Bitcoin (BTC) has been locked successful a choky trading range, fluctuating betwixt $30,000 and $31,000. While immoderate on-chain metrics amusement that this ongoing sideways question has been observed earlier Bitcoin’s erstwhile bull runs, determination is small to bespeak that a important displacement could hap soon.

Graph showing Bitcoin’s terms successful July 2023 (Source: CryptoSlate BTC)

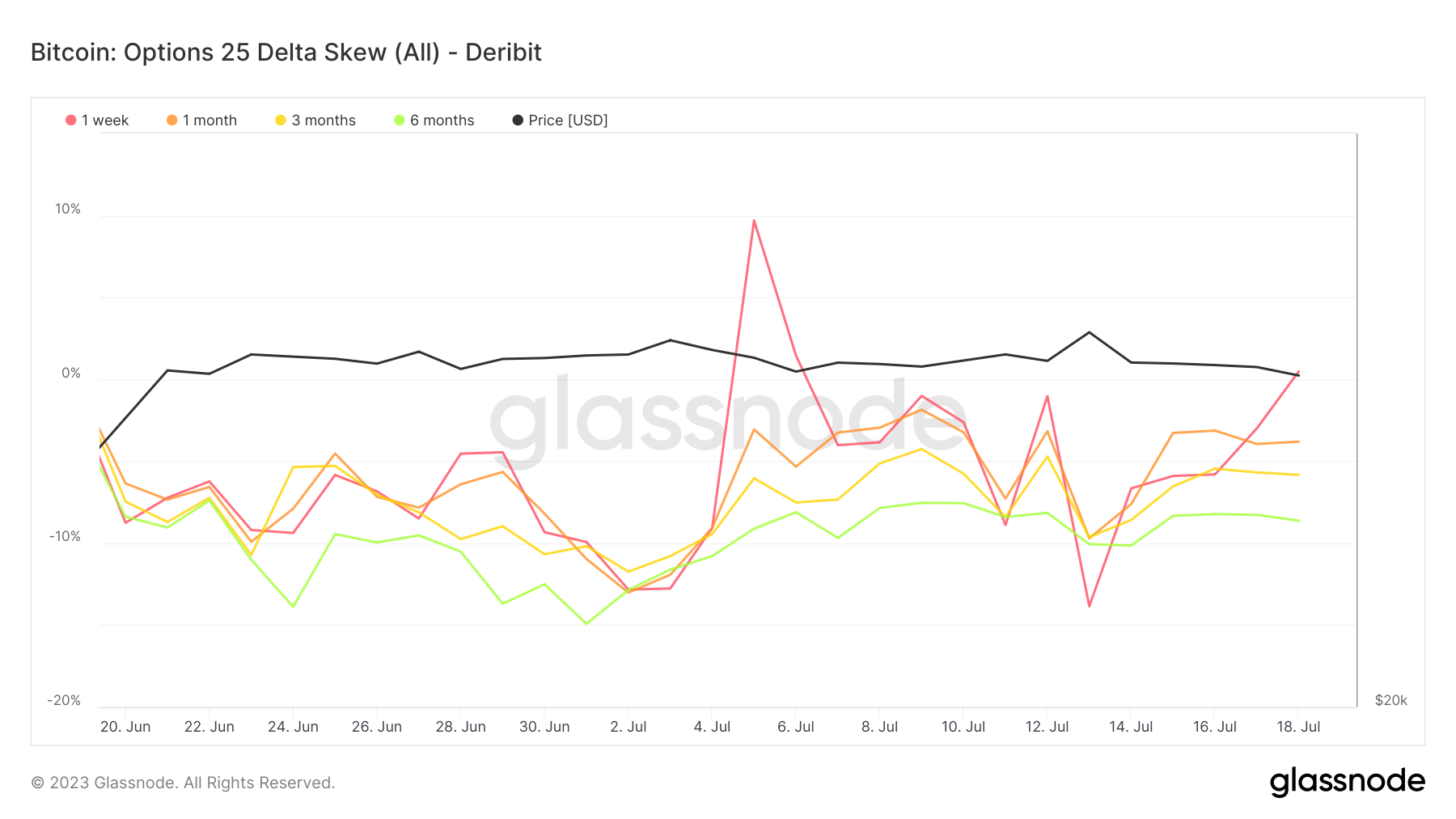

Graph showing Bitcoin’s terms successful July 2023 (Source: CryptoSlate BTC)The derivatives market, peculiarly the options market, reveals a divided sentiment astir Bitcoin’s performance. This part is evident erstwhile analyzing Bitcoin options delta skew. The delta skew for options contracts expiring 1 week, 1 month, 3 months, and six months from present is 0.48%, -3.8%, -5.83%, and -8.62%, respectively.

Graph showing Bitcoin’s delta skew from June 19 to July 19, 2023 (Source: Glassnode)

Graph showing Bitcoin’s delta skew from June 19 to July 19, 2023 (Source: Glassnode)Delta skew, besides known arsenic the “skew” oregon “risk reversal,” is simply a measurement of marketplace sentiment often utilized successful the options market. It measures the quality successful implied volatility betwixt out-of-the-money (OTM) puts and OTM calls.

If the marketplace is bullish, OTM telephone options (options to bargain supra the existent price) volition person higher implied volatility than OTM enactment options (options to merchantability beneath the existent price) due to the fact that traders are consenting to wage much for the accidental to bargain the plus astatine a higher terms successful the future, expecting the terms to rise. This concern results successful a affirmative delta skew.

Conversely, if the marketplace is bearish, OTM enactment options volition person a higher implied volatility than OTM telephone options, resulting successful a antagonistic delta skew. In this case, traders are consenting to wage much for the accidental to merchantability the plus astatine a higher terms successful the future, arsenic they expect the terms to fall.

The 0.48% delta skew for Bitcoin options expiring successful 1 week is somewhat positive, indicating somewhat bullish to level sentiment for BTC successful the abbreviated term. However, the delta skew for options expiring successful 1 month, 3 months, and six months is antagonistic (-3.8%, -5.83%, and -8.62%, respectively), suggesting that the marketplace sentiment becomes progressively bearish implicit the longer term. Traders are consenting to wage much for the accidental to merchantability Bitcoin astatine a higher terms successful the future, expecting the terms to fall.

