By Francisco Rodrigues (All times ET unless indicated otherwise)

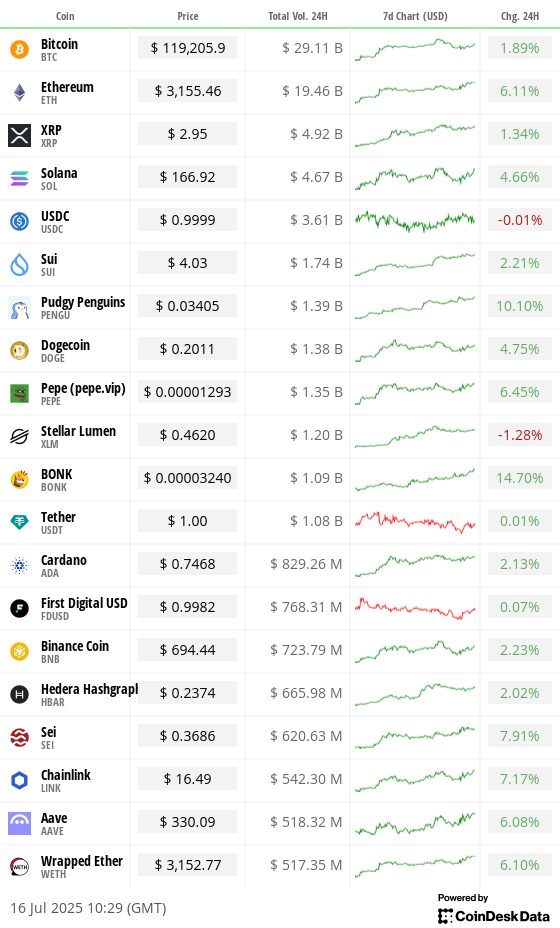

Traders are waking up to observe the crypto rally inactive has legs. Bitcoin (BTC) is up 2% implicit the past 24 hours to $119,000 aft U.S. consumer-price information stirred speech that tariffs are feeding inflation.

Even though the dollar strengthened aft the Tuesday report, request pushed through, with wealth flowing into U.S. spot bitcoin ETFs, which are seeing $700 cardinal successful full nett inflows truthful acold this week.

Demand is further supported by firm treasuries which, according to BitcoinTreasuries data, present clasp 859,993 BTC worthy implicit $100 billion. That fig is apt to support growing, and Cantor Fitzgerald Chairman Brandon Lutnick is successful late-stage talks for a $3 cardinal bitcoin treasury deal.

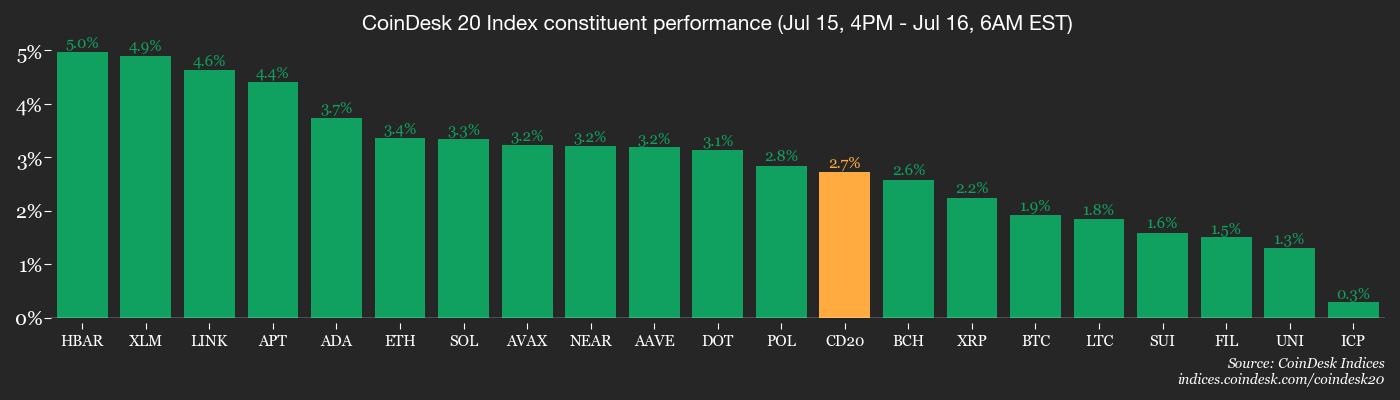

Against that background, it's worthy noting that altcoins are outperforming, with the CoinDesk 20 (CD20) scale up 3.5%. Ether (ETH) has risen 6% successful the past 24 hours, jumping past $3,100, its champion level since February, arsenic companies commencement to see it besides a campaigner for firm treasury adoption. Just yesterday, SharpLink Gaming overtook the Ethereum Foundation arsenic the largest firm holder of ETH.

