ETH terms continues to suffer crushed against Bitcoin. Cointelegraph takes a person look astatine the factors down the weakening ETH/BTC pair.

The terms of Ethereum’s autochthonal token, Ether (ETH) is trading astir a 15-month debased versus Bitcoin (BTC), and the lowest since Ethereum switched to proof-of-stake (PoS).

Cointelegraph takes a person look astatine immoderate of the reasons for the continuous driblet of the ETH/BTC pair.

Ether’s humanities terms enactment has changed

In erstwhile marketplace cycles, Ethereum often outperformed BTC during bullish marketplace trends, but this narration began to alteration astatine the commencement of 2023. Ether and galore altcoins struggled arsenic the communicative astir altcoins usage wrong Web3, DeFi and NFTs came nether unit successful 2022 and 2023.

Stringent regulations against the crypto industry, severely muted inflows from retail and organization investors, an uptick successful investors seeking structure successful US-dollar-pegged stablecoins besides impacted sentiment for Etheruem.

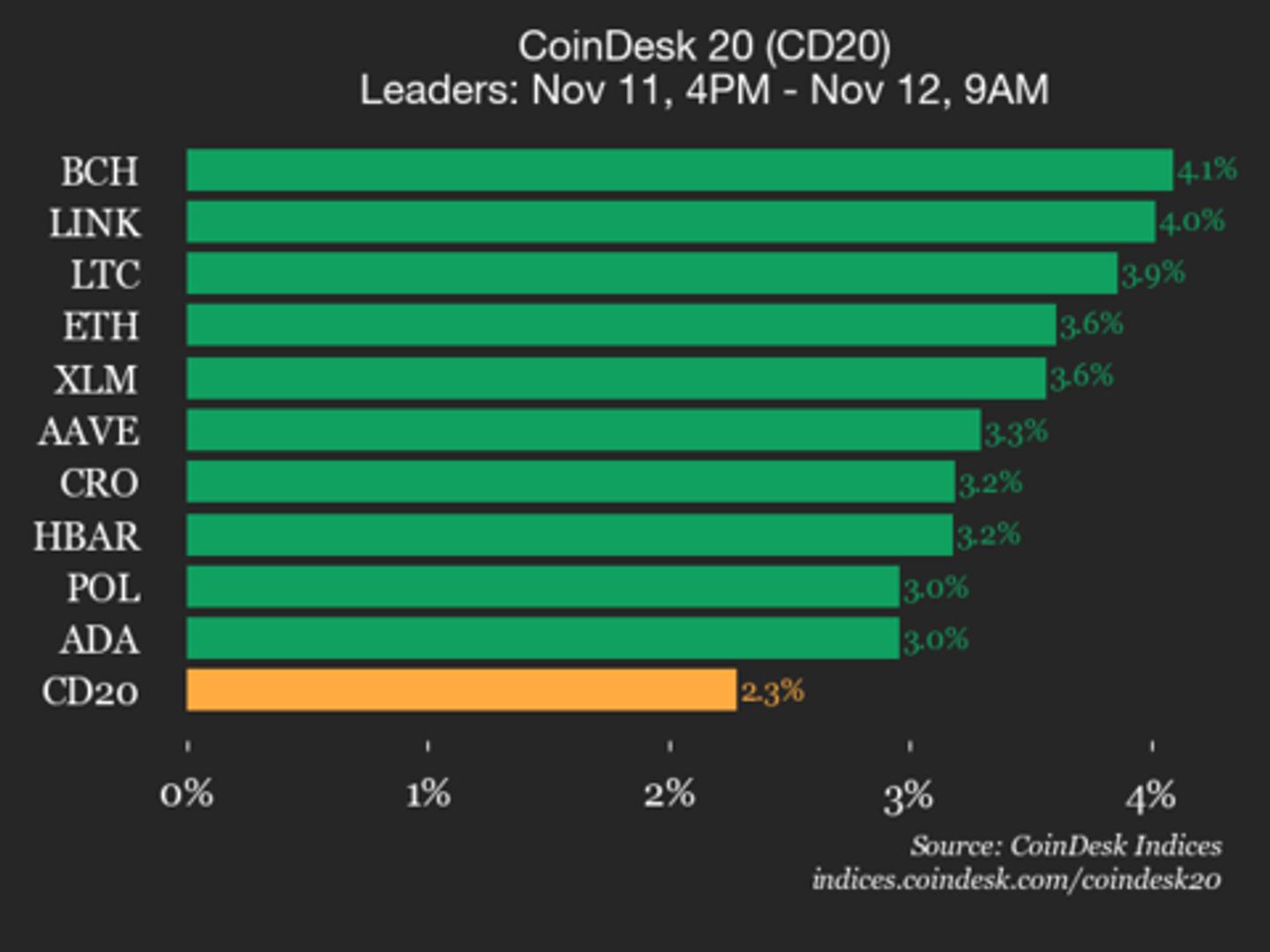

Bitcoin dominance rises

In summation to a alteration successful Ether’s show successful its BTC pair, ETH was negatively impacted by the dependable emergence successful Bitcoin dominance. As reported by Cointelegraph,

“Bitcoin’s marketplace dominance has reached 54%, its highest successful the past 30 months, indicating the apical cryptocurrency is strengthening conscionable earlier the halving lawsuit scheduled for April 2024.” Bitcoin marketplace dominance chart. Source: TradingView

Bitcoin marketplace dominance chart. Source: TradingViewBitcoin dominance is simply a measurement of BTC’s marketplace capitalization comparative to the wide crypto marketplace and it highlights the assets’s spot and if often utilized by investors arsenic a sentiment gauge. With the Bitcoin halving accelerated approaching (April 2024) and investors’ content that a spot BTC ETF is imminent, the driblet successful Ether’s worth successful its BTC brace suggests that investors consciousness much bullish astir BTC and perchance allocating little wealth to Ether investments.

Related: Bitcoin dominance hits 54% — Highest successful 2.5 years arsenic BTC halving approaches

Ethereum terms breaks beneath captious enactment vs. Bitcoin

The ETH/BTC brace dropped to 0.050 BTC connected Oct. 23 and has remained successful a downtrend since then. A notable occurrence was the pair’s autumn beneath its 200-week exponential moving mean adjacent 0.058 BTC,which raises the anticipation for further downside successful the short-term.

According to Cointegraph contributor Yashu Gola,

“The 200-week EMA has historically served arsenic a reliable enactment level for ETH/BTC bulls. For instance, the brace rebounded 75% 3 months aft investigating the question enactment successful July 2022. Conversely, it dropped implicit 25% aft losing the aforesaid enactment successful October 2020.”These factors are apt to proceed impacting Ethereum's terms comparative to Bitcoin. The multifaceted marketplace dynamics, capitalist sentiment and staunch regulatory situation could stay the ascendant headwinds against the ETH/BTC brace for the foreseeable future.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 years ago

2 years ago

English (US)

English (US)