By Omkar Godbole (All times ET unless indicated otherwise)

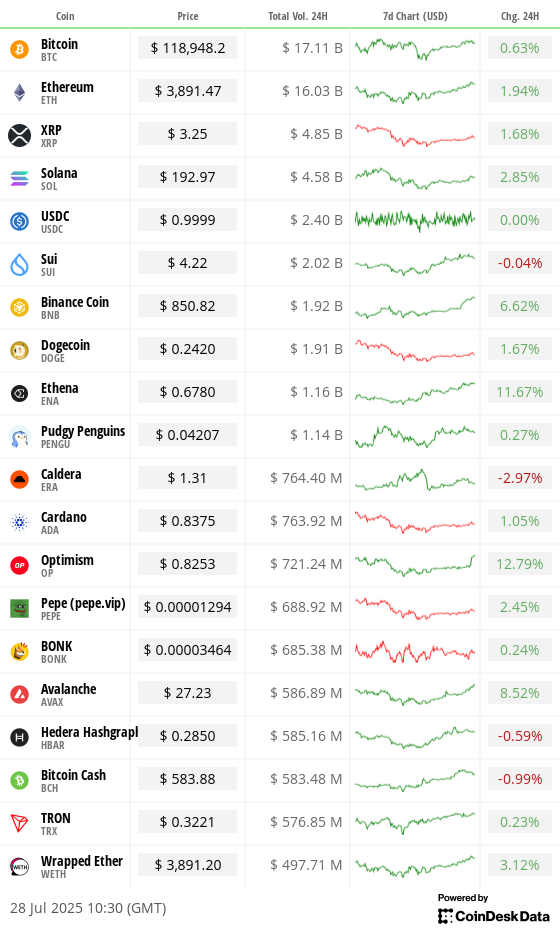

Bitcoin (BTC) traded small changed astir $120,000, struggling to physique connected a play bounce characterized by accordant request astatine astir $117,000.

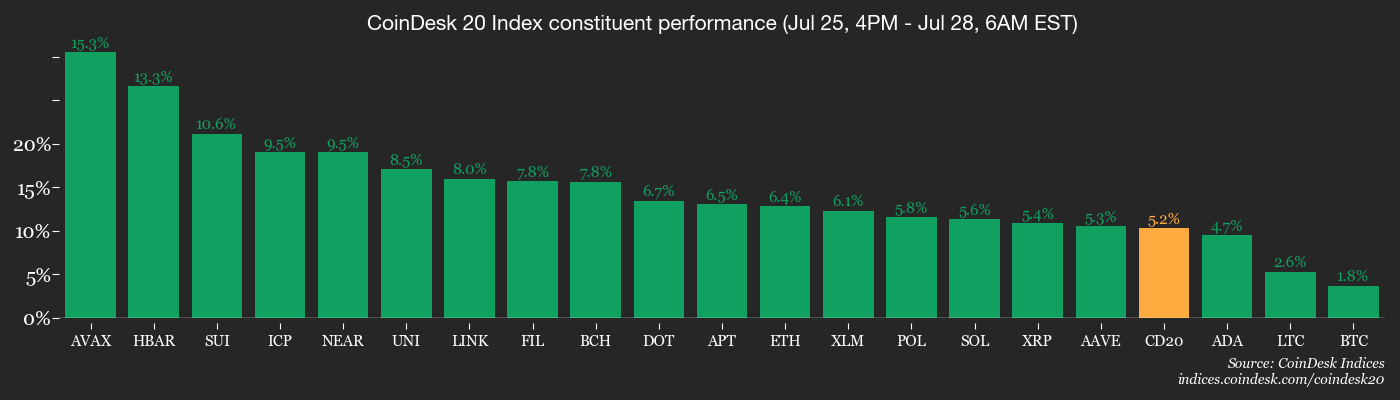

Other tokens were little moribund. The CD20 Index, which captures astir 80% of the integer plus market, roseate 2% implicit 24 hours portion the CD80 Index traded 4% higher, pointing to the comparative spot of altcoins.