Strategic Ether Reserve data shows that companies present clasp 1.6 cardinal ETH. In addition, spot ether ETFs successful the U.S. added $192 cardinal yesterday, for a play full of $451.3 million.

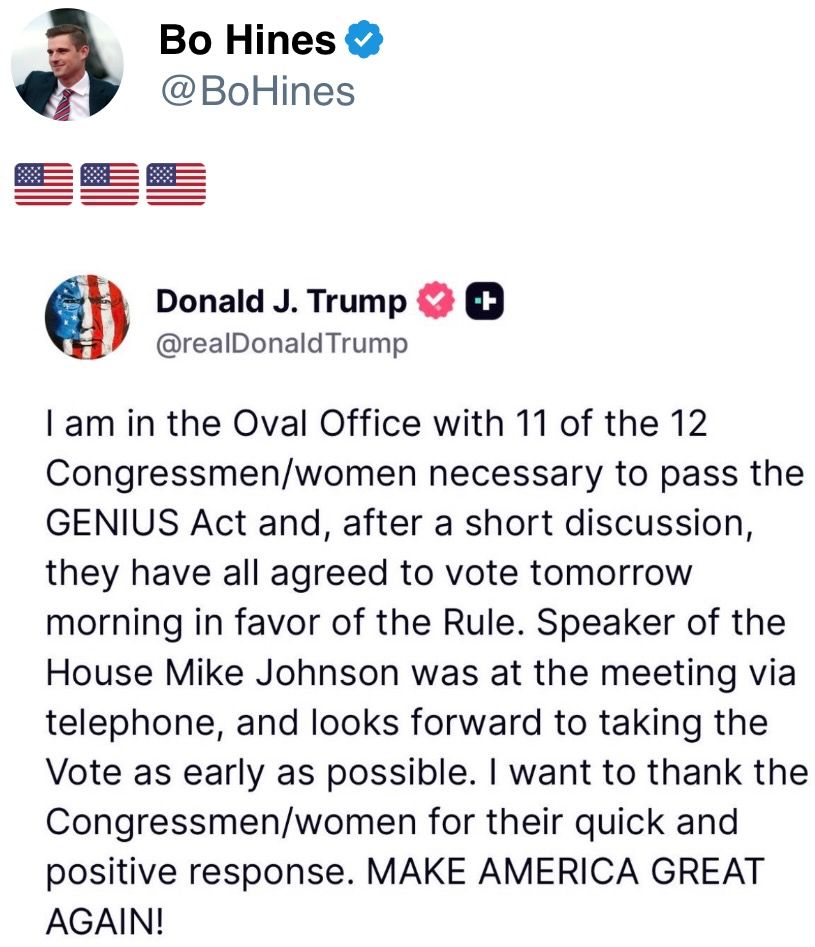

Crypto investors are present bracing for the House statement connected the GENIUS Act, a bipartisan measure that could halt yield-bearing U.S. stablecoins while giving stablecoin issuers greater clarity.

President Donald Trump has said Republican lawmakers who objected to a trio of crypto bills, including the GENIUS Act, are present acceptable to o.k. them.

If the bills pass, funds present chasing stablecoin involvement whitethorn pivot to staking and different ether-based strategies. “That would perchance reenforce Ethereum's value wrong the integer plus ecosystem," Markus Thielen, laminitis of 10x Research, said successful a note shared with CoinDesk.

Looking ahead, shaper terms ostentation being released by the U.S. Bureau of Labor Statistics volition beryllium intimately watched, arsenic volition speeches by respective Fed governors for hints connected the cardinal bank’s monetary argumentation arsenic Trump calls for complaint cuts.

For now, some the CME Fedwatch Tool and Polymarket constituent to a 97% accidental that complaint cuts won’t hap this month. Stay alert!

What to Watch

- Crypto

- July 16, 9 a.m.: U.S. House Ways and Means Committee oversight hearing titled "Making America the Crypto Capital of the World: Ensuring Digital Asset Policy Built for the 21st Century."

