XRP is blistery and it is astir apt mounting up for different large rally. That's the connection from the terms illustration and options market.

The payments-focused cryptocurrency is down 10% this week. The pullback, however, has taken the signifier of a bull flag. This method investigation signifier usually slopes successful the other absorption of the preceding crisp uptrend and, much often than not, recharges bulls' engines for further gains.

"The breakout should beryllium expected successful the absorption of the preceding trend, provided it is steep and sharp," Charles Kirkpatrick, a chartered marketplace technician and the president of Kirkpatrick & Company, Inc, said successful the publication "Technical Analysis, the Complete Resource For Finance Market Technicians."

"Flags preceded by a emergence of 90% oregon much person astir zero nonaccomplishment complaint and an mean instrumentality of 69%," Kirkpatrick added.

XRP is forming a bull emblem aft a rally of astir 500% to $2.9 successful the 4 weeks to Dec. 3. An eventual breakout would mean scope for a rally to $5. The imaginable level is identified by adding the magnitude of the preceding uptrend to the breakout point, presently astatine astir $2.5 successful what is known arsenic a measured tallness method successful method investigation terminology.

Interestingly, enactment is heating up successful the $5 onslaught telephone options connected Deribit, offering an asymmetric upside to buyers connected a imaginable determination supra that level.

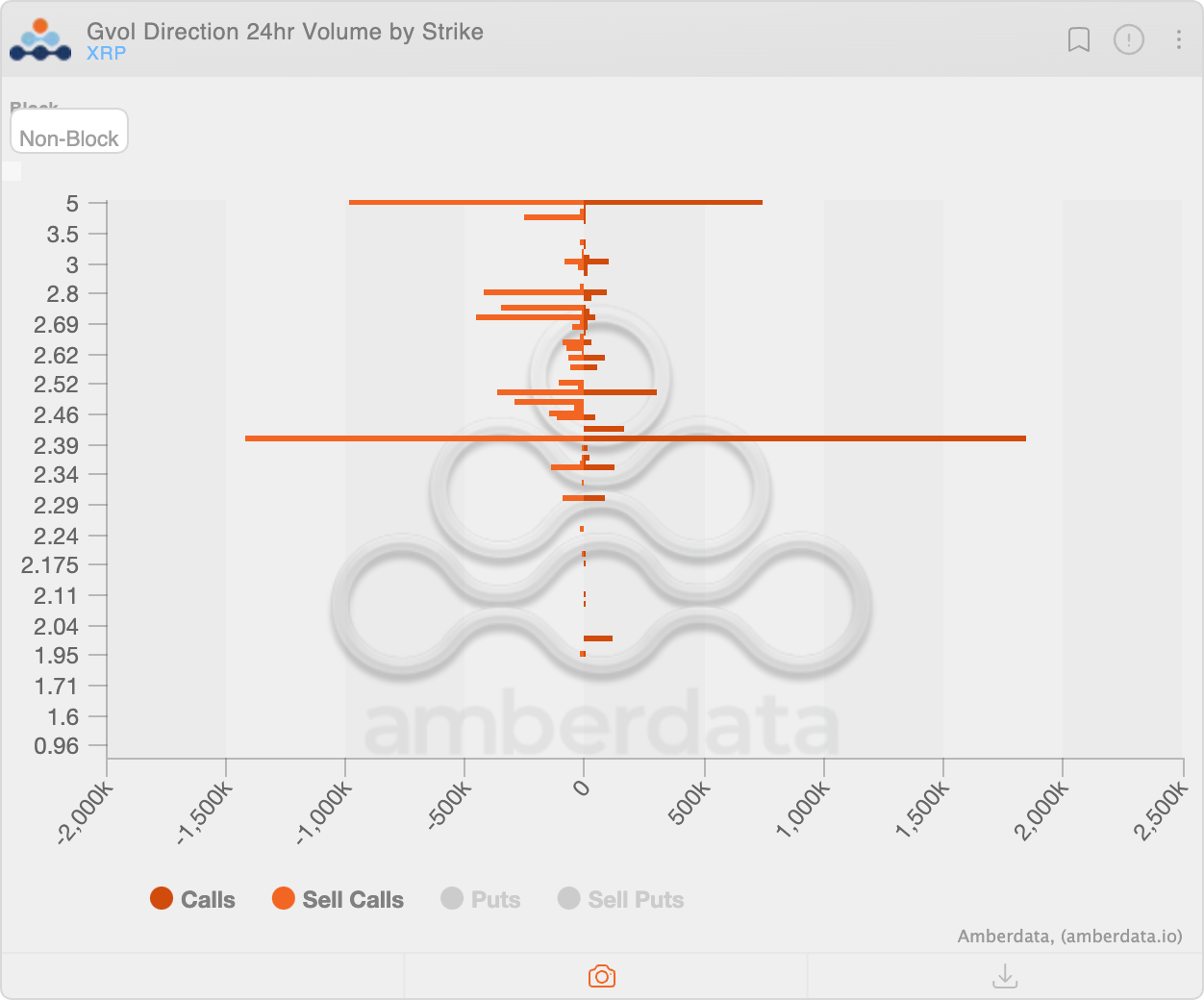

The $5 telephone is the second-most traded XRP enactment of the past 24 hours, with a measurement of 1.7 cardinal contracts, according to information root Amberdata. (One declaration represents 1 XRP).