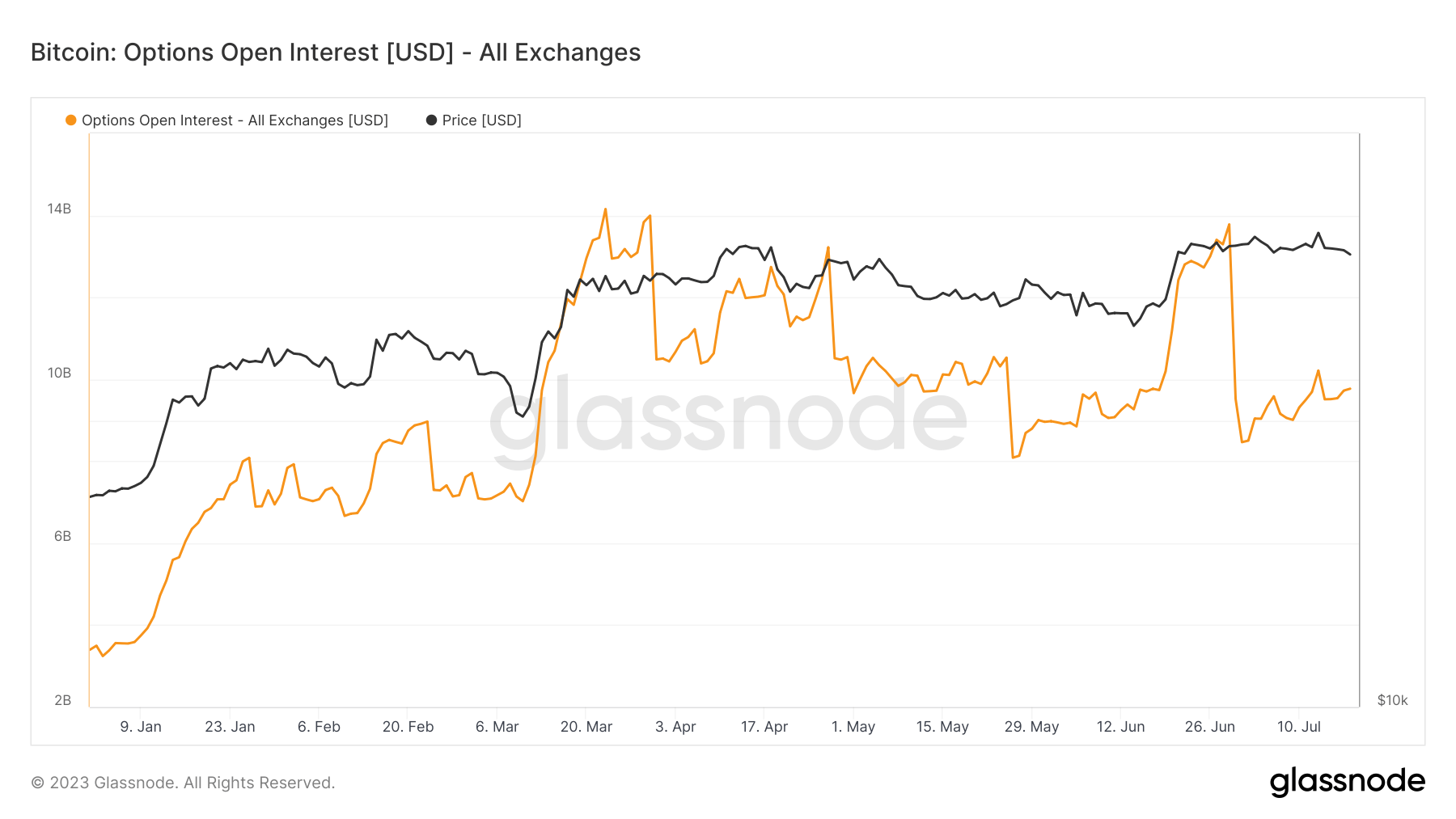

This divided sentiment contrasts with the operation of the full unfastened involvement for Bitcoin telephone options, which stands astatine $9.7 billion. Open involvement refers to the full fig of outstanding options contracts that person not been settled. It is simply a critical metric that reflects wealth travel into the derivatives market.

Graph showing the full unfastened involvement for Bitcoin options YTD (Source: Glassnode)

