The Abu Dhabi Investment Council (ADIC) astir tripled its vulnerability to Bitcoin during the 3rd 4th done BlackRock’s spot Bitcoin fund, according to a caller report.

Several marketplace participants saw it arsenic a awesome that organization involvement successful crypto is inactive gaining momentum successful the United Arab Emirates.

ADIC, an concern limb of Mubala Investment Company, told Bloomberg connected Wednesday it sees Bitcoin (BTC) arsenic the integer equivalent of gold.

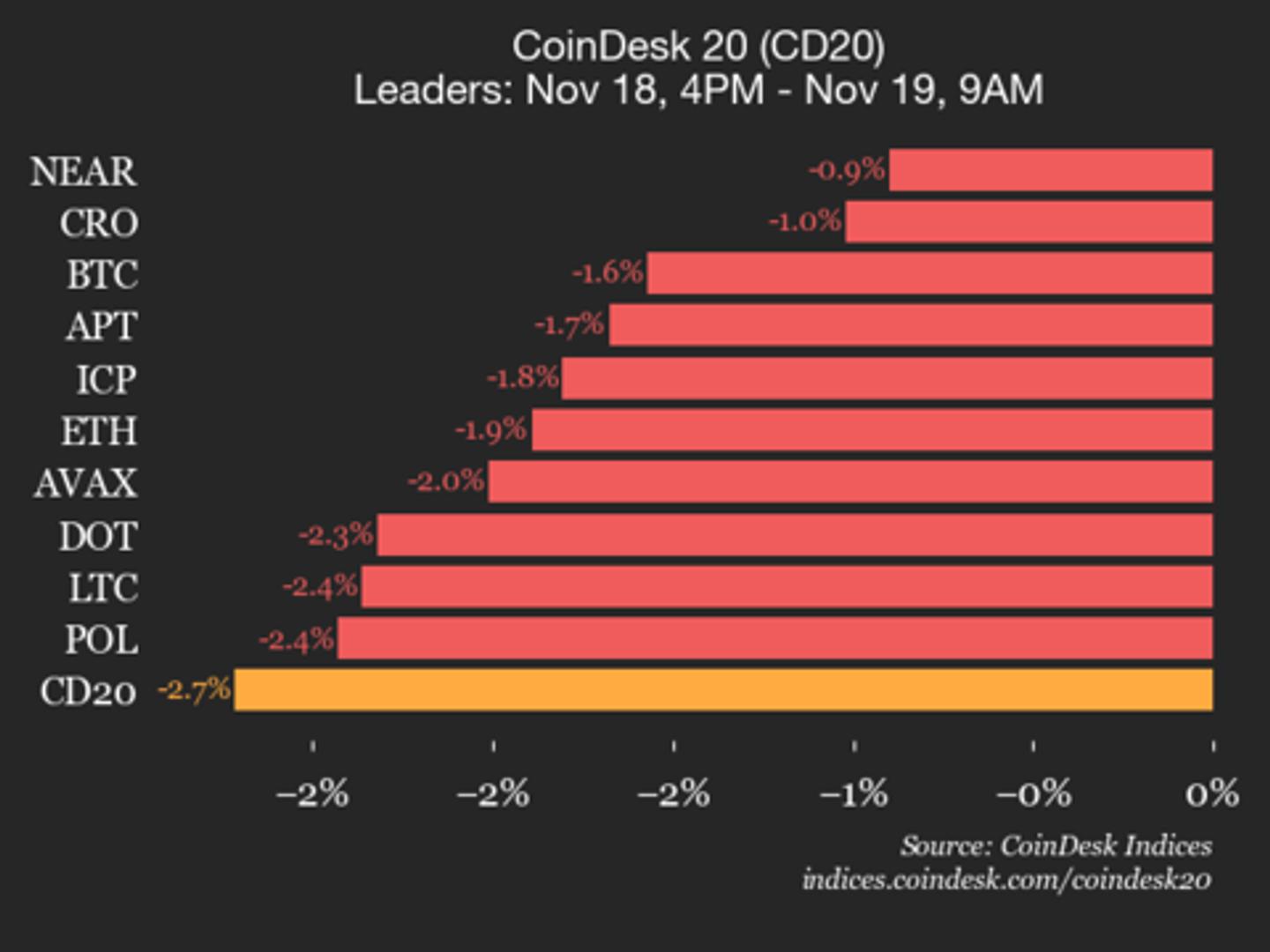

ADIC’s IBIT summation came during a volatile play for Bitcoin. The 4th ended conscionable days earlier BTC surged to an all-time precocious of $125,100 connected Oct. 5, earlier dropping backmost beneath $90,000 connected Wednesday.

