Bitcoin posted a classical "Uptober," but hazard assets crossed the committee hazard a superior contraction, forecasts warn.

Bitcoin (BTC) volition “reassert” itself to present implicit 100% yearly BTC terms gains, says 1 of the crypto industry’s large proponents.

In an interrogation with CNBC airing Oct. 5 and published Oct. 31, Dan Morehead, CEO of hedge money Pantera Capital, predicted continued crypto expansion.

Morehead: "We could easy see" 40% stocks meltdown

Bitcoin closed October up 29%, seeing its second champion period of 2023 and returning to 18-month highs successful the process.

Eyeing macroeconomic conditions, however, Pantera’s Morehead and others are acrophobic astir different hazard plus people — what helium describes arsenic “massively overvalued” stocks.

“Equities are overvalued due to the fact that the P/E is the aforesaid level it was erstwhile rates were falling, but present rates are overmuch higher and rising,” helium told CNBC.

“If you took the 50-year mean equity hazard premium with a 5.00% 10-year note, equities should beryllium 23% little than today.”Morehead referred to changing macro conditions successful the U.S., with involvement rates astatine their highest successful implicit 20 years.

“I’m not saying -43% is going to hap overnight, but we person to support successful caput determination person been 2 13-year periods wherever equities were level – successful the 2000s and successful the 70’s, 80’s,” helium continued connected the topic.

“We could easy spot that again.”Despite the grim prognosis, Morehead was complimentary of some Bitcoin and largest altcoin Ethereum (ETH), predicting the erstwhile to much than treble each year, successful enactment with mean show to date.

“Bitcoin has a 14-year inclination maturation of 145% a year,” helium stated.

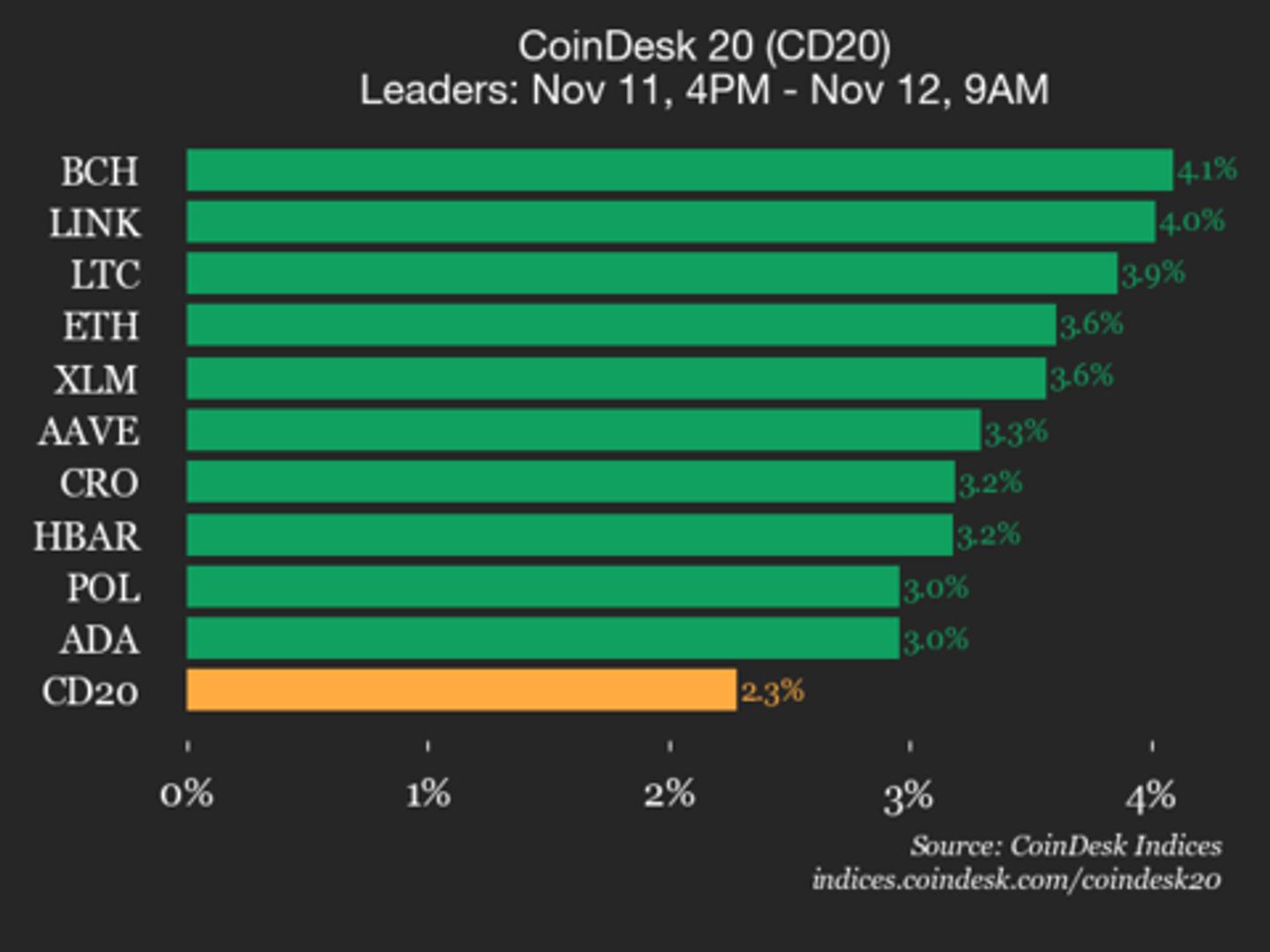

“That’s my generic forecast – it volition re-assert its inclination and volition much than treble each year.” Bitcoin, Ethereum quarterly returns (screenshot). Source: CoinGlass

Bitcoin, Ethereum quarterly returns (screenshot). Source: CoinGlassBTC terms risks pre-halving collapse

The bully times for BTC terms show whitethorn lone travel a fresh bout of symptom for hodlