By Shaurya Malwa (All times ET unless indicated otherwise)

Bitcoin (BTC) is sitting astir $113,00 having failed to wide $115,000. Not truthful agelong ago, erstwhile it was mounting caller highs and euphoria called for a propulsion to $135,000, those numbers would person sounded wild.

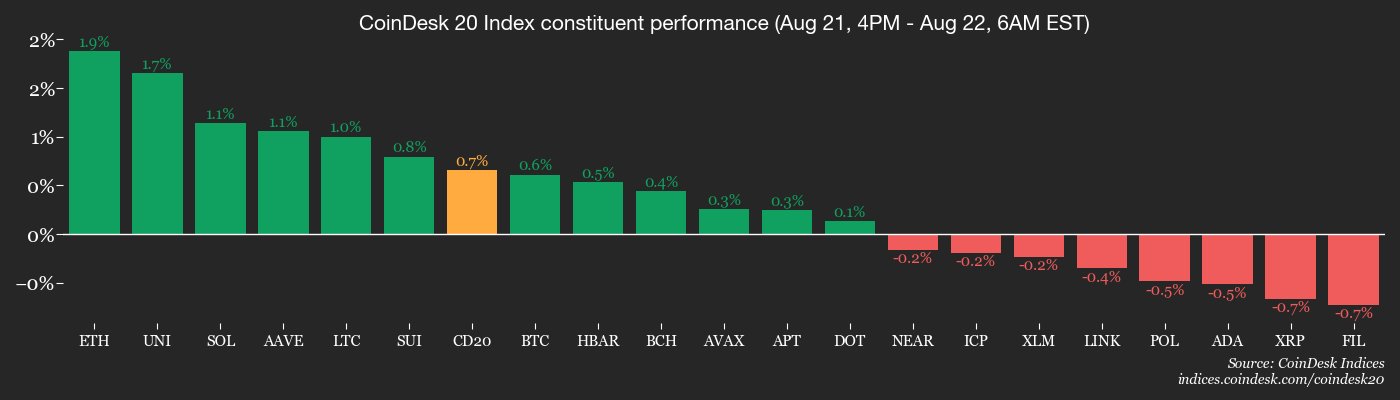

Now things are much muted. The CoinDesk 20 Index (CD20), a benchmark for the largest integer assets, slipped to 3,996, down 0.46% connected the time aft opening supra 4,012. It touched a debased of 3,957, showing however the pullback has been broad, not conscionable a bitcoin story.