According to Glassnode, bitcoin dip buyers are adding vulnerability astir the $117,000 level, with 73,000 BTC present held astatine this outgo basis. "Each dip is being absorbed arsenic investors steadily accumulate successful this range," Glassnode said.

For those looking to articulation the existent bull run, 1 expert suggests perfect introduction points either supra the $120,000 absorption level upon a cleanable breakout oregon adjacent the erstwhile resistance-turned-support level astir $111,600, which aligns with the May high.

Corporate request for large cryptocurrencies shows nary signs of slowing down. Early Monday, Metaplanet said it bought different 780 BTC astatine an mean terms exceeding $118,000, bringing its full holdings to 17,132 BTC, valued astir $2 billion.

Similarly, SharpLink Gaming, the second-largest firm holder of ether (ETH), expanded its reserves by different 77,210 ETH, worthy $295 million. According to Ultra Sound Money, this acquisition notably outstripped ether's 30-day nett issuance of 72,795 ETH, suggesting beardown underlying demand. However, ether's caller rally notably lacks on-chain support, with progressive addresses and different usage metrics failing to support gait with the terms surge. (See Chart of the Day for much connected that.)

In broader altcoin news, Aptos, a layer-1 proof-of-stake blockchain, surpassed Solana to go the third-largest concatenation by full worth of real-world assets (RWA) connected its network, present trailing lone zkSync and Ethereum.

For its part, the Ethena Foundation reportedly acquired 83 cardinal ENA tokens betwixt July 22 and July 25 done a third-party marketplace shaper arsenic portion of its buyback program. Meanwhile, blockchain sleuth Lookonchain reported a whale transaction involving the speech of 1.75 cardinal FARTCOIN for 790.4 cardinal PUMP.

Looking ahead, traders are keenly awaiting the White House’s integer plus report, scheduled for merchandise connected July 30, anticipating that it could service arsenic a important catalyst for cryptocurrency markets.

On the macroeconomic front, reports of a imaginable 90-day hold to U.S.-China tariffs intermission and the announcement of the U.S.-EU commercialized woody failed to spur notable gains successful risk-sensitive currencies specified arsenic the Australian dollar oregon U.S. banal scale futures, indicating a cautious planetary marketplace sentiment. Stay alert!

What to Watch

- Crypto

- July 28: Starknet (STRK), an Ethereum layer-2 validity rollup (zk-rollup), launches v0.14.0 connected mainnet.

- July 31, 12 p.m.: A unrecorded webinar featuring Bitwise CIO Matt Hougan and Bitzenship laminitis Aleesandro Palombo sermon bitcoin’s imaginable arsenic the adjacent planetary reserve currency amid dedollarization trends. Registration link.

- Aug. 1: The Helium Network (HNT), present moving connected Solana, undergoes its halving event, cutting yearly caller token issuance to 7.5 cardinal HNT.

- Aug. 1: Hong Kong’s Stablecoins Ordinance takes effect, introducing a licensing authorities to modulate stablecoin activities successful the city.

- Aug. 1: New Bretton Woods Labs volition motorboat BTCD, which it says is the archetypal afloat bitcoin-backed stablecoin, connected the Elastos (ELA) mainnet — a decentralized blockchain secured by merged mining with bitcoin and overseen by the Elastos Foundation.

- Aug. 15: Record day for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who conscionable pre-distribution requirements.

- Macro

- Day 1 of 2: U.S. and Chinese officials meet successful Stockholm for their 3rd circular of commercialized talks. Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng pb discussions focused connected preventing further tariff escalations. While extending the tariff truce acceptable to expire Aug. 12 is simply a cardinal goal, the gathering besides aims to laic the groundwork for aboriginal negotiations and a imaginable leaders’ acme aboriginal this year.

- July 28, 8 a.m.: Mexico's National Institute of Statistics and Geography releases June unemployment complaint data.

- Unemployment Rate Prev. 2.7%

- July 29, 10 a.m.: The U.S. Bureau of Labor Statistics releases June U.S. labour marketplace information (the JOLTS report).