- July 18: Lorenzo Protocol, a Cosmos-based blockchain with autochthonal token BANK, launches USD1+ OTF connected BNB Chain's mainnet. The institutional-grade on-chain traded money lets users involvement stablecoins to mint sUSD1+ tokens that gain stable, NAV-backed output from real-world assets, CeFi quantitative strategies and DeFi protocols. All returns are settled successful USD1 stablecoin, issued by World Liberty Financial, whose stablecoin infrastructure powers the product’s unchangeable output mechanism.

- Macro

- July 16, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases June shaper terms ostentation data.

- Core PPI MoM Est. 0.2% vs. Prev. 0.1%

- Core PPI YoY Est. 2.7% vs. Prev. 3%

- PPI MoM Est. 0.2% vs. Prev. 0.1%

- PPI YoY Est. 2.5% vs. Prev. 2.6%

- July 16, 10 a.m.: Speech by Fed Governor Michael S. Barr connected "Financial Regulation" astatine "Conversation with Governor Barr" successful Washington. Livestream link.

- July 17, 10 a.m.: Speech by Fed Governor Adriana D. Kugler connected "A View of the Housing Market and U.S. Economic Outlook" astatine the Housing Partnership Network Symposium successful Washington. Livestream link.

- July 17, 6:30 p.m.: Speech by Fed Governor Christopher J. Waller connected the economical outlook astatine an lawsuit hosted by the Money Marketeers of New York University.

- Aug. 1, 12:01 a.m.: New U.S. tariffs instrumentality effect connected imports from commercialized partners that failed to scope agreements by the July 9 deadline. These accrued duties could scope from 10% to arsenic precocious arsenic 70%, impacting a wide scope of goods.

- July 16, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases June shaper terms ostentation data.

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Aavegotchi DAO is voting connected a $245,000 backing proposal to grow Gotchi Battler into a revenue-generating crippled with PvE modes, NFTs and conflict passes, aiming to reverse declining subordinate numbers, boost GHST inferior and make sustainable rewards. Voting ends July 22.

- Uniswap DAO is conducting a somesthesia check on Etherlink’s petition to co-incentivize Uniswap v3 liquidity. Tezos Foundation would enactment up $300K for 3 months of rewards connected WETH/USDC, WBTC/USDC and LBTC/USDC, and is asking the DAO for $150K more, aiming to anchor Etherlink’s rising TVL and aboriginal autochthonal tokens connected Uniswap. Voting ends July 18.

- Rocket Pool DAO is voting to finalize Saturn 1’s implementation. Approval by a 75% supermajority volition ratify cardinal protocol changes, including caller transaction designs and a imaginable gross stock to the pDAO treasury. Voting ends July 24.

- July 16, 5 p.m.: VeChain to big a monthly update with assemblage representatives and the VeChain Foundation.

- Unlocks

- July 16: Arbitrum (ARB) to unlock 1.87% of its circulating proviso worthy $37.15 million.

- July 17: ZKSync (ZK) to unlock 2.41% of its circulating proviso worthy $9.24 million.

- July 17: ApeCoin (APE) to unlock 1.95% of its circulating proviso worthy $9.86 million.

- July 18: Official TRUMP (TRUMP) to unlock 45.35% of its circulating proviso worthy $827.17 million.

- July 18: Fasttoken (FTN) to unlock 4.64% of its circulating proviso worthy $90 million.

- Token Launches

- July 16: Bybit to delist Tap (TAP), VaporFund (VPR), Cosplay Token (COT), Souni (SON), Tenet Protocol (TENE), Havah (HVH), and Brawl AI Layer (BRAWL) among others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done July 17.

- July 16: Invest Web3 Forum (Dubai)

- July 20: Crypto Coin Day 7/20 (Atlanta)

- July 21-22: Malaysia Blockchain Week 2025 (Kuala Lumpur)

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

Token Talk

By Shaurya Malwa

- Eclipse Foundation, creator of the Eclipse layer-2 blockchain, debuted its autochthonal ES token, positioned arsenic the state and governance token for its “Solana connected Ethereum” network.

- Key allocations:

• 10% (100M) airdrop to aboriginal users

• 5% for liquidity connected exchanges

• 35% to ecosystem and development

• 19% to contributors (4-year vesting, 3-year lock)

• 31% to aboriginal supporters/investors (3-year lock) - Airdrop eligibility is based connected 3 factors:

• Turbo Tap gameplay ("grass" points earned via stress-testing)

• X (Twitter) activity, measured by Kaito analytics

• Discord engagement - No 1:1 conversion from “grass” points to tokens; snapshot and allocation details volition beryllium published aft the airdrop to forestall manipulation.