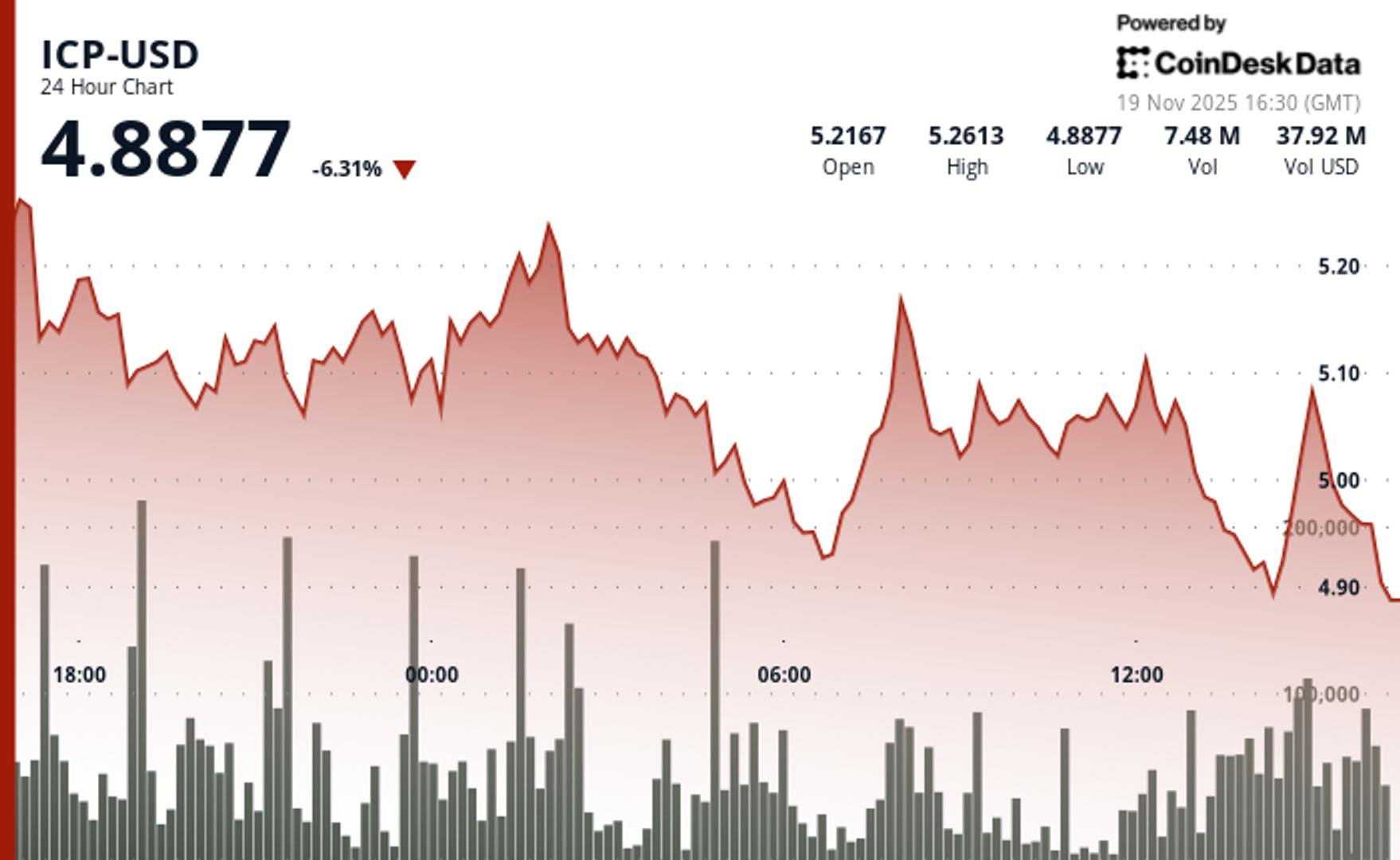

IBIT has plunged since the extremity of the 3rd quarter

Bloomberg reported that ADIC accrued its IBIT holdings from 2.4 cardinal shares astatine the commencement of Q3 to astir 8 cardinal by Sept. 30, valuing the presumption astatine astir $520 million. IBIT closed the 4th astatine $65 per stock and roseate to $71 connected Oct. 6, the time aft Bitcoin deed its all-time high.

However, Bitcoin’s caller plunge beneath $100,000 has dragged IBIT little arsenic well. The ETF closed Wednesday astatine $50.71, down astir 23% since the extremity of the 3rd quarter.

Despite the Bitcoin terms decline, the ADIC banal summation was wide work arsenic a motion of broader organization adoption.

Crypto concern level M2 treasury manager, Zayed Aleem, said successful a LinkedIn station connected Wednesday that it is “fantastic to spot specified organization condemnation and different beardown awesome that the UAE is securing its spot arsenic a planetary hub for integer assets.”

Echoing a akin sentiment, crypto commentator MartyParty said that “the presumption reflects a strategical stake connected BTC’s relation arsenic a store of value.”

The quality comes conscionable 1 time aft IBIT experienced its astir important regular outflows since its January 2024 launch, totaling $523.2 million, according to Farside, amid Bitcoin concisely falling to $88,000. At the clip of publication, Bitcoin is trading astatine $92,089, according to CoinMarketCap.

IBIT is having an “ugly stretch,” says ETF analyst

ETF expert Eric Balchunas said connected Wednesday that the IBIT ETF was having an “ugly stretch.”

Related: Crypto speech Kraken submits confidential US IPO filing

“Although YTD flows are inactive astatine an astronomical +$25b (6th overall). All told $3.3b successful full outflows past period from BTC ETFs, which is 3.5% of AUM,” Balchunas said.

Since the IBIT launched successful January 2024, it has posted astir $63.12 cardinal successful nett inflows, according to Farside.

Analysts are divided connected wherever Bitcoin volition spell for the remainder of the year. Bitcoin expert VICTOR precocious said that the existent drawdown is “the adjacent your eyes and bid benignant of range.”

Magazine: Ethereum’s Fusaka fork explained for dummies: What the hellhole is PeerDAS?

1 hour ago

1 hour ago

English (US)

English (US)