As the chances of a Bitcoin exchange-traded money (ETF) being approved rise, six-figure BTC terms predictions are besides becoming progressively common, peculiarly present that the April 2024 halving is little than 180 days away.

BTC terms humanities patterns, halving

Bitcoin’s (BTC) terms trends often grounds cyclical behavior. Analysts person drawn parallels betwixt the existent terms trajectory and humanities patterns, suggesting a imaginable bullish rhythm reminiscent of 2013 to 2017.

BTC/USD 1-month illustration (Bitcoin halving marked successful yellow). Source: TradingView

BTC/USD 1-month illustration (Bitcoin halving marked successful yellow). Source: TradingViewSimilarly, Bitcoin’s humanities bull runs thin to travel four-year cycles, often spurred by events similar the halving, which reduces the complaint astatine which caller BTC is created and earned by miners.

The adjacent halving lawsuit volition hap successful April 2024, and traditionally, bull runs tin start months earlier and proceed until the terms of Bitcoin reaches a caller all-time high.

The cyclical quality of Bitcoin's terms is hard to deny. pic.twitter.com/q3RJ1i2blk

— filbfilb (@filbfilb) November 1, 2023In fact, predictions that Bitcoin’s terms volition reach over $100,000 are becoming much commonplace present that the halving is little than 180 days away.

Related: Bitcoin halving 2024: Everything you request to know

But portion immoderate judge the upcoming halving volition beryllium the most important yet, others reason that it may play retired differently this clip around.

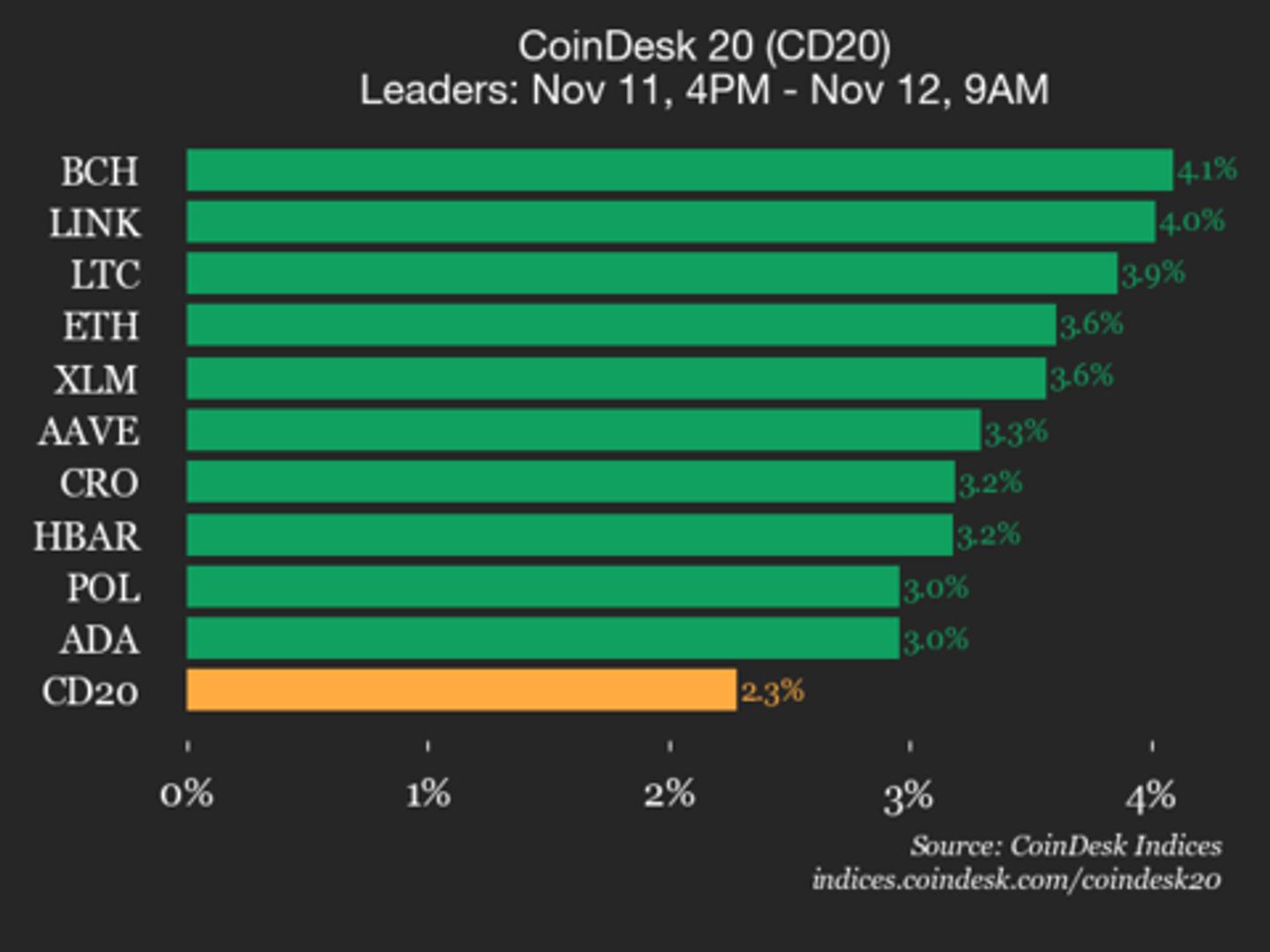

Bitcoin accumulation: Not lone whales

Significant stakeholders are showing assurance successful Bitcoin by expanding their holdings. On-chain analytics person revealed a inclination reversal, wherein large investors are trading stablecoins for much Bitcoin, which could perchance adhd momentum for a rally beyond $35,000.

More importantly, Bitcoin “whales,” oregon entities with astatine slightest 1,000 BTC, are showing signs of accumulation, which has historically preceded large rallies.

Bitcoin: Point-in-time accumulation inclination score. Source: Glassnode

Bitcoin: Point-in-time accumulation inclination score. Source: GlassnodeGlassnodes information shows Bitcoin’s Accumulation Trend Score is presently 1 (chart above), indicating that connected aggregate, larger whale entities, which are a large portion of the network, are accumulating.

Additionally, smaller entities person acceptable accumulation records, breaking caller highs throughout 2023.

Bitcoin ETF support becoming likely

The treatment surrounding Bitcoin ETFs in the United States has been gaining momentum.

Bloomberg ETF analysts person upgraded the likelihood of a Bitcoin ETF approval to 65%. If approved, specified an ETF could pull much organization investors into the abstraction and positively interaction the cryptocurrency’s price.

Main instrumentality distant of today: Bitcoin makrket Cap went up by much than $50 cardinal successful minutes, and precise apt the wealth flowing into Bitcoin were little than $500 cardinal (ratio 100:1)

A erstwhile Blackrock Director said that we tin expect $150-200 cardinal flowing into Bitcoin successful 3…

A Bitcoin ETF is expected to trigger monolithic demand from institutions, according to EY.

Crypto marketplace sentiment upswing

The cryptosphere’s Fear & Greed Index, a barometer of capitalist sentiment, registered a notable people of 72, hinting astatine prevailing “greed” successful the market.

The Fear & Greed Index registered a people of 72, which represents “greed.” Source: Alternative.me

The Fear & Greed Index registered a people of 72, which represents “greed.” Source: Alternative.meThis displacement successful marketplace sentiment has been a precursor to terms rallies successful the past and could beryllium an indicator of an upcoming bull run. Interestingly, this is the highest level of “greed" since November 2021, erstwhile Bitcoin reached its all-time precocious terms of $69,000.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 years ago

2 years ago

English (US)

English (US)