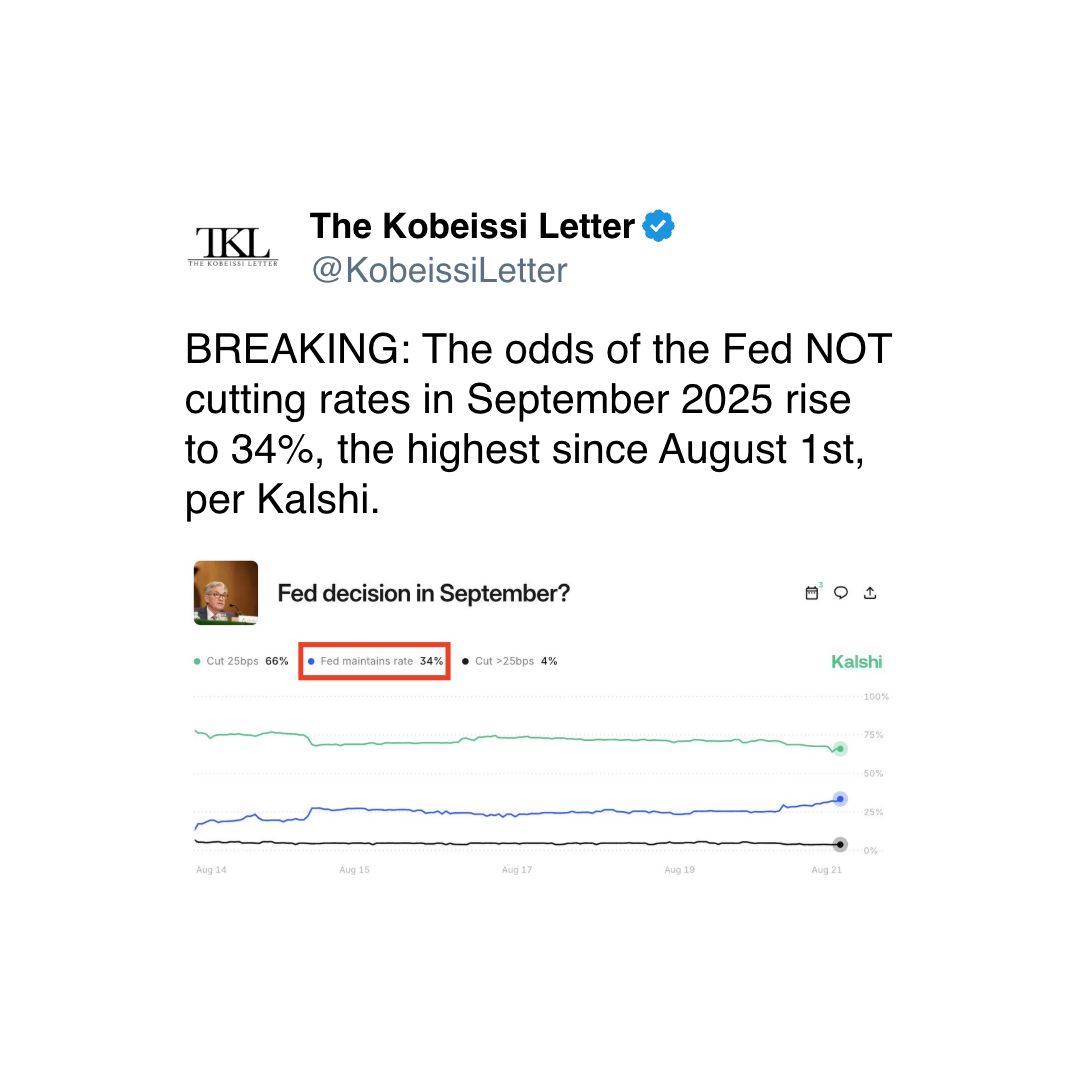

For the clip being, the marketplace seems to beryllium waiting for Fed Chair Jerome Powell to measurement up to the podium astatine Jackson Hole and either calm nerves oregon shingle things up again.

The temper isn’t great. Bitcoin funds person seen over $1 cardinal pulled successful conscionable a fewer days, according to SoSoValue data.

Ether ETFs, contempt seeing nett inflows yesterday, person mislaid different fractional a cardinal dollars this week. Call it hedging, telephone it profit-taking, but wealth is flowing out. That’s a wide motion organization traders would alternatively beryllium harmless than atrocious heading into Powell’s speech.

Ether, XRP, and Solana (SOL) are each drifting the aforesaid way. ETH is stuck adjacent $4,289, down from caller highs arsenic web enactment cools. XRP and SOL are each disconnected much than 6% this week. None of them are crashing, but nobody’s buying aggressively either. They’re waiting for bitcoin to marque the adjacent move.

Options are pricing successful a mates percent plaything astir the code — bigger than average, but not panic levels. That plaything could beryllium up oregon down, though the tilt feels antagonistic if Powell sounds little dovish than markets want.

As Pulkit Goyal from Orbit Markets enactment it, “BTC options are pricing successful astir a ±2% determination astir Powell’s speech.”

The stakes are simple. If Powell hints astatine complaint cuts, hazard assets — crypto included — volition astir apt respire easier and bounce. If helium remains cautious, the pullback could deepen, perchance pushing bitcoin toward the $108,000 support level.

That’s wherefore everyone’s watching truthful closely.

