Amidst the planetary question of caller retail investment, France’s Autorité des Marchés Financiers (AMF) has observed a important uptick successful the fig of individuals holding crypto assets. A survey conducted by the AMF, supported by the Technical Support Instrument of the EU, reveals that arsenic of 2023, 9% of French adults ain crypto assets.

Young French Investors Favor Crypto Over Stock Market, AMF Study Shows

The AMF survey, which included implicit a 1000 caller retail investors successful France, shows that 24% of French adults person investments successful assorted fiscal instruments. Among these, a notable proportionality has invested successful cryptocurrencies. While accepted investments proceed to predominate portfolios, the inclination towards crypto assets, particularly among the youth, highlights a generational displacement successful concern preferences and the progressive adoption of integer concern solutions successful the country.

The illustration of these caller investors is younger and much divers than ever before, with an mean property of 36 years and a important information being nether 35. The information indicates that these individuals are not conscionable looking for fiscal maturation but are besides influenced by societal phenomena and integer trends. The emergence successful crypto asset ownership is peculiarly pronounced among this demographic, suggesting a correlation betwixt age, integer savviness, and concern choices successful emerging technologies.

“New investors put little often successful the banal marketplace than accepted investors,” the AMF survey details. “Many person taken an involvement successful crypto-assets: 54% of them ain immoderate (63% of caller investors aged 25-34), compared with 25% of accepted investors.”

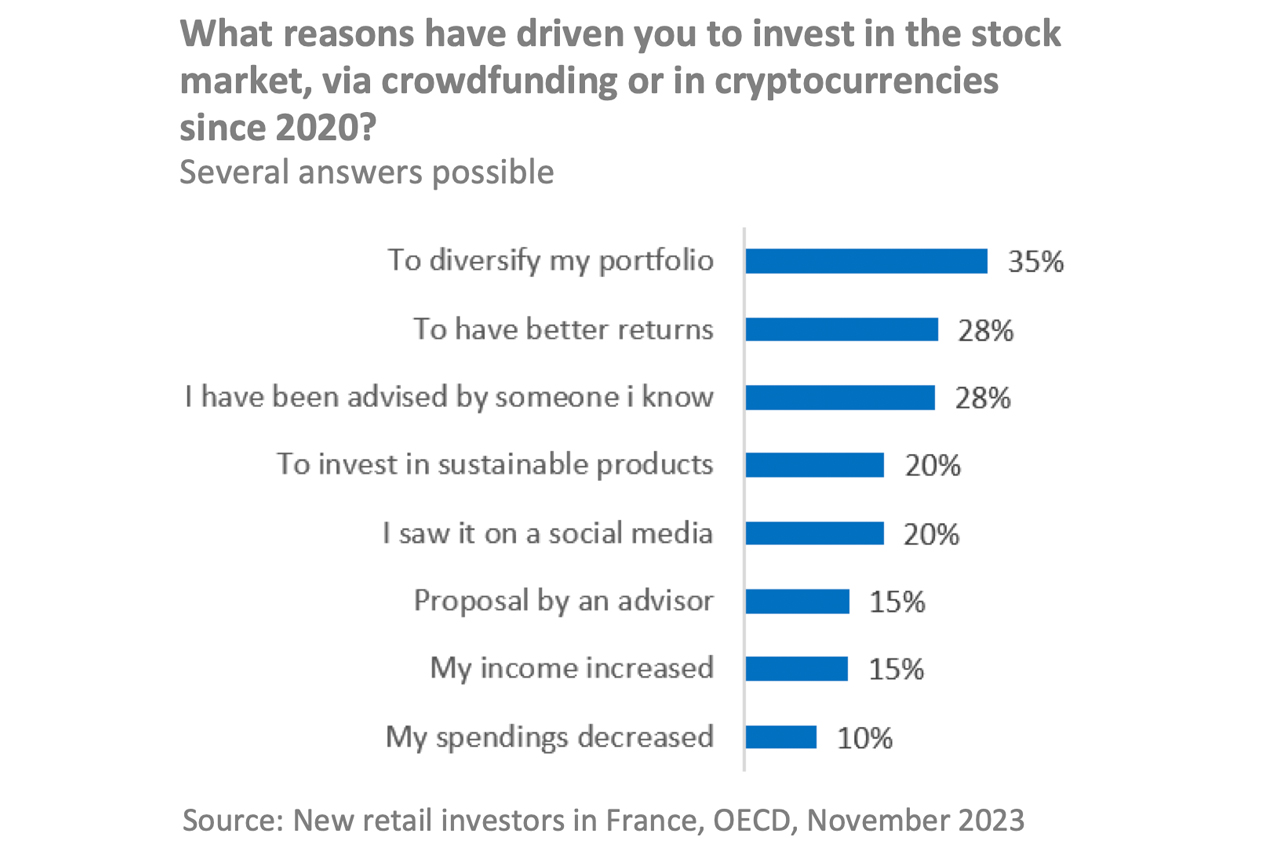

Motivations for investing among the French are varied, but the communal threads see seeking higher returns and diversifying savings. Interestingly, societal networks and adjacent influences person go important factors, with galore caller investors drawn to the marketplace by what they observe online oregon perceive from acquaintances.

While the enthusiasm for crypto assets is evident, the survey besides sheds airy connected the hazard illustration and concern amounts. A bulk of caller investors follow a cautious approach, preferring moderate-risk investments, with emblematic investments successful crypto assets averaging astir €4,070.

The AMF survey further highlights a concerning spread successful fiscal literacy among caller investors. Misconceptions astir concern fundamentals specified arsenic hazard diversification and the interaction of ostentation are common, contempt a self-reported overestimation of their fiscal understanding. The AMF researchers remark that this disconnect points to the request for enhanced fiscal education, peculiarly arsenic caller concern forms similar crypto assets go progressively mainstream.

What bash you deliberation astir the AMF survey? Share your thoughts and opinions astir this taxable successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)