- Job Openings Est. 7.35M vs. Prev. 7.7691M

- Job Quits Prev. 3.293M

- July 29, 10 a.m.: The Conference Board (CB) releases July U.S. user assurance data.

- CB Consumer Confidence Est. 95.5 vs. Prev. 93

- July 30, 8 a.m.: Mexico's National Institute of Statistics and Geography releases (preliminary) Q2 GDP maturation data.

- GDP Growth Rate QoQ Prev. 0.2%

- GDP Growth Rate YoY Prev. 0.8%

- July 30, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (advance estimate) Q2 GDP data.

- GDP Growth Rate QoQ Est. 2.5% vs. Prev. -0.5%

- GDP Price Index QoQ Est. 2.4% vs. Prev. 3.8%

- GDP Sales QoQ Prev. -3.1%

- PCE Prices QoQ Prev. 3.7%

- Real Consumer Spending QoQ Prev. 0.5%

- July 30, 9:45 a.m.: The Bank of Canada (BoC) announces its monetary argumentation determination and publishes the quarterly Monetary Policy Report. The property league follows astatine 10:30 a.m. Livestream link.

- Policy Interest Rate Est. 2.75% Prev. 2.75%

- July 30, 2 p.m.: The Federal Reserve announces its monetary argumentation decision; national funds rates are expected to stay unchanged astatine 4.25%-4.50%. Chair Jerome Powell’s property league follows astatine 2:30 p.m.

- July 30, 5:30 p.m.: Brazil’s cardinal bank, Banco Central bash Brasil, announces its monetary argumentation decision.

- Selic Rate Prev. 15%

- Aug. 1, 12:01 a.m.: New U.S. tariffs instrumentality effect connected imports from trading partners that neglect to unafraid a commercialized woody by this date. These accrued duties could scope from 10% to arsenic precocious arsenic 70%, impacting a wide scope of goods.

- Earnings (Estimates based connected FactSet data)

- July 29: PayPal Holdings (PYPL), pre-market, $1.30

- July 30: Robinhood Markets (HOOD), post-market, $0.31

- July 31: Coinbase Global (COIN), post-market, $1.39

- July 31: Reddit (RDDT), post-market, $0.19

- July 31: Sequans Communications (SQNS), pre-market

- Aug. 5: Galaxy Digital (GLXY), pre-market, $0.19

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: Coincheck (CNCK), post-market

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Events

- Governance votes & calls

- Lido DAO is voting connected a new strategy that lets validator exits be triggered automatically done the execution layer, not conscionable by node operators. It includes tools for antithetic authorization pathways, exigency controls and built‑in limits to forestall misuse. The update is expected to marque staking much decentralized, much unafraid and much responsive. Voting ends July 28.

- GnosisDAO is voting connected a connection to provide $30 cardinal a year, paid quarterly, to Gnosis Ltd., present a non-profit, to prolong its 150‑person squad gathering captious Gnosis Chain infrastructure, products (like Gnosis Pay and Circles), concern improvement and operations. Voting ends July 28.

- Aavegotchi DAO is voting on funding 3 caller features for the authoritative decentralized application: a Wearable Lendings UI, Gotchis Batch Lending and a BRS Optimizer. Voting ends July 29.

- Balance DAO is voting on deploying Balancer v3 connected HyperEVM. Voting ends July 29.

- NEAR Protocol is voting on potentially reducing NEAR’s inflation from 5% to 2.5%. Two-thirds of validators indispensable support the connection for it to pass, and if truthful it could beryllium implemented by precocious Q3. Voting ends Aug. 1

- July 29, 10 a.m.: Ether.fi to big a bi-quarterly expert call.

- Unlocks

- July 28: Jupiter (JUP) to unlock 1.78% of its circulating proviso worthy $32.35 million.

- July 31: Optimism (OP) to unlock 1.79% of its circulating proviso worthy $26.26 million.