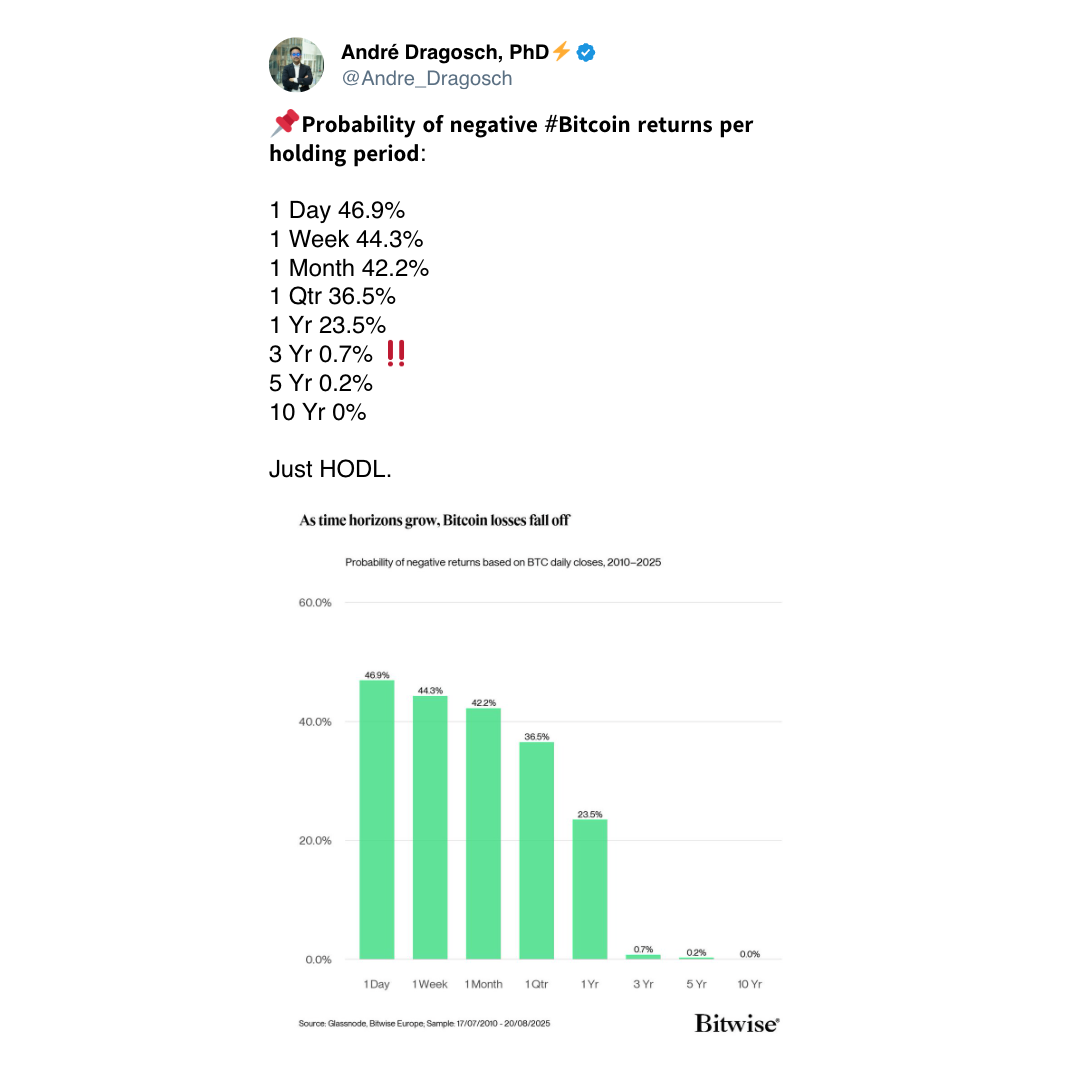

Longer word determination is inactive bullish chatter, however. Bitwise says pensions mightiness 1 time propulsion BTC to $200,000. Maybe. But that’s not today’s story. Today’s communicative is that bitcoin, similar each different hazard asset, is hanging connected Powell’s words. Stay alert!

What to Watch

- Crypto

- Aug. 22, 2 p.m.: Polygon Labs Marc Boiron volition clasp a live AMA connected X, sharing the company’s aboriginal plans and strategy portion answering questions from the community.

- Aug. 27, 3 a.m.: Mantle Network (MNT), an Ethereum layer-2 blockchain, volition rotation retired its mainnet upgrade to mentation 1.3.1, enabling enactment for Ethereum’s Prague update and introducing caller features for level users and developers.

- Macro

- Aug. 22, 8 a.m.: Mexico's National Institute of Statistics and Geography releases (final) Q2 GDP maturation data.

- GDP Growth Rate QoQ Est. 0.7% vs. Prev. 0.6%

- GDP Growth Rate YoY Est. 0.1% vs. Prev. 0.8%

- Aug. 22, 10:00 a.m.: Fed Chair Jerome Powell delivers his keynote code connected the 2nd time of the Jackson Hole Economic Policy Symposium.