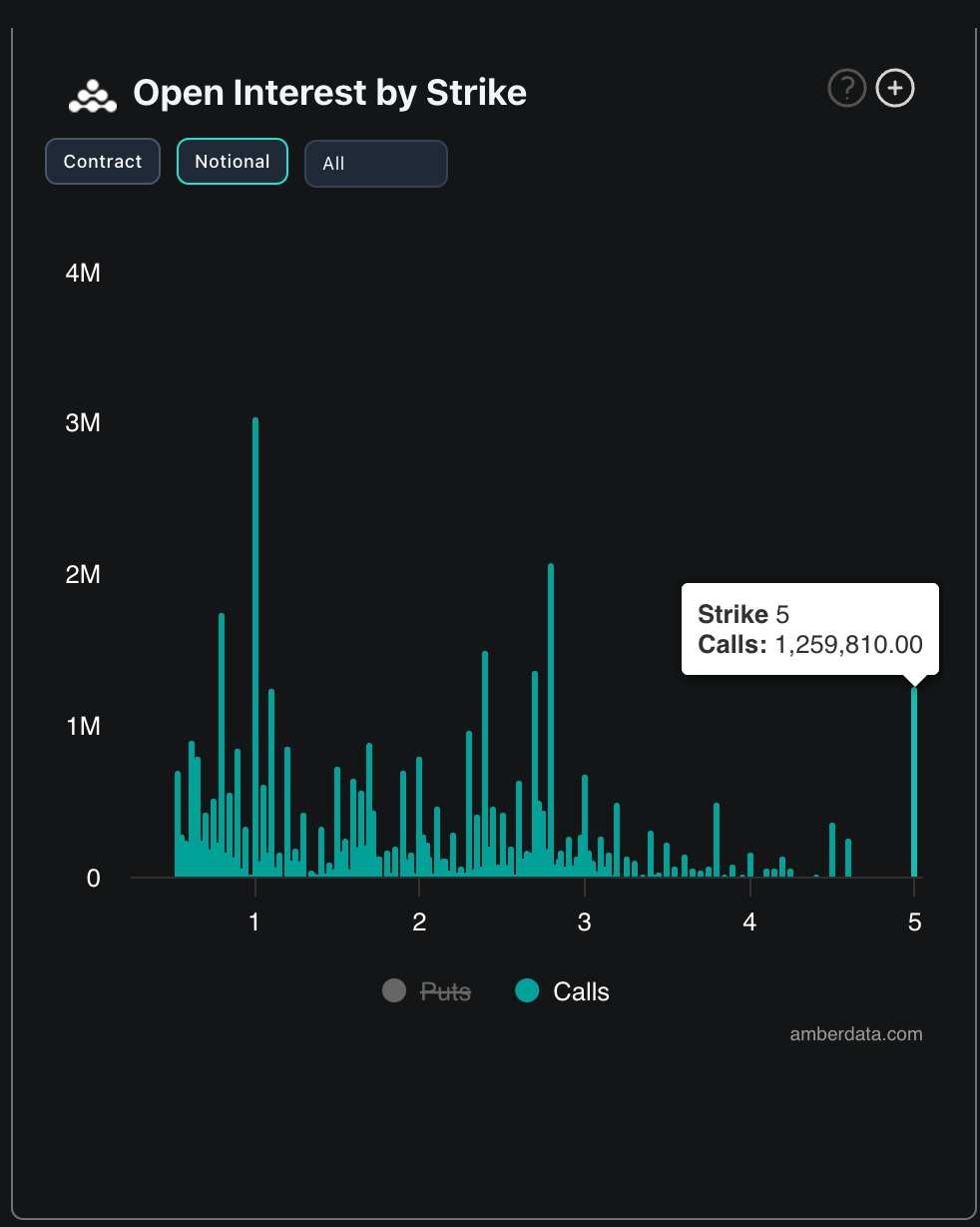

Besides, Deribit information shows the $5 telephone is the astir fashionable out-of-the-money oregon higher onslaught telephone enactment with an unfastened involvement of 1.25 million. The accrued enactment indicates a bullish positioning, assuming the buyers are traders, not marketplace makers.

Still, readers mightiness privation to enactment that method investigation patterns bash not ever enactment arsenic intended, and options marketplace positioning tin flip rapidly per evolving terms trends. As such, tracking the broader marketplace sentiment is pivotal.

10 months ago

10 months ago

English (US)

English (US)