- Aug. 1: Sui (SUI) to unlock 1.27% of its circulating proviso worthy $188.54 million.

- Aug. 2: Ethena (ENA) to unlock 0.64% of its circulating proviso worthy $28 million.

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating proviso worthy $14.85 million.

- Aug. 12: Aptos (APT) to unlock 1.73% of its circulating proviso worthy $55.87 million.

- Token Launches

- July 28: NERO Chain (NERO) and Spheron Network (SPON) to beryllium listed connected Gate.io, Bitget, MEXC, and others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done Aug. 31.

- Day 1 of 2: TWS Conference 2025 (Singapore)

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

Token Talk

By Shaurya Malwa

- Believe App's API v2 allows crypto projects to physique self-reinforcing tokenomic flywheels, wherever automated actions similar burns, airdrops and aboriginal buybacks are triggered by circumstantial task events.

- The halfway worth lies successful enabling affirmative feedback loops successful which 1 bullish trigger leads to automated, on-chain actions that reenforce momentum (e.g., a spike successful trading measurement triggering a buyback-to-burn-to-airdrop pipeline).

- All flywheel actions are powered by basal coins, secured via a dual-signature multisig wallet. That means they necessitate some Believe and the project’s support to execute, adding beardown extortion against misuse.

- Projects tin configure regular enactment limits, and each flywheel enactment is publically transparent via a vault address, enabling assemblage information successful contributing funds to powerfulness the flywheel.

- Each transaction includes an on-chain JSON memo for proof, offering auditable, transparent and regulatory-aligned documentation for each enactment taken.

- Authentication is simple: Generate an API cardinal from the Believe Web App and walk it with each petition utilizing the x-believe-api-key header.

- Believe App-linked LAUNCHCOIN could beryllium 1 to ticker arsenic specified flywheel mechanisms spell live, accruing worth to the token.

Derivatives Positioning

- Cumulative unfastened involvement successful bitcoin CME futures and offshore modular and perpetual futures roseate to 742,180 BTC connected Saturday, the highest since October 2022. Though the figure's pulled backmost somewhat since then, the elevated level suggests terms volatility.

- Open involvement successful ether futures has reached a beingness precocious of 15.53 cardinal ETH, alongside affirmative backing rates successful perpetual futures. The operation points to bullish marketplace sentiment.

- On Deribit, BTC and ETH hazard reversals amusement telephone bias crossed each tenors, with bullishness much pronounced successful ETH.

- Block flows featured a ample abbreviated positions successful the $105,000 onslaught telephone expiring connected Aug. 15.

- The one-year call-put skew connected BlackRock's IBIT ETF has jumped to 1.60, showing the strongest telephone bias successful 2 months.

Market Movements

- BTC is up 1.55% from 4 p.m. ET Friday astatine $118,871.47 (24hrs: +0.61%)

- ETH is up 5.6% astatine $3,891.41 (24hrs: +1.91%)

- CoinDesk 20 is up 4.58% astatine 4,113.88 (24hrs: +1.65%)

- Ether CESR Composite Staking Rate is down 10 bps astatine 2.86%

- BTC backing complaint is astatine 0.0044% (4.818% annualized) connected KuCoin

- DXY is up 0.56% astatine 98.19

- Gold futures are unchanged astatine $3,337.30

- Silver futures are down 0.26% astatine $38.26

- Nikkei 225 closed down 1.1% astatine 40,998.27

- Hang Seng closed up 0.68% astatine 25,562.13

- FTSE is up 0.12% astatine 9,131.39

- Euro Stoxx 50 is up 0.85% astatine 5,397.41

- DJIA closed connected Friday up 0.47% astatine 44,901.92

- S&P 500 closed up 0.4% astatine 6,388.64

- Nasdaq Composite closed up 0.24% astatine 21,108.32

- S&P/TSX Composite closed up 0.45% astatine 27,494.35

- S&P 40 Latin America closed down 0.42% astatine 2,616.48

- U.S. 10-Year Treasury complaint is down 1.2 bps astatine 4.374%

- E-mini S&P 500 futures are up 0.26% astatine 6,442.00

- E-mini Nasdaq-100 futures are up 0.45% astatine 23,527.50

- E-mini Dow Jones Industrial Average Index are up 0.17% astatine 45,160.00

Bitcoin Stats

- BTC Dominance: 60.79% (-0.39%)