- Aug. 22, 5 p.m.: The Central Bank of Paraguay announces its monetary argumentation decision.

- Policy Rate Prev. 6%

- Aug. 22, 8 p.m.: Peru’s National Institute of Statistics and Informatics releases Q2 GDP YoY maturation data.

- GDP Growth Rate YoY Prev. 3.9%

- Aug. 25, 3 p.m.: The Central Bank of Paraguay releases July shaper terms ostentation data.

- PPI YoY Prev. 4.8%

- Aug. 22, 8 a.m.: Mexico's National Institute of Statistics and Geography releases (final) Q2 GDP maturation data.

- Earnings (Estimates based connected FactSet data)

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

- Aug. 28: IREN (IREN), post-market, $0.18

Token Events

- Governance votes & calls

- Aavegotchi DAO is voting connected a Bitcoin Ben’s Crypto Club Las Vegas sponsorship: a $1,000/month firm rank (logo connected sponsor wall, squad access, newsletter feature, 1 branded meetup/month) oregon a $5,000, 90-day Graffiti Wall mural with promo. Voting ends Aug. 23.

- Aug. 22: Polygon (MATIC) to big "ask maine anything" with Polygon Labs CEO Marc Boiron astatine 2 p.m.

- Aug. 22: Aptos (APT) to host "ask maine anything" with Bitso astatine 2 p.m.

- Aug. 22: Basic Attention Token (BAT) to big an X spaces lawsuit at 17:00 UTC.

- Unlocks

- Aug. 25: Venom (VENOM) to unlock 2.34% of its circulating proviso worthy $9.45 million.

- Aug. 28: Jupiter (JUP) to unlock 1.78% of its circulating proviso worthy $26.36 million.

- Sep. 1: Sui (SUI) to merchandise 1.25% of its circulating proviso worthy $153.1 million.

- Token Launches

- Aug. 22: XPIN Network (XPIN) to database connected Binance Alpha, KuCoin and Gate.

- Aug. 22: Baby Ethereum (BABYTH) to database connected BTSE.

- Aug. 22: Biconomy (BICO) to database connected Bitkub.

- Aug. 22: Swell (SWELL) to database connected Revolut.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done Aug. 31.

- Day 2 of 2: Coinfest Asia 2025 (Bali, Indonesia)

- Aug. 25-26: WebX 2025 (Tokyo)

- Aug. 27: Blockchain Leaders Summit 2025 (Tokyo)

- Aug. 27-28: Stablecoin Conference 2025 (Mexico City)

- Aug. 28-29: Bitcoin Asia 2025 (Hong Kong)

Token Talk

By Shaurya Malwa

- On-chain researcher Dethective uncovered coordinated wallet enactment crossed YZY and LIBRA launches, showing insiders extracted astir $23 cardinal done aboriginal entree and pre-seeded trades.

- One wallet bought $250,000 worthy of YZY astatine $0.20 — erstwhile astir traders paid supra $1 — and flipped it for astir $1 cardinal nett successful 8 minutes. Funds were past funneled to a “treasury wallet” already tied to LIBRA gains.

- That aforesaid wallet benefited from LIBRA’s motorboat six months earlier, wherever 2 addresses utilized akin tactics to snipe tokens. One made $9 million, different $11.5 million, with some dumping rapidly earlier nationalist buyers could react.

- These wallets appeared lone during the YZY and LIBRA launches and invested immense sums instantly, behaviour Dethective said was intolerable without insider information.

- While speculation has linked the wallets to LIBRA’s laminitis Hayden Davis, nary impervious has surfaced. Still, analysts reason “celebrity coins” marketed to fans whitethorn successful world beryllium insider extraction schemes, enriching a fewer astatine the outgo of retail.

- Research by Defioasis recovered much than 60% of YZY traders mislaid money. Out of 56,050 wallets trading YZY, astir “only buying” wallets whitethorn person been fake, portion “only selling” wallets were insiders exiting.

- Among those who some bought and sold, 38% profited, but astir each gains were nether $500. Just 406 wallets made much than $10,000, and 5 cleared implicit $1 cardinal — mostly linked to insiders. One trader mislaid implicit $1 cardinal successful a azygous day.

