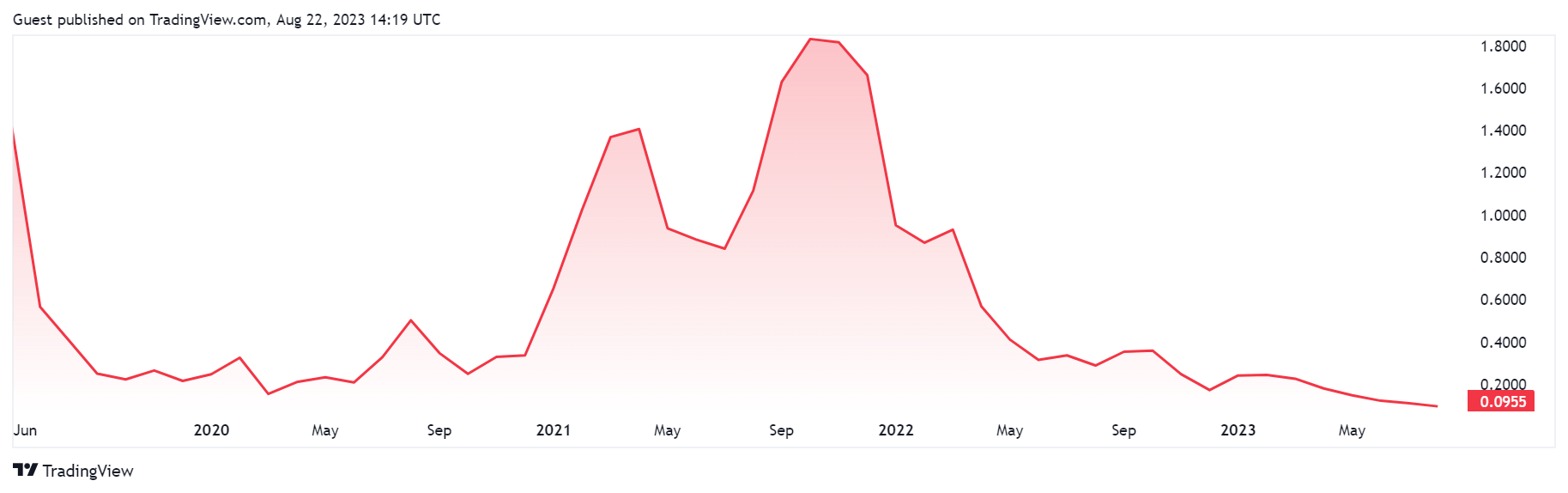

Algorand’s ALGO token terms has plunged to caller lows pursuing the crypto market’s epic clang connected Aug. 17.

According to CryptoSlate’s data, the integer plus fell to an all-time debased of $0.08846 past Thursday. While its worth has since rebounded to $0.09673 arsenic of property time, marketplace sentiments surrounding the plus stay negative.

Why is ALGO worth dropping

Earlier successful the year, the SEC classified the ALGO token arsenic a information arsenic portion of its charges against the U.S.-based crypto speech Bittrex. This classification has important implications for the fiscal regulations that the token and its holders face.

Despite beardown opposition from its Foundation, ALGO has seen a diminution successful request owed to capitalist hesitation astir assets without wide regulatory status. This has resulted successful the token’s worth dropping by much than 87% since the classification.

Source: Tradingview

Source: TradingviewBefore the SEC classification, Algorand’s ecosystem faced challenges erstwhile MyAlgo, a salient wallet successful the ecosystem, was hacked successful March. The incidental resulted successful losses of implicit $10 million, shaking assurance successful the network’s information measures.

However, Algorand’s Foundation CEO Staci Warden has watered down the effect of the falling worth of the asset. According to Warden, the web is connected the way to occurrence arsenic it was inactive attracting developers to its ecosystem.

Despite the falling worth of ALGO, Algorand Foundation CEO Staci Warden remains optimistic, believing that the network’s quality to proceed attracting developers is simply a affirmative motion for its future.

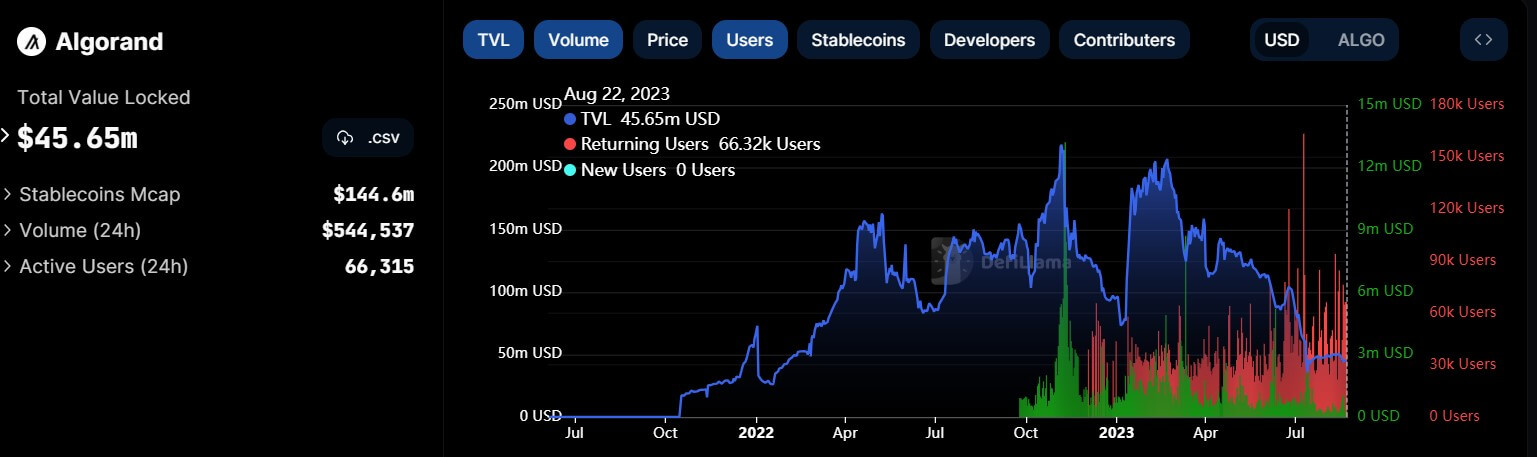

DeFi enactment stalls

Meanwhile, the terms diminution is amid a falling DeFi enactment connected the network. Data from DeFillama shows that the full worth of assets locked connected the blockchain has fallen to little than $50 cardinal aft peaking astatine much than $200 cardinal successful February.

Source: DeFillama

Source: DeFillamaInterestingly, the driblet successful TVL is not simply a effect of ALGO’s falling prices. In July, Algorand’s largest decentralized concern protocol, Algofi, said it would coiled down its operations owed to its inability to support the platform. At its peak, the DeFi level contributed implicit 50% of Algorand’s DeFi activity.

Algofi’s abrupt closure severely impacted assurance successful different protocols, which were inactive striving to pull caller users to their platforms.

The station Algorand’s ALGO token nosedives amid SEC classification and deflating DeFi activity appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)