- Ether to bitcoin ratio: 0.03266 (0.71%)

- Hashrate (seven-day moving average): 933 EH/s

- Hashprice (spot): $59.08

- Total Fees: 4.12 BTC / $488,258

- CME Futures Open Interest: 147,525 BTC

- BTC priced successful gold: 35.1 oz

- BTC vs golden marketplace cap: 9.93%

Technical Analysis

- Bitcoin cash's (BCH) regular illustration shows that prices person topped the prolonged sideways transmission formation, suggesting a resumption of the uptrend from the June 2023 lows.

- The adjacent large absorption is seen astatine $800, the plaything precocious registered successful September 2021.

Crypto Equities

- Strategy (MSTR): closed connected Friday astatine $405.89 (-2.18%), +3.08% astatine $418.41 successful pre-market

- Coinbase Global (COIN): closed astatine $391.66 (-1.27%), +1.95% astatine $399.30

- Circle (CRCL): closed astatine $192.86 (-0.11%), +3.04% astatine $198.72

- Galaxy Digital (GLXY): closed astatine $30.59 (-4.08%), +5.1% astatine $32.15

- MARA Holdings (MARA): closed astatine $17.25 (-0.06%), +3.36% astatine $17.83

- Riot Platforms (RIOT): closed astatine $14.54 (-1.02%), +0.41% astatine $14.60

- Core Scientific (CORZ): closed astatine $13.76 (+0.51%), +0.94% astatine $13.89

- CleanSpark (CLSK): closed astatine $11.82 (-4.21%), +2.79% astatine $12.15

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $26.56 (-2.03%), +2.41% astatine $27.20

- Semler Scientific (SMLR): closed astatine $38.08 (-2.08%), +0.18% astatine $38.15

- Exodus Movement (EXOD): closed astatine $33.02 (-1.76%)

- SharpLink Gaming (SBET): closed astatine $21.99 (-5.7%), +6.64% astatine $23.45

