The realized terms represents the mean outgo astatine which each existent Bitcoin holders bought their coins. Essentially, it provides a snapshot of the “collective memory” of the market, capturing the terms astatine which the past transaction of each Bitcoin took place. Determining Bitcoin’s realized terms is important arsenic it offers insights into the existent profitability of the market’s participants. However, similar immoderate metric, it’s not without flaws. A imaginable drawback is that it doesn’t relationship for mislaid oregon dormant coins, perchance skewing the estimation.

The True Market Mean Price, commonly called the Active-Investor Price, is simply a caller metric pioneered by ARK Invest successful collaboration with Glassnode. Rather than relying connected humanities transactions, this measurement emphasizes the actions of existent marketplace participants. Specifically, it calculates the mean terms astatine which Bitcoins were past transacted, considering lone those coins that person changed hands wrong a defined period. This attack filters retired the power of long-dormant coins and focuses connected caller marketplace sentiment. As a result, the True Market Mean Price delivers a precise practice of the worth astatine which progressive Bitcoin participants, those genuinely progressive successful the marketplace dynamics, person acquired their assets.

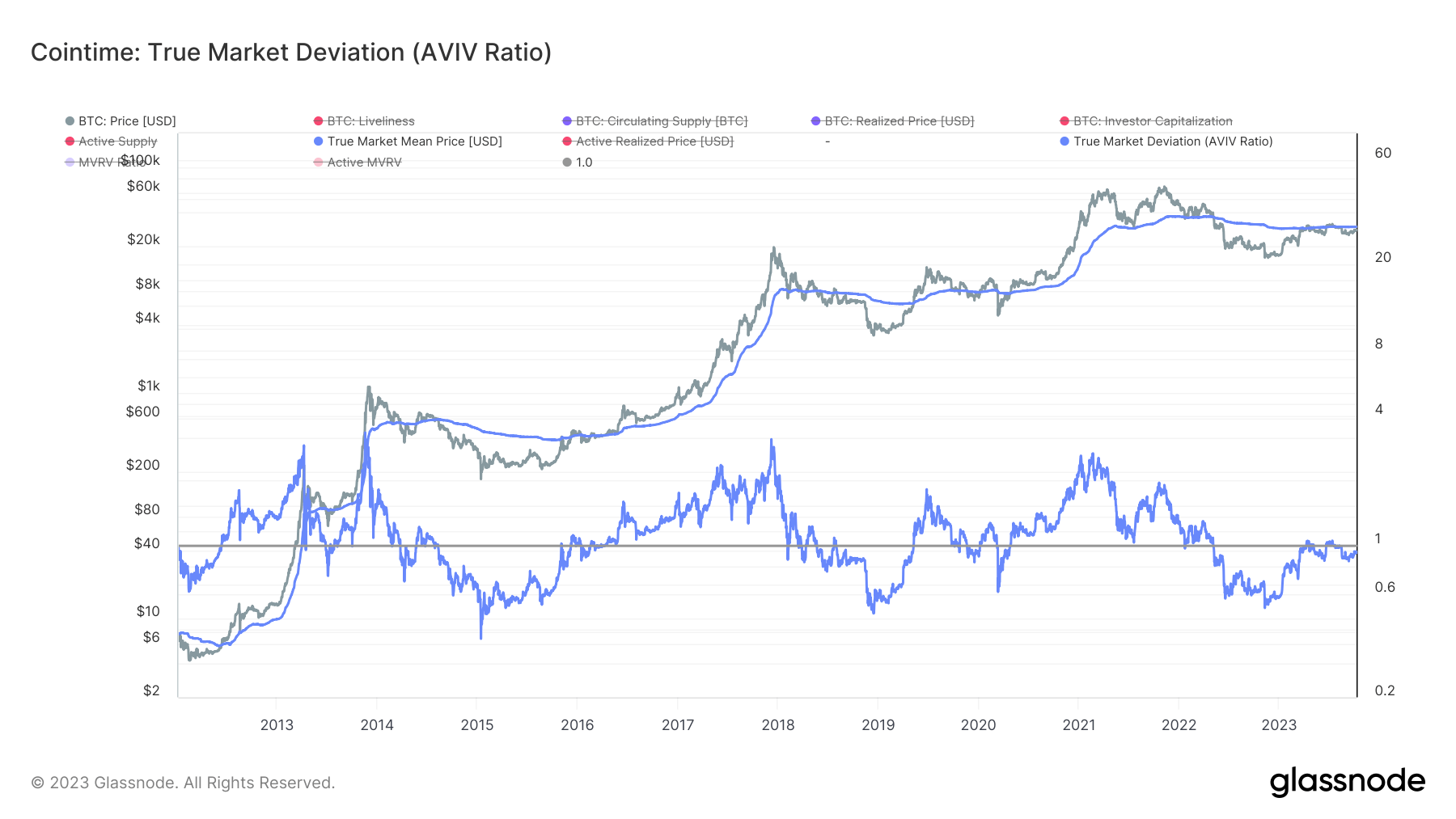

Building connected this metric is the True Market Deviation, which calculates the ratio of the existent spot terms of Bitcoin to the True Market Mean Price. The higher the ratio, the greater the deviation from the mean terms paid by progressive investors. Essentially, this metric tin bespeak whether Bitcoin is presently overvalued oregon undervalued based connected progressive marketplace participation.