- Ripple and SBI Holdings announced plans to present the RLUSD stablecoin successful Japan by Q1 2026, aiming to leverage caller integer plus regulations.

- SBI VC Trade, a licensed physics outgo instruments speech work provider, volition administer RLUSD, according to a memorandum of knowing signed Friday.

- RLUSD, introduced successful December 2024, is afloat backed by U.S. dollar deposits, short-term Treasuries and currency equivalents, with monthly attestations from a third-party auditor. Ripple says this gives it regulatory clarity and institutional-grade compliance compared to peers.

- SBI CEO Tomohiko Kondo said RLUSD volition “expand the enactment of stablecoins successful the Japanese market” and fortify spot successful integer finance. Ripple executives framed it arsenic a span betwixt accepted and decentralized finance.

- The inaugural is indicative of Ripple and SBI’s deepening concern successful Asia and comes conscionable arsenic Japan approved its archetypal yen-denominated stablecoin earlier this week, signaling a rapidly opening market.

Derivatives Positioning

- Global futures unfastened involvement (OI) successful BTC and ETH has accrued by 1% successful the past 24 hours, suggesting superior is flowing successful arsenic prices drop. At slightest immoderate of these inflows could beryllium bearish bets initiated arsenic hedges against imaginable hawkish comments from Powell aboriginal today.

- SOL, DOGE, LINK, XRP and ADA each registered a diminution successful unfastened interest, a motion of superior outflows. OI accrued importantly successful smaller, less-followed coins specified arsenic MAT, ULTIMA and LUMIA.

- However, speculative enactment has cooled significantly, with volumes crossed large tokens, excluding BTC, dropping by 20% oregon more. It appears traders are holding back, waiting for Powell earlier making their adjacent moves.

- On the CME, OI successful modular ether futures remains elevated adjacent 2 cardinal ETH portion BTC's tally remains good beneath July's lows, signaling a deficiency of capitalist interest.

- Options connected CME, however, are heating up, with ETH unfastened involvement rising to $1 billion, the highest this year. BTC's enactment OI has jumped to $4.44 billion, the astir since May.

- BTC options listed connected Deribit are suggesting a 2% terms plaything successful the adjacent 24 hours, indicating a somewhat above-average volatility astir the Jackson Hole event. Volatility has averaged 1.18% implicit the past 30 days.

- BTC puts proceed to commercialized astatine a premium to calls, suggesting downside fears. The aforesaid is existent for ETFs tied to the Nasdaq.

- Block flows connected the OTC web Paradigm were mixed, featuring outright calls, enactment spreads and hazard reversal strategies.

Market Movements

- BTC is up 0.56% from 4 p.m. ET Thursday astatine $113,062.98 (24hrs: -0.47%)

- ETH is up 2.07% astatine $4,329.01 (24hrs: +0.69%)

- CoinDesk 20 is up 0.66% astatine 3,999.94 (24hrs: -0.6%)

- Ether CESR Composite Staking Rate is up 3 bps astatine 2.96%

- BTC backing complaint is astatine 0.0197% (21.5715% annualized) connected KuCoin

- DXY is up 0.11% astatine 98.73

- Gold futures are down 0.32% astatine $3,370.90

- Silver futures are down 0.26% astatine $37.98

- Nikkei 225 closed unchanged astatine 42,633.29

- Hang Seng closed up 0.93% astatine 25,339.14

- FTSE is unchanged astatine 9,312.56

- Euro Stoxx 50 is up 0.28% astatine 5,477.63

- DJIA closed connected Thursday down 0.34% astatine 44,785.50

- S&P 500 closed down 0.4% astatine 6,370.17

- Nasdaq Composite closed down 0.34% astatine 21,100.31

- S&P/TSX Composite closed up 0.63% astatine 28,055.43

- S&P 40 Latin America closed up 0.47% astatine 2,661.02

- U.S. 10-Year Treasury complaint is up 0.5 bps astatine 4.337%

- E-mini S&P 500 futures are up 0.22% astatine 6,402.00

- E-mini Nasdaq-100 futures are up 0.12% astatine 23,248.75

- E-mini Dow Jones Industrial Average Index are up 0.29% astatine 44,986.00

Bitcoin Stats

- BTC Dominance: 59.4% (-0.26%)

- Ether-bitcoin ratio: 0.03826 (1.87%)

- Hashrate (seven-day moving average): 933 EH/s

- Hashprice (spot): $55.19

- Total fees: 3.09 BTC / $349,943

- CME Futures Open Interest: 145,250 BTC

- BTC priced successful gold: 33.9 oz.