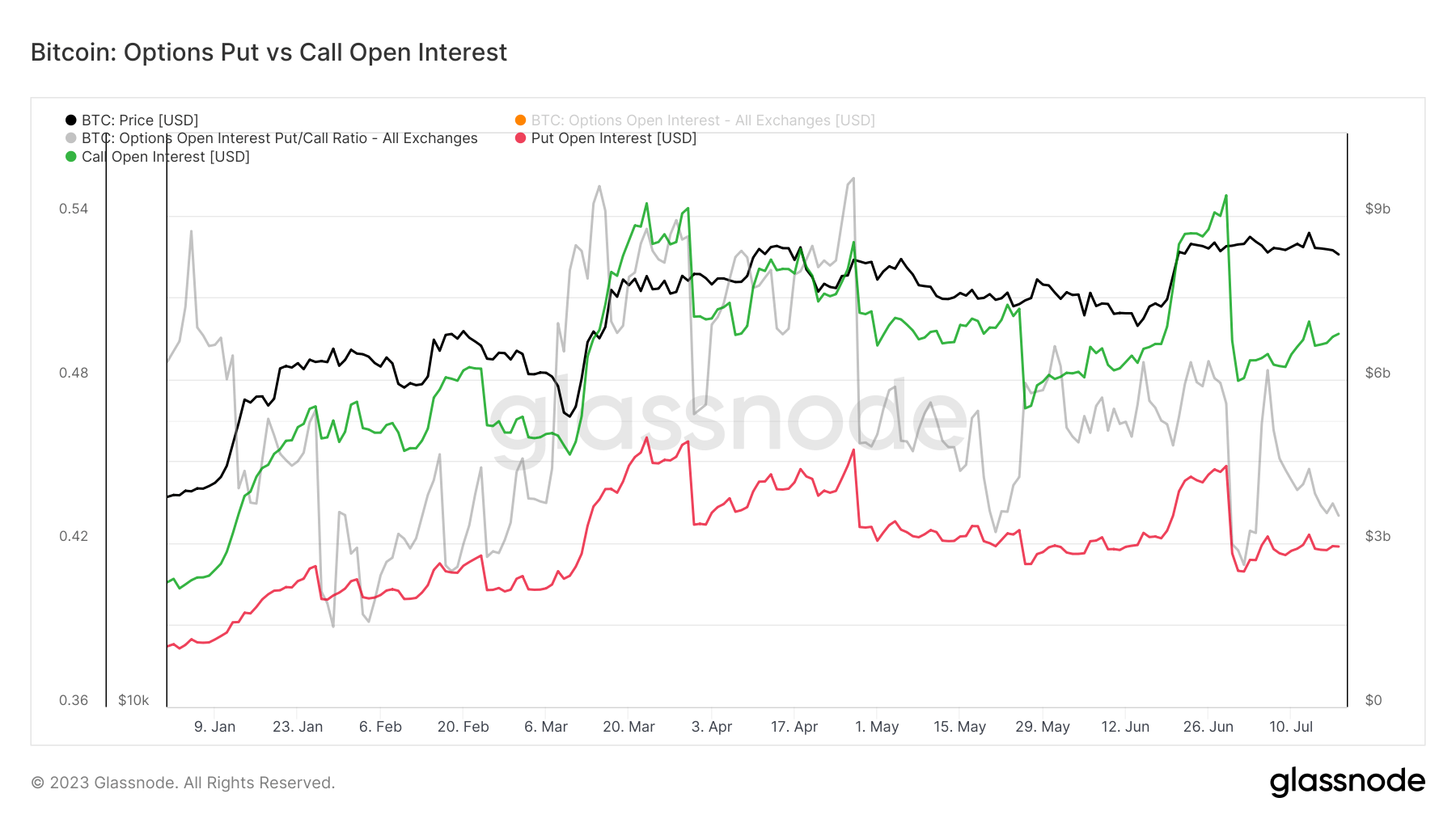

Graph showing the full unfastened involvement for Bitcoin options YTD (Source: Glassnode)The full unfastened involvement for Bitcoin calls is $6.93 billion, importantly higher than the unfastened involvement for puts, which is $2.83 billion. This discrepancy could suggest that traders are mostly much bullish connected Bitcoin, expecting the terms to increase, hence the higher fig of telephone options.

Graph comparing the Bitcoin options unfastened involvement for puts and calls YTD (Source: Glassnode)