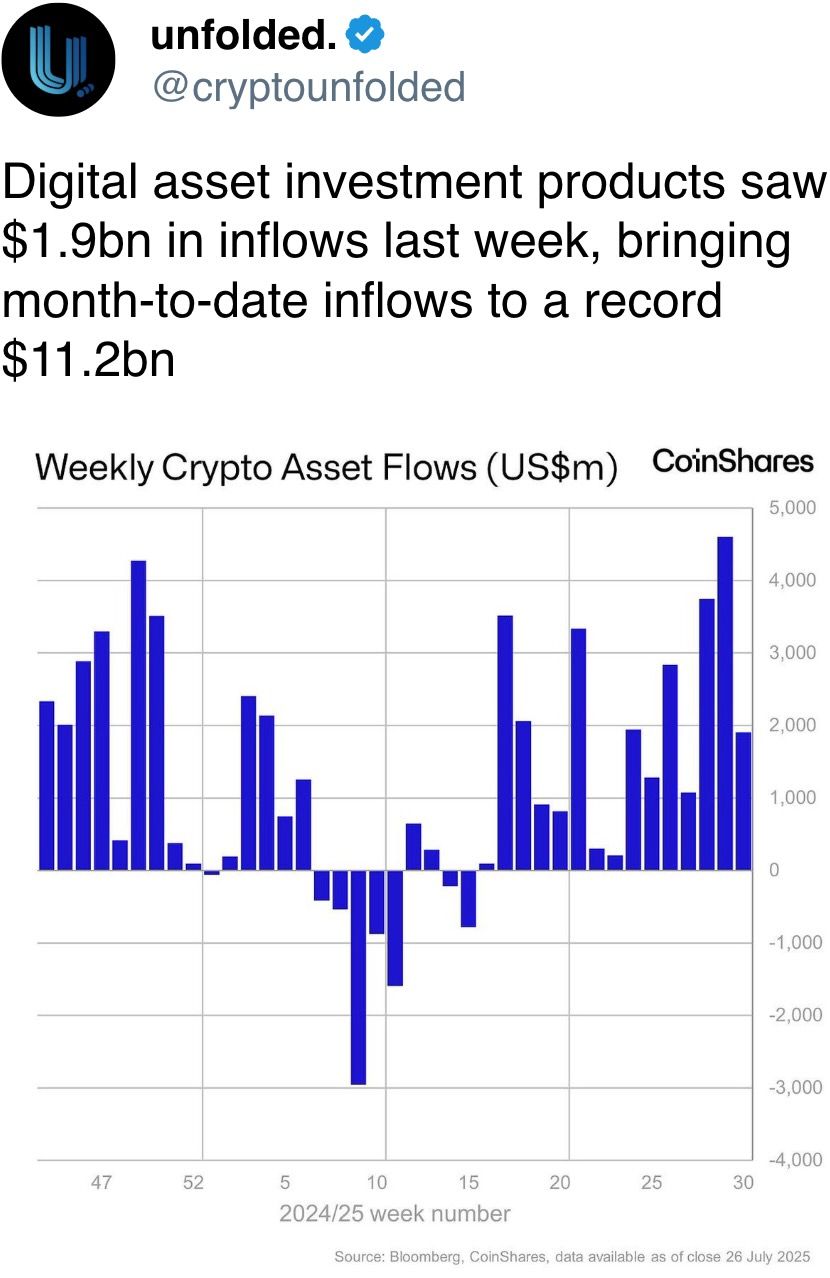

ETF Flows

Spot BTC ETFs

- Daily nett flow: $130.8 million

- Cumulative nett flows: $54.79 billion

- Total BTC holdings ~ 1.29 million

Spot ETH ETFs

- Daily nett flow: $452.8 million

- Cumulative nett flows: $9.35 billion

- Total ETH holdings ~ 5.51 million

Source: Farside Investors

Overnight Flows

Chart of the Day

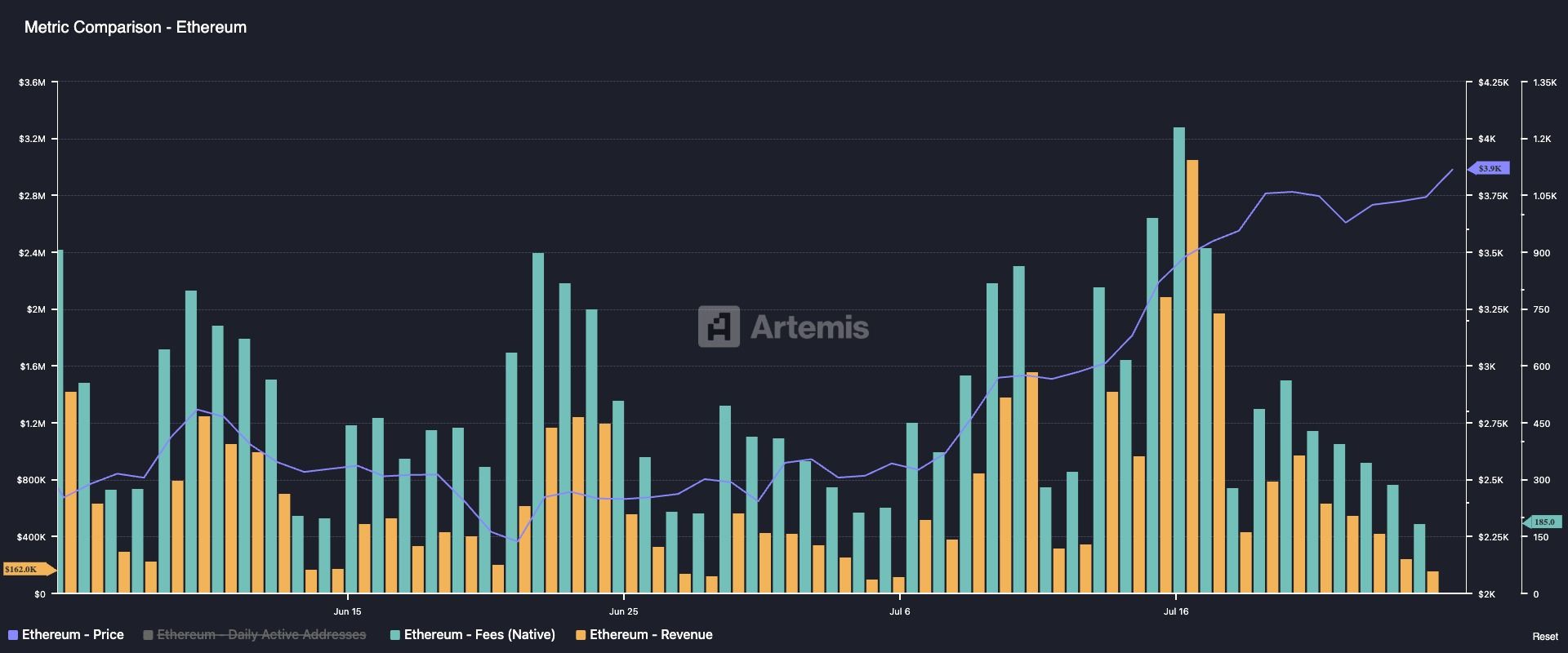

- Ethereum's autochthonal fees, the transaction costs paid successful ether (ETH) to validators for executing transactions, and full gross person declined, decoupling from the 56% surge successful ether's spot price.

- The divergence raises a question: Will ETH's rally clasp up if the firm treasury request weakens?

While You Were Sleeping

- U.S. and China Meet arsenic Trade Truce Nears Expiration (The New York Times): The 2 days of talks successful Stockholm are seeking to widen the tariff ceasefire earlier Aug. 12, erstwhile U.S. import duties connected Chinese goods are acceptable to emergence 10 percent points.

- Brazil to Double Down connected BRICS successful Defiance of Donald Trump (Financial Times): To antagonistic U.S. unit implicit its home affairs, Brazil is deepening ties with different BRICS countries, Europe and South America, including efforts to revive the Mercosur-EU commercialized pact and grow determination integration.

