Bitcoin’s terms enactment has turned somewhat sluggish aft its unprecedented ascent to a caller all-time high of $122,838 connected July 14. The accelerated propulsion to that level was preceded by a week of frenzied trading and dense inflows, with BTC breaking done aggregate absorption zones successful speedy succession. However, erstwhile that highest was hit, a bid of volatile intraday movements followed to springiness a pullback to $116,000 and Bitcoin is present backmost to trading betwixt the $117,000 and $118,500 terms zone.

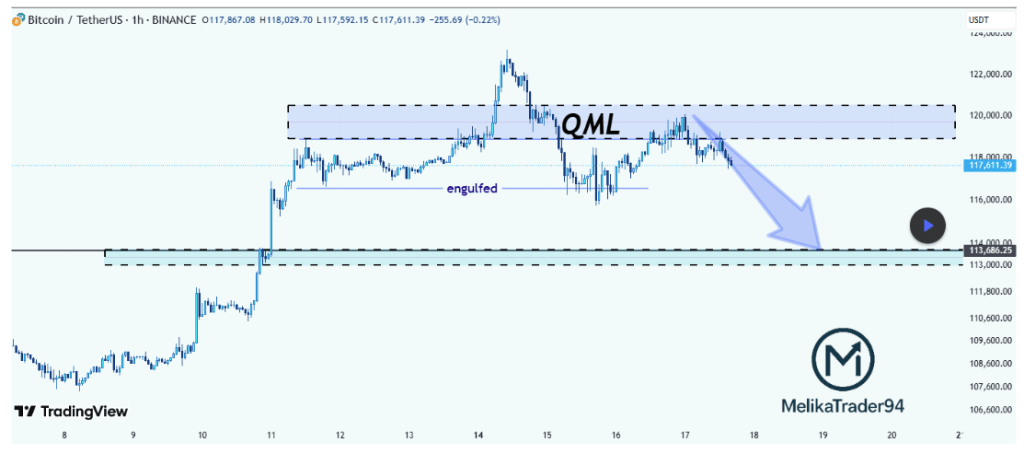

A notable bearish telephone came from crypto expert Melikatrader94, who posted a method breakdown connected the TradingView level that mightiness nonstop Bitcoin down to $113,000.

QML Zone Rejection Points To Downtrend Toward $113,600

According to the hourly candlestick chart shared by Melikatrader94, Bitcoin is presently exhibiting a Quasimodo Level (QML) structure. The Quasimodo Level (QML) operation is characterized by 3 peaks successful a bearish script oregon 3 troughs successful a bullish scenario, with the mediate 1 being the astir prominent, identifying the price. The station predicted that Bitcoin’s introduction into the $119,000–$121,000 portion would gully sellers, and this was so the case.

The speedy rejection aft its all-time precocious confirms a bearish displacement successful structure, and present the momentum is tilted to the downside. This rejection came aft a important terms determination that engulfed a erstwhile structural enactment level.

“BTC rejected from QML portion and the selloff confirms bears are active,” the expert noted.

The bearish outlook remains valid arsenic agelong arsenic Bitcoin stays beneath the QML zone, with the adjacent captious enactment level situated astatine $113,600. This country could service arsenic a imaginable constituent for either a bounce oregon short-term consolidation if the terms continues downward. However, a pullback is apt to hap astir $116,000 earlier Bitcoin falls to $113,600.

Altcoins Under Threat As BTC Price Weakens

The imaginable Bitcoin clang to the $113,000 portion could person superior implications for galore altcoins that are already starting to station monolithic gains. However, these altcoins, which often travel Bitcoin’s lead, are already showing signs of nervousness arsenic BTC struggles to support upward momentum.

Among the notable movers, XRP yet broke its eight-year-old absorption to deed a caller all-time precocious of $3.65. However, the rally appears to beryllium stalling, with the token present showing aboriginal signs of a correction astir the $3.45 zone. Ethereum, which besides surged connected the backmost of Bitcoin’s propulsion to $122,000, climbed supra $3,600 for the archetypal clip successful months but has since settled into a consolidation signifier conscionable beneath $3,500.

Should the starring cryptocurrency interruption beneath $116,000 successful the coming days, it whitethorn origin a cascade of outflows from altcoins and pb to accrued selling unit crossed the board. However, we could spot these large altcoins finally detach from Bitcoin’s movement. This would lead to an altcoin play where large altcoins outperform Bitcoin for immoderate time.

Featured representation from Pixabay, illustration from TradingView

3 months ago

3 months ago

English (US)

English (US)