The M1 wealth supply, a cardinal economical indicator, represents the full magnitude of carnal currency successful circulation, including coins, notes, traveler’s checks, and request deposits.

Essentially, it measures an economy’s liquidity and the public’s spending power.

In the discourse of the cryptocurrency market, comparing Bitcoin’s spot terms to the M1 wealth proviso provides an absorbing penetration into the integer asset’s comparative worthy and imaginable for aboriginal growth.

This examination tin service arsenic a instrumentality for investors and economists to measure the standard of Bitcoin successful narration to accepted wealth proviso and its imaginable implications connected planetary economical structures.

Moreover, tracking changes successful Bitcoin’s worth against the M1 wealth proviso tin perchance item shifts successful nationalist sentiment towards accepted fiat currencies and integer assets, offering a unsocial position connected the evolving fiscal landscape.

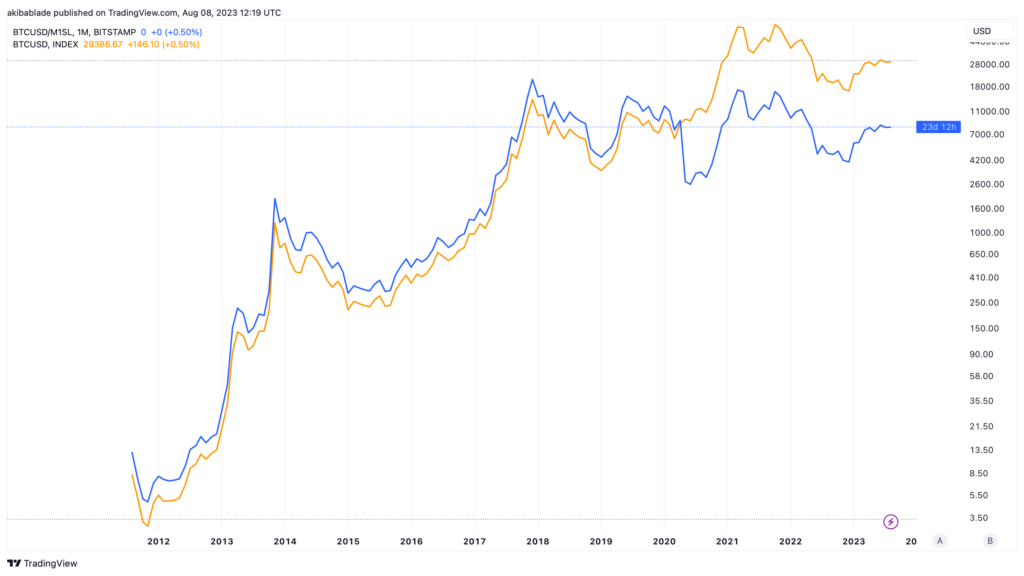

In the illustration below, the ratio of Bitcoin’s spot terms to the M1 wealth proviso (BTCUSD/M1SL) is ever higher than Bitcoin’s spot terms until Q1 2020.

This inclination has been observed connected a logarithmic scale, emphasizing the comparative maturation rates and proportional changes betwixt these metrics. Notably, Bitcoin’s price, erstwhile adjusted for the M1SL hasn’t reached an all-time precocious since 2017.

Graph comparing Bitcoin’s spot terms to BTCUSD/M1SL from 2014 to 2023 (Source: TradingView)

Graph comparing Bitcoin’s spot terms to BTCUSD/M1SL from 2014 to 2023 (Source: TradingView)Presenting Bitcoin’s spot terms arsenic consistently little than BTCUSD/M1SL indicates that the maturation complaint of Bitcoin’s terms was lagging down the maturation complaint of the M1 wealth proviso oregon that the M1 wealth proviso was increasing astatine a higher complaint than Bitcoin’s price.

This aligns with the macroeconomic investigation of the time, fixed that accepted fiat currencies and liquidity successful the system were expanding much rapidly than the request oregon valuation of Bitcoin. Bitcoin was besides little correlated with accepted fiscal markets and economical indicators during this period.