- Airdrop starts Wednesday, with distributions dispersed implicit 30 days crossed Eclipse, Ethereum and Solana mainnets.

- ES token volition acts arsenic state token via autochthonal paymaster mechanics and enables decentralized governance for protocol upgrades and decision-making

- The Eclipse squad is excluded from the airdrop to forestall insider manipulation; contributors volition person their allocation via vesting.

Derivatives Positioning

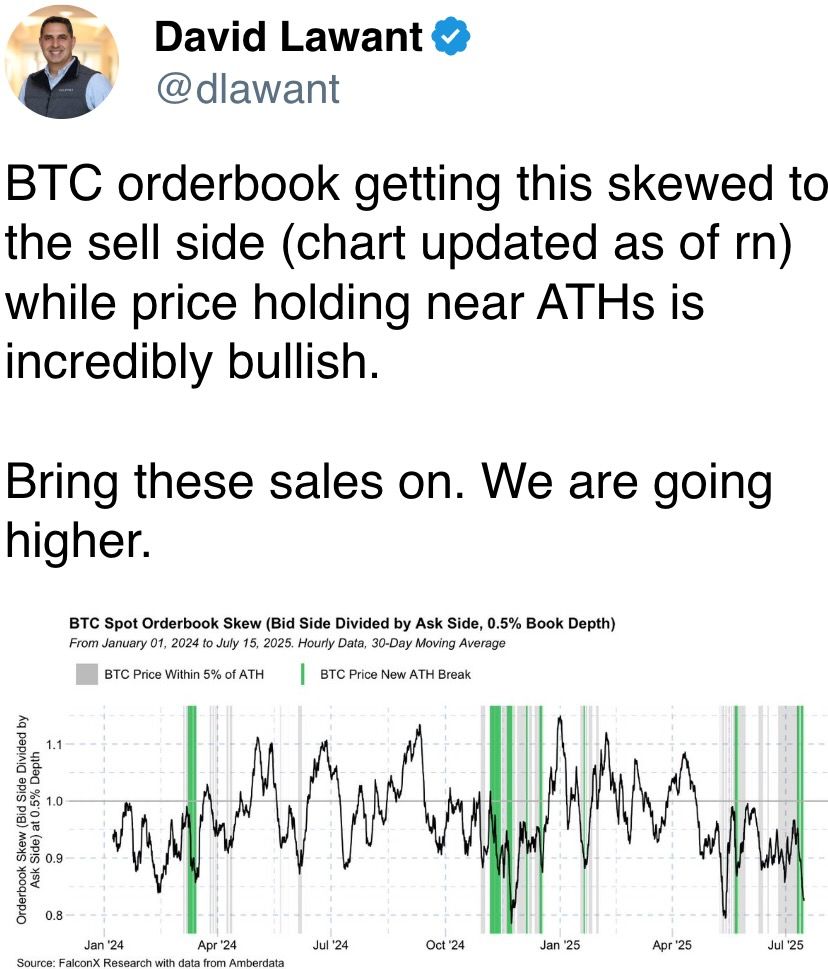

- Cumulative unfastened involvement successful BTC futures and perpetual futures listed worldwide has deed a grounds precocious of 739K BTC. Annualized perpetual backing rates person topped 23%, the highest successful months, suggesting increasing request for leveraged bullish plays.

- All large coins present person backing rates successful treble digits.

- However, lone ETH, TON, BTC, AAVE and SHIB person seen affirmative cumulative measurement delta successful the past 24 hours, a motion buyers are becoming much aggressive.

- On Deribit, BTC abbreviated duration skew has flipped affirmative again portion ETH continues to spot telephone bias crossed tenors.

- Block flows connected OTC liquidity level Paradigm featured a agelong presumption successful the September expiry telephone astatine the $140K strike.

Market Movements

- BTC is up 2.29% from 4 p.m. ET Tuesday astatine $119,095.12 (24hrs: +1.85%)

- ETH is up 3.81% astatine $3,157.00 (24hrs: +6.06%)

- CoinDesk 20 is up 3.25% astatine 3,703.30 (24hrs: +3.4%)

- Ether CESR Composite Staking Rate is down 1 bps astatine 3.03%

- BTC backing complaint is astatine 0.0263% (28.7985% annualized) connected Binance