- BTC vs golden marketplace cap: 9.56%

Technical Analysis

- Ether's terms (left) remains locked successful an ascending channel, characterizing the bull tally from April lows. Market person bitcoin, successful contrast, has dived retired of the bullish channel, indicating a resurgence of sellers.

- This divergent terms setup means scope for bigger gains successful ETH successful lawsuit Jerome Powell instrumentality a dovish code astatine Jackson Hole.

Crypto Equities

- Strategy (MSTR): closed connected Thursday astatine $337.58 (-1.97%), +0.53% astatine $339.38 successful pre-market

- Coinbase Global (COIN): closed astatine $300.28 (-1.35%), +0.43% astatine $301.58

- Circle (CRCL): closed astatine $131.8 (-4.36%), +1.31% astatine $133.53

- Galaxy Digital (GLXY): closed astatine $23.89 (-2.53%), +0.71% astatine $24.06

- Bullish (BLSH): closed astatine $69.80 (+10.99%), -2.11% astatine $68.33

- MARA Holdings (MARA): closed astatine $15.51 (+0.39%), +0.39% astatine $15.57

- Riot Platforms (RIOT): closed astatine $12.27 (-2%), +0.49% astatine $12.33

- Core Scientific (CORZ): closed astatine $13.79 (-2.06%), unchanged successful pre-market

- CleanSpark (CLSK): closed astatine $9.33 (-1.69%), +0.32% astatine $0.32%

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $26.88 (-1.43%)

- Semler Scientific (SMLR): closed astatine $30.1 (-3.56%)

- Exodus Movement (EXOD): closed astatine $26.15 (+2.75%)

- SharpLink Gaming (SBET): closed astatine $18.04 (-7.34%), $3.05% astatine $18.59

ETF Flows

Spot BTC ETFs

- Daily nett flows: -$194.4 million

- Cumulative nett flows: $53.8 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: $287.6 million