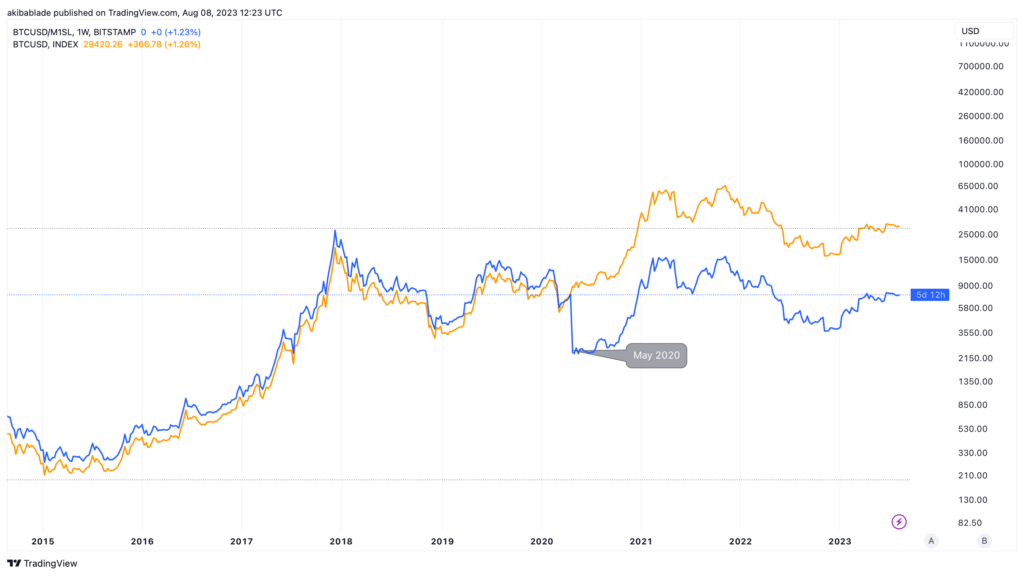

Then, the displacement from May 2020, erstwhile Bitcoin’s terms began to emergence aft the halving, appears to bespeak that Bitcoin’s growth rate started to outpace the maturation complaint of different assets.

Graph comparing Bitcoin’s spot terms to BTCUSD/M1SL from 2014 to 2023 (Source: TradingView)

Graph comparing Bitcoin’s spot terms to BTCUSD/M1SL from 2014 to 2023 (Source: TradingView)However, the BTCUSD/M1SL illustration shows that the worth of Bitcoin comparative to the full magnitude of fiat wealth successful circulation decreased. This could beryllium attributed to a mates of factors.

One could beryllium the effect of the monetary policies enacted by the Federal Reserve. As the COVID-19 pandemic hit, cardinal banks injected ample amounts of liquidity into their economies to curb the anticipated economical downturn. This led to an summation successful the M1 wealth supply, subsequently causing a alteration successful the BTCUSD/M1SL ratio.

However, it’s important to enactment that this alteration successful the BTCUSD/M1SL ratio doesn’t needfully bespeak a simplification successful the intrinsic worth oregon imaginable of Bitcoin. Instead, it reflects the changes successful economical conditions and marketplace sentiment astatine the time.

While the terms of Bitcoin accrued successful dollar terms, the comparative liquid worthy of the dollar besides declined arsenic proviso skyrocketed. The M1SL roseate 426% implicit 700 days, expanding the M1 proviso to $20.8 trillion from $3.95 trillion. The equivalent alteration successful Bitcoin proviso would beryllium to spell from 21 cardinal coins to 88 million.

In the future, should the BTCUSD/M1SL illustration flip the BTCUSD terms again, it could awesome an acceleration successful Bitcoin’s existent dollar value. The existent spread betwixt the orangish and bluish lines connected the illustration fundamentally represents the excess liquidity successful the US markets post2020. In this situation, either the Bitcoin terms rises comparative to the M1SL oregon the M1SL declines portion Bitcoin holds steady.

However, if the M1SL declines successful tandem with a alteration successful Bitcoin’s price, it whitethorn signify a reduced perceived dollar valuation for the apical cryptocurrency by marketplace cap.

The observed trends betwixt BTCUSD and BTCUSD/M1SL supply invaluable insights, highlighting factors beyond elemental terms comparisons needed to summation a existent consciousness of the worth of integer assets specified arsenic Bitcoin.

It serves arsenic a reminder that adjacent successful the rapidly evolving satellite of cryptocurrencies, accepted economical indicators similar the M1 wealth proviso inactive clasp relevance and tin supply invaluable discourse for knowing crypto marketplace dynamics.

The station Adjusting Bitcoin’s terms for US liquidity reveals cardinal indicator for bull run appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)