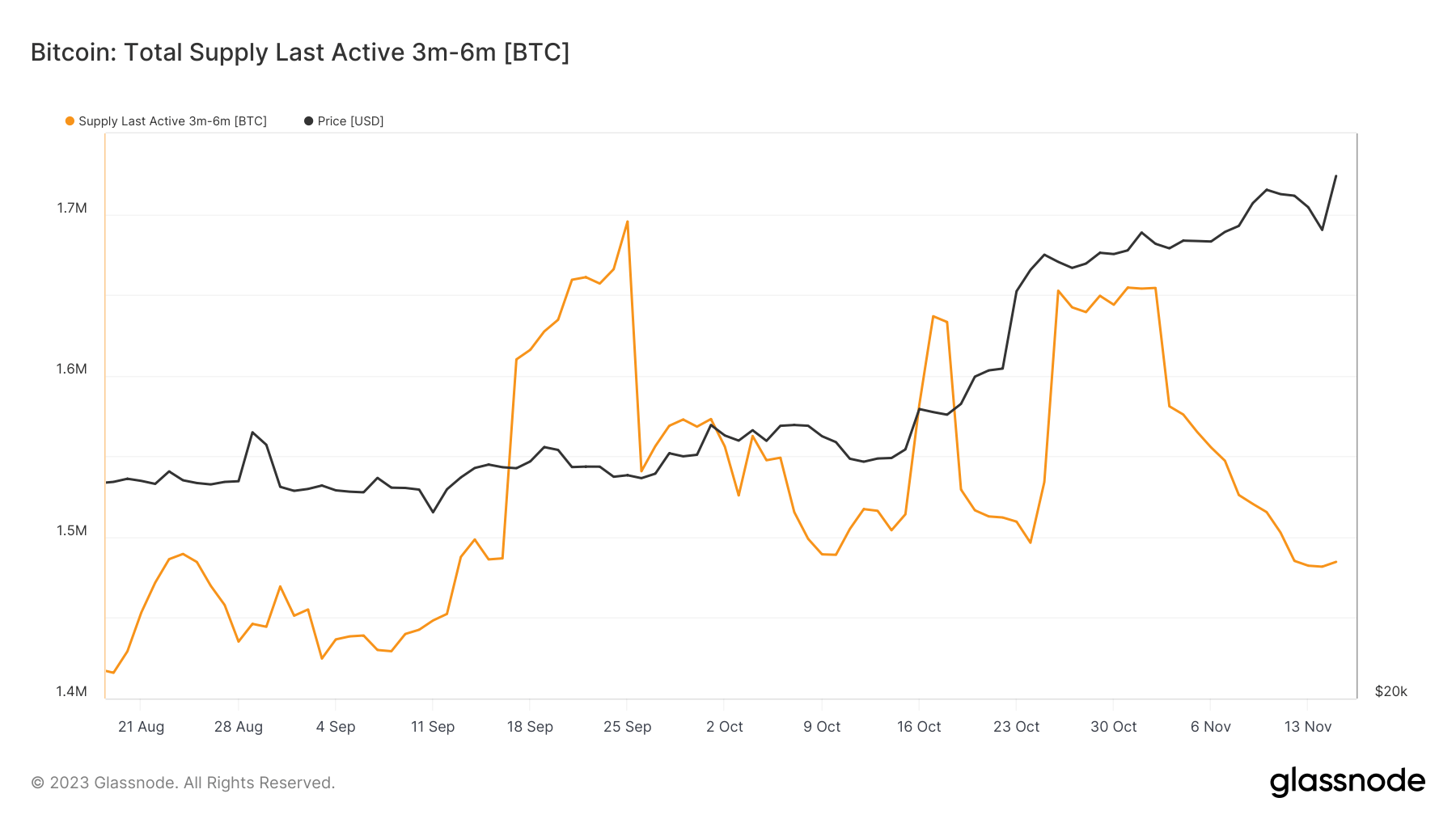

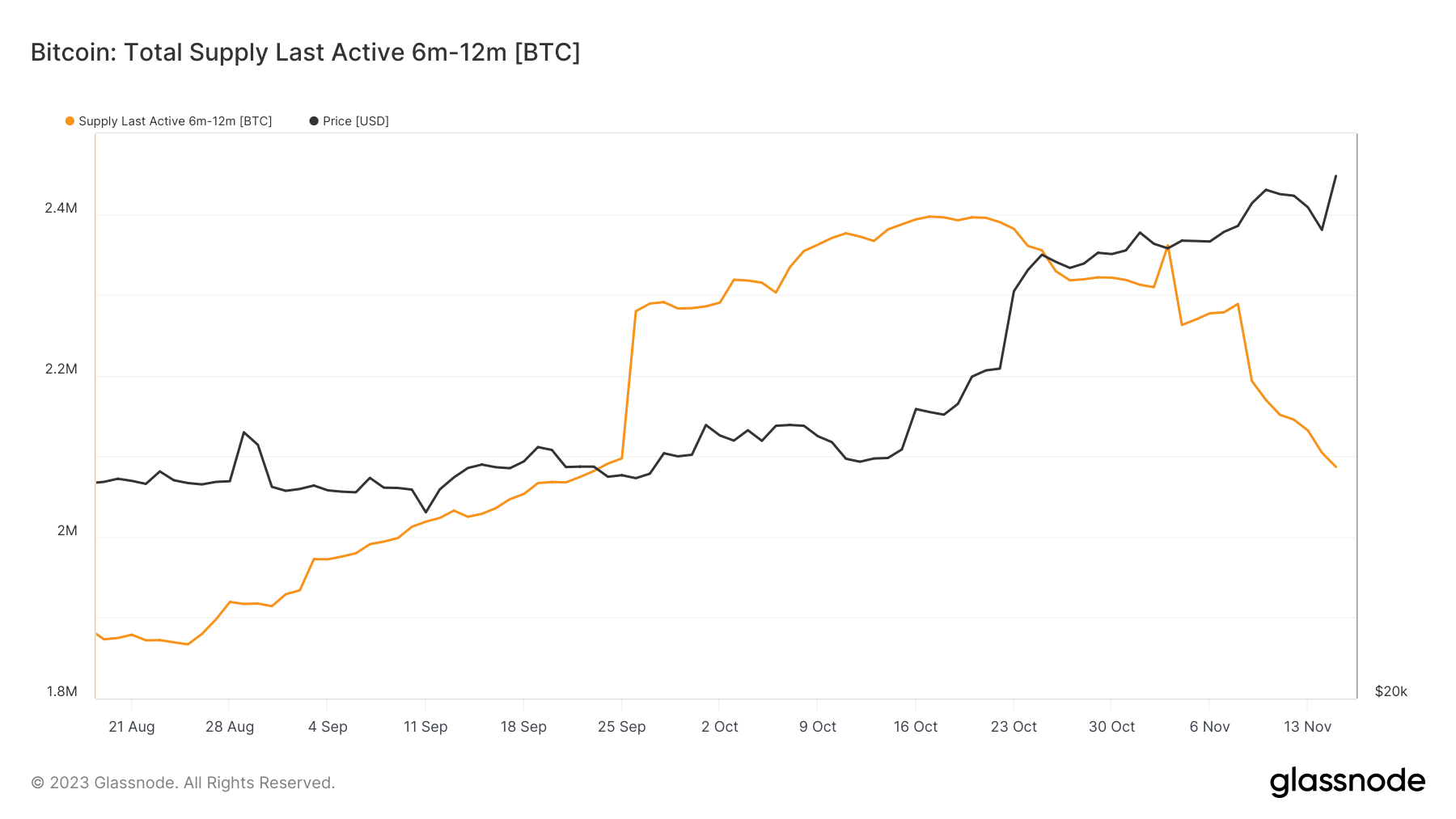

The proviso past progressive successful the 3-6 and 6-12 months categories besides showed intriguing movements. The 3-6 months class saw an summation followed by a flimsy decrease, portion the 6-12 months class consistently decreased.

Graph showing the proviso past moved betwixt 3 months and 6 months agone from Aug. 19 to Nov. 15, 2023 (Source: Glassnode)

Graph showing the proviso past moved betwixt 3 months and 6 months agone from Aug. 19 to Nov. 15, 2023 (Source: Glassnode)This fluctuation mightiness bespeak a question of Bitcoin from a comparatively dormant authorities (6-12 months) to a much progressive authorities (3-6 months), perchance successful effect to marketplace developments oregon terms movements.

Graph showing the proviso past moved betwixt 6 months and 12 months agone from Aug. 19 to Nov. 15, 2023 (Source: Glassnode)

Graph showing the proviso past moved betwixt 6 months and 12 months agone from Aug. 19 to Nov. 15, 2023 (Source: Glassnode)These proviso dynamics are important for knowing the liquidity and stableness of the Bitcoin market. A important information of Bitcoin being held for extended periods leads to a alteration successful the circulating supply, which tin lend to terms increases, particularly successful the discourse of Bitcoin’s capped supply. On the different hand, debased liquidity, marked by little proviso disposable for trade, tin pb to accrued terms volatility.

The insights drawn from this investigation are not conscionable reflective of existent marketplace conditions but besides predictive of imaginable aboriginal trends. For instance, if a sizeable information of Bitcoin that has been held for implicit 3 years starts becoming active, it mightiness awesome a imaginable selling pressure, perchance starring to a terms decrease. Moreover, the absorption of these proviso categories to outer events tin supply invaluable insights into however antithetic capitalist segments comprehend and respond to these developments.

The station Analyzing Bitcoin’s proviso trends arsenic surge successful semipermanent Bitcoin holdings points to capitalist confidence appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)