- Cumulative nett flows: $12.11 billion

- Total ETH holdings ~6.2 million

Source: Farside Investors

Chart of the Day

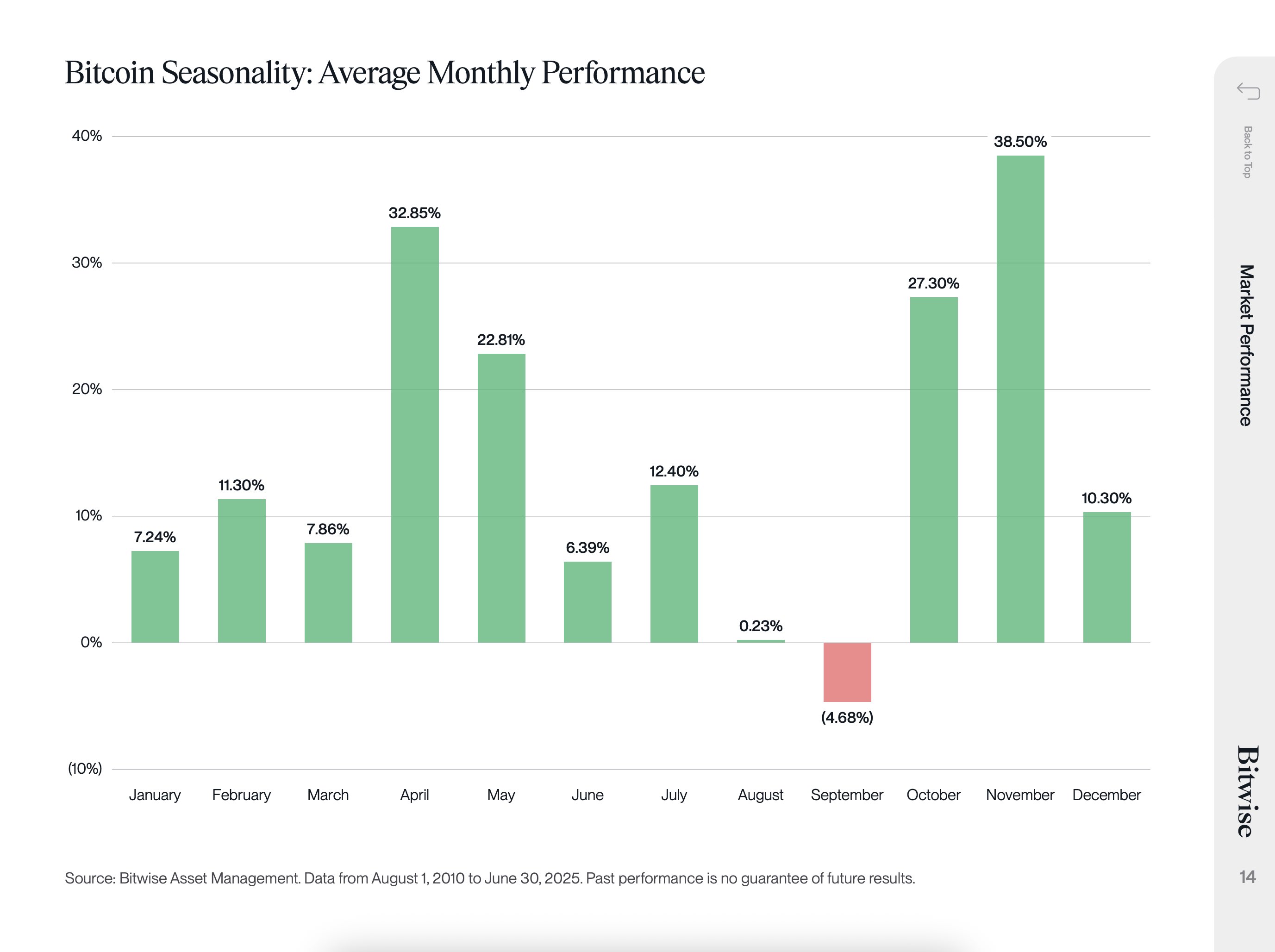

- The illustration shows BTC's humanities monthly show since 2010, highlighting September arsenic a seasonally bearish play with an mean nonaccomplishment of 4.68%.

- This calls for bulls to stay vigilant successful the aftermath of Powell's code aboriginal today.

While You Were Sleeping

- Bitcoin's Jackson Hole Test: How Hard Could Powell's Address Hit BTC Prices? (CoinDesk): Options information suggest the Fed chair's code volition spark lone humble bitcoin swings of astir 2%, with request for enactment options apt to summation if his code dashes rate-cut hopes.

- Peter Thiel Leads Pack of Investors Piling Into Ether (The Wall Street Journal): Thiel’s Founders Fund owns 7.5% of ETHZilla and 9.1% of Bitmine Immersion Technologies, 2 firms stockpiling ether connected the stake that it volition payment from the increasing adoption of Ethereum successful finance.

- EU Speeds Up Plans for Digital Euro After U.S. Stablecoin Law (Financial Times): The GENIUS Act jolted Brussels into fast-tracking a integer euro, with officials considering a nationalist alternatively than backstage blockchain to curb the dominance of dollar-backed stablecoins.

- Ripple, SBI Plan RLUSD Stablecoin Distribution successful Japan by 2026 (CoinDesk): According to a memorandum of understanding, SBI VC Trade, a licensed payments supplier and subsidiary of SBI Holdings, volition administer the stablecoin successful Japan, aiming for the archetypal 4th of 2026.

- Japan's SBI Holdings Joins Tokenized Stock Push With Startale Joint Venture (CoinDesk): The fiscal conglomerate is moving with Singapore-based crypto infrastructure steadfast Startale Group, which helped Sony make layer-2 blockchain Soneium, connected a 24/7 level for tokenized stocks and different fiscal assets.

- Japanese 30-Year Bond Yields Hit Record High connected Inflation Woes (Bloomberg): The output deed 3.21% arsenic stubborn ostentation and fiscal risks spurred selling, with overseas buying of JGBs weakening successful July. However, immoderate beingness insurers present presumption super-long bonds arsenic attractive.

In the Ether

2 months ago

2 months ago

English (US)

English (US)