Some 41% of cardinal banks that participated successful the Official Monetary and Financial Institutions Forum (OMFIF) survey said they expect to person an operational cardinal slope integer currency (CBDC) by 2028. The survey recovered that the sentiment towards CBDCs is turning affirmative with 30% of the respondents having go much inclined to contented a integer currency successful the past 12 months.

17% of Respondents Rule retired CBDC Deployment

As per the latest Official Monetary and Financial Institutions Forum (OMFIF) survey study, 41% of cardinal banks expect to person an operational cardinal slope integer currency (CBDC) by 2028, portion adjacent to 70% anticipation to person 1 wrong 10 years. However, 17% of the cardinal banks that participated successful the survey person ruled retired launching one.

The survey recovered that the sentiment towards CBDCs is turning affirmative with 30% of the respondents having go much inclined to contented a integer currency successful the past 12 months. According to the survey report, this alteration of bosom could good suggest that the exploratory enactment and feasibility studies carried retired by cardinal banks are producing results.

Low CBDC Adoption a Key Concern

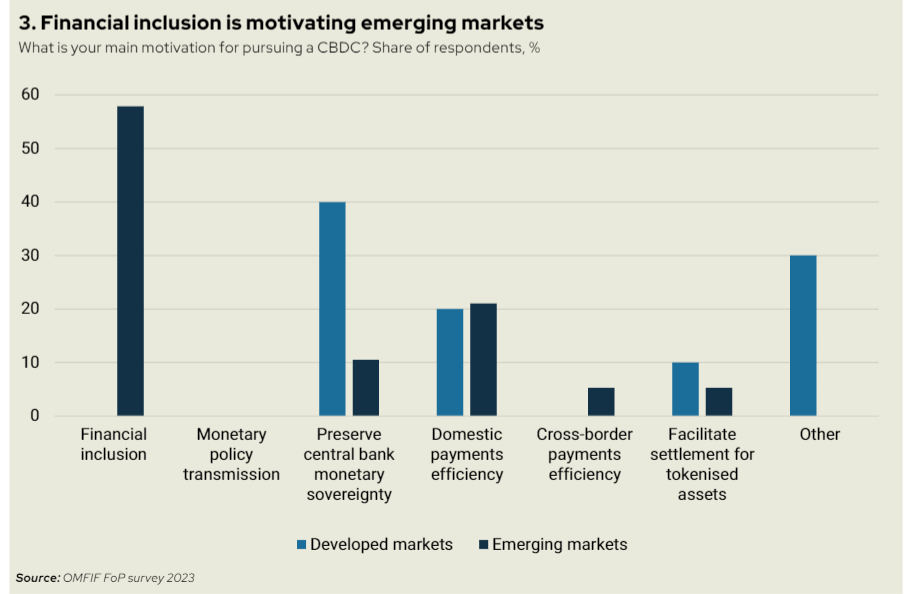

Regarding the evident divided betwixt the cardinal banks’ reasons for wanting to contented CBDCs, the OMFIF study states:

For the bulk of emerging marketplace respondents, the wide information is to amended fiscal inclusion. For galore developed marketplace cardinal banks, it is much of a antiaircraft play to sphere monetary sovereignty.

Only 1 successful 5 of the respondents cited the ratio of outgo systems arsenic their information for seeking to deploy CBDCs.

The survey findings meantime bespeak that 68% of cardinal banks from the developed markets spot the debased adoption of CBDCs arsenic a cardinal concern. They besides place imaginable slope disintermediation arsenic their 2nd highest concern. However, for respondents from emerging markets, lone 37% identified debased adoption of CBDCs arsenic their superior concern. A akin percent of the cardinal banks mention cybersecurity arsenic their main concern.

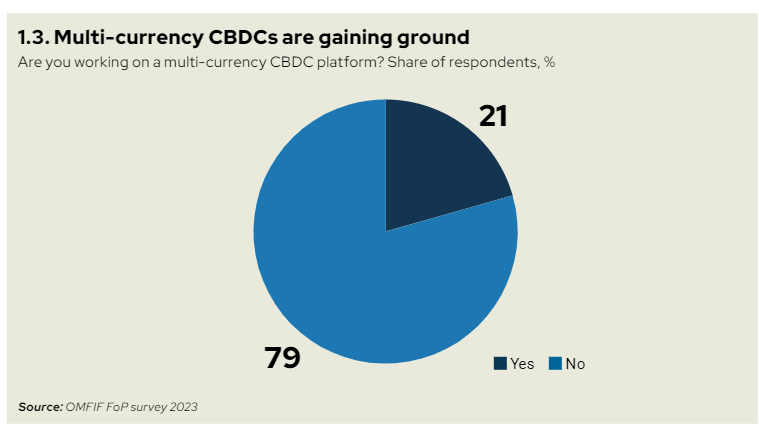

As the fig of progressive CBDCs grows, galore players successful the backstage assemblage spot know-your-customers capacity, wallet provision, and outgo processing arsenic cardinal areas of collaboration. The survey besides recovered that the conception of cross-border CBDC networks is becoming popular.

What are your thoughts connected this story? Let america cognize what you deliberation successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)