- Cambodia, Thailand Agree to ‘Immediate and Unconditional Ceasefire’ (BBC): The midnight section clip ceasefire follows U.S. unit linking solution to commercialized talks aft deadly borderline clashes since July 24.

- Here Is the Bitcoin Price Level That Could Be an Attractive Entry Point for BTC Bulls (CoinDesk): For traders hesitant to bargain now, 10x Research’s Markus Thielen says waiting for a pullback to May’s erstwhile resistance, present support, terms beneath $112,000, mightiness beryllium the champion strategy.

- Clearmatics' New DeFi Derivatives Let Traders Bet connected Anything, but It's Not a Prediction Market (CoinDesk): Unlike prediction markets similar Polymarket that resoluteness connected binary events, Clearmatics’ on-chain futures way real-world metrics specified arsenic ostentation and temperatures, enabling ongoing vulnerability and hazard hedging.

- Metaplanet Buys 780 More Bitcoin, Increases Stash to 17,132 BTC (CoinDesk): The Japanese institution made its latest acquisition astatine an mean terms of 17.5 cardinal yen ($118,176) per BTC. Its shares roseate 5% connected Monday, outperforming the Nikkei 225, which fell 1.1%.

- EU Reaches Tariff Deal With US to Avert Painful Trade Blow (Bloomberg): To unafraid a 15% basal tariff, excluding alloy and aluminum, effectual Aug. 1, the EU agreed to boost U.S. vigor purchases, grow subject imports and put $600 cardinal much successful America.

In the Ether

3 months ago

3 months ago

English (US)

English (US)