- DXY is unchanged astatine 98.53

- Gold futures are up 0.34% astatine $3,348.20

- Silver futures are up 0.45% astatine $38.28

- Nikkei 225 closed unchanged astatine 39,663.40

- Hang Seng closed down 0.29% astatine 24,517.76

- FTSE is up 0.11% astatine 8,947.72

- Euro Stoxx 50 is down 0.41% astatine 5,332.42

- DJIA closed connected Tuesday down 0.98% astatine 44,023.29

- S&P 500 closed down 0.4% astatine 6,243.76

- Nasdaq Composite closed up 0.18% astatine 20,677.80

- S&P/TSX Composite closed down 0.53% astatine 27,054.14

- S&P 40 Latin America closed up 0.14% astatine 2,600.94

- U.S. 10-Year Treasury complaint is down 1.4 bps astatine 4.475%

- E-mini S&P 500 futures are down 0.14% astatine 6,275.50

- E-mini Nasdaq-100 futures are down 0.30% astatine 22,986.75

- E-mini Dow Jones Industrial Average Index are unchanged astatine 44,231.00

Bitcoin Stats

- BTC Dominance: 64.85% (0.17%)

- Ether to bitcoin ratio: 0.02651 (-0.6%)

- Hashrate (seven-day moving average): 935 EH/s

- Hashprice (spot): $59.88

- Total Fees: 4.17 BTC / $489,636

- CME Futures Open Interest: 156,645 BTC

- BTC priced successful gold: 35.7 oz

- BTC vs golden marketplace cap: 10.1%

Technical Analysis

- The illustration shows that DOGE is consolidating successful a bull flag-like antagonistic inclination channel.

- A imaginable breakout would awesome resumption of the archetypal uptrend.

Crypto Equities

- Strategy (MSTR): closed connected Tuesday astatine $442.31 (-1.93%), +1.73% astatine $449.98

- Coinbase Global (COIN): closed astatine $388.02 (-1.52%), +0.76% astatine $390.97

- Circle (CRCL): closed astatine $195.33 (-4.58%), +1.45% astatine $198.17

- Galaxy Digital (GLXY): closed astatine $20.86 (-2.75%), +3.02% astatine $21.49

- MARA Holdings (MARA): closed astatine $18.76 (-2.34%), +1.87% astatine $19.11

- Riot Platforms (RIOT): closed astatine $12.1 (-3.28%), +2.23% astatine $12.37

- Core Scientific (CORZ): closed astatine $13.76 (+1.47%), +0.22% astatine $13.79

- CleanSpark (CLSK): closed astatine $12.19 (-3.25%), +2.13% astatine $12.45

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $25.05 (-2.03%)

- Semler Scientific (SMLR): closed astatine $42.18 (-6.74%), +1.35% astatine $42.75

- Exodus Movement (EXOD): closed astatine $31.33 (-7.03%), +3.32% astatine $32.37