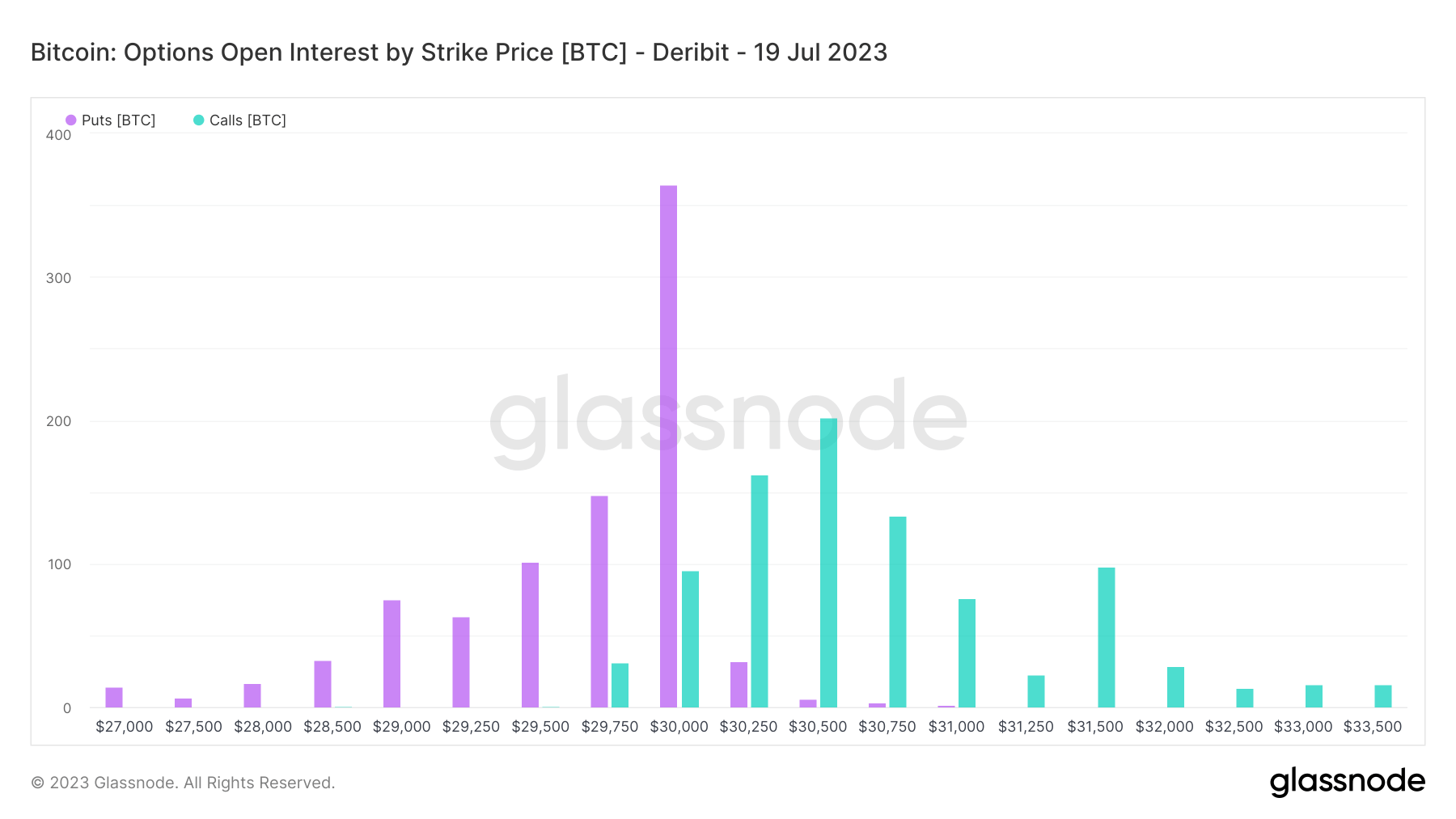

Graph comparing the Bitcoin options unfastened involvement for puts and calls YTD (Source: Glassnode)However, the unfastened involvement of telephone and enactment options by onslaught terms for options contracts expiring connected July 19 shows a antithetic story. An adjacent magnitude of unfastened interest, 365.4 BTC, is betting that BTC volition autumn beneath $30,000 and emergence supra $30,250-$30,500. This equilibrium of involvement indicates a marketplace astatine a standstill, reflecting Bitcoin’s existent terms level.

Graph showing the unfastened involvement for options expiring connected July 19, 2023, by onslaught terms (Source: Glassnode)

Graph showing the unfastened involvement for options expiring connected July 19, 2023, by onslaught terms (Source: Glassnode)In conclusion, the indecisive derivatives marketplace is keeping Bitcoin flat. While immoderate traders are bullish, expecting a terms increase, an adjacent fig are bearish, betting connected a terms decrease. This part supports Bitcoin successful a choky trading range, with small denotation of a important displacement successful the coming days.

Contrary to the bearish sentiment reflected successful the options market, semipermanent forecasts by immoderate experts suggest a much bullish viewpoint, with traders seemingly acceptable to thrust retired the existent level marketplace successful anticipation of aboriginal terms rises.

The station An indecisive options marketplace keeps Bitcoin flat appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)