Recent information from Glassnode sheds airy connected the value of this deviation. Historically, dips successful the True Market Deviation beneath 1 person consistently correlated with terms drops. On the different hand, spikes supra 1 person signaled bull rallies. This implies that erstwhile Bitcoin’s spot terms surpasses the True Market Mean Price, it often indicates a marketplace top, signaling a perchance bully selling opportunity. Conversely, erstwhile the terms drops beneath this mean price, it has traditionally signaled a robust buying window.

Graph showing the existent marketplace mean terms and existent marketplace deviation (AVIV score) from 2012 to 2023 (Source: Glassnode)

Graph showing the existent marketplace mean terms and existent marketplace deviation (AVIV score) from 2012 to 2023 (Source: Glassnode)Fast-forward to this year’s data. Since the opening of the year, the True Market Mean Price for Bitcoin has seen a humble uptick, moving from $28,660 to $29,720. Intriguingly, Bitcoin’s terms has remained supra this mean for little than 30 days passim the year. With Bitcoin’s leap supra $27,000, the AVIV ratio has increased, lasting astatine 0.928. At the clip of writing, Bitcoin’s spot terms is astir $27,590, notably beneath the True Market Mean Price of $29,720.

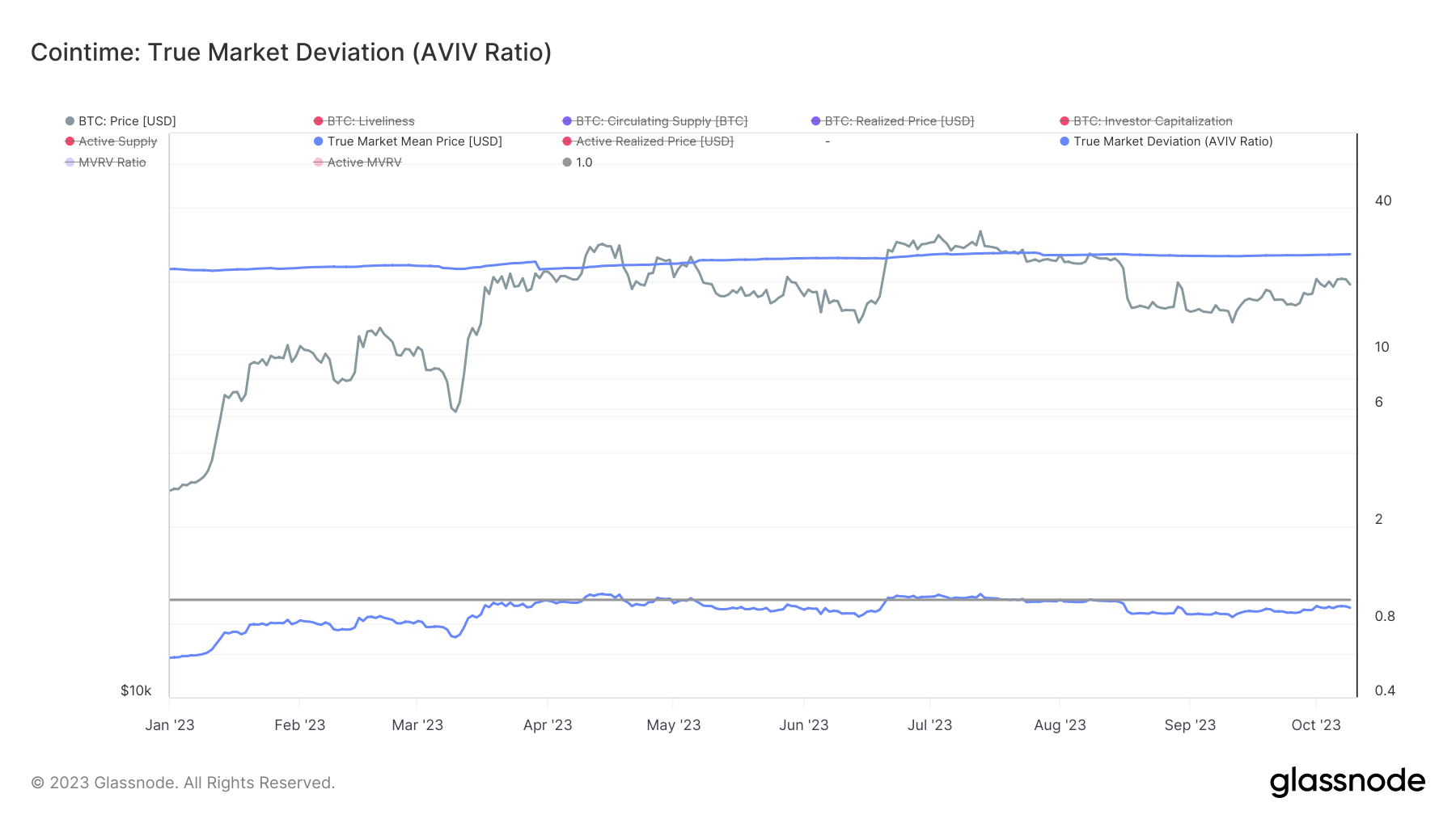

Graph showing the existent marketplace mean terms and existent marketplace deviation (AVIV score) successful 2023 (Source: Glassnode)

Graph showing the existent marketplace mean terms and existent marketplace deviation (AVIV score) successful 2023 (Source: Glassnode)The information suggests that contempt the caller surge, Bitcoin mightiness inactive beryllium undervalued erstwhile considering the terms astatine which progressive marketplace participants acquired their coins. This could hint astatine a imaginable upward question successful the adjacent future, provided different marketplace factors stay conducive.

The station Active capitalist price: a caller position connected Bitcoin’s valuation appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)