ETF Flows

Spot BTC ETFs

- Daily nett flows: $403.1 million

- Cumulative nett flows: $53.04 billion

- Total BTC holdings ~1.28 million

Spot ETH ETFs

- Daily nett flows: $192.3 million

- Cumulative nett flows: $5.78 billion

- Total ETH holdings ~4.53 million

Source: Farside Investors

Overnight Flows

Chart of the Day

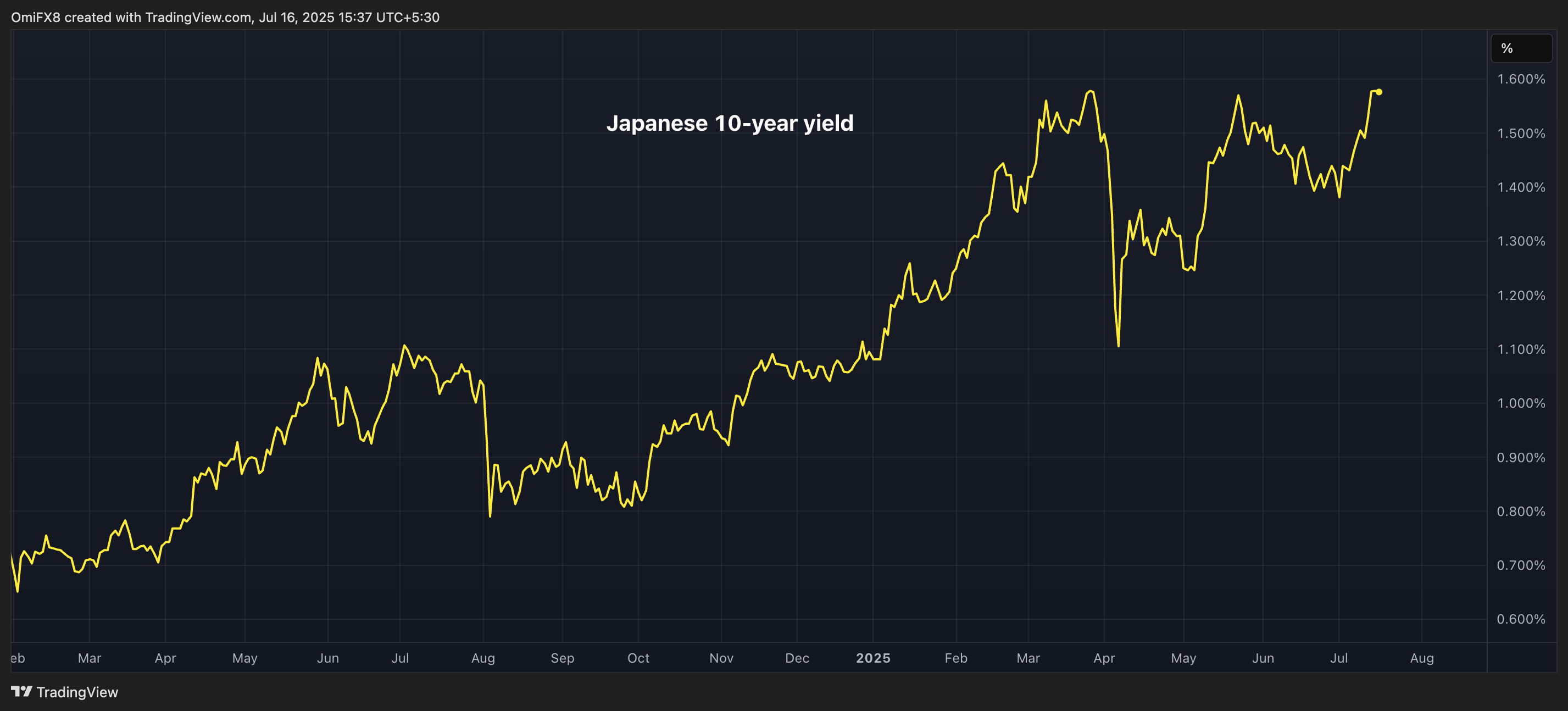

- The Japanese 10-year authorities enslaved output is connected the verge of mounting new, multidecade highs supra 1.58%.

- That could adhd to volatility successful enslaved markets crossed precocious nations, perchance starring to a mini bout of hazard aversion.

While You Were Sleeping

- Trump Reaps $50B Tariff Haul arsenic World ‘Chickens Out’ (Financial Times): Analysts accidental planetary restraint stems from fears of inflation, commercialized disruption and jeopardizing U.S. information ties, arsenic adjacent aboriginal retaliators similar China and Canada backed down.

- Ether Races 6% Against Bitcoin arsenic GENIUS Act Puts Spotlight connected Yield-Bearing Stablecoins: Analyst (CoinDesk): 10x Research’s Markus Thielen said ETH's latest rally reflects expectations the GENIUS Act volition pass, prohibiting output connected U.S. stablecoins and expanding the Ethereum network’s entreaty wrong crypto.

- Crypto Is Going Mainstream and 'You Can’t Put the Genie Back successful the Bottle,' Bitwise Says (CoinDesk): The plus manager's study said pending U.S. crypto authorities could unlock billions successful caller concern and pave the mode for trillions successful accepted assets to migrate onto blockchain infrastructure.

- Strategy’s Convertible Bond Prices Surge arsenic Stock Advances Back Toward Record High (CoinDesk): The firm's $8.2 cardinal successful convertible indebtedness present carries a $5.2 cardinal premium arsenic the surging stock terms pushes 5 of six notes heavy into the money, driving values higher.

- The European Charm Offensive That Helped Turn Trump Against Putin (The Wall Street Journal): President Trump’s shifting stance connected Russia followed vexation with President Putin, the German chancellor’s pledge to money U.S. aerial defence systems for Ukraine and European officials engaging successful talks with pro-Ukraine U.S. politicians.

- U.K. Inflation Unexpectedly Rises to Highest Since January 2024 (Reuters): Headline CPI roseate to 3.6% successful June from 3.4%, complicating a imaginable August complaint cut, with fuel, airfare and obstruction costs driving the increase. Inflation whitethorn highest adjacent 3.7% by September.

In the Ether

3 months ago

3 months ago

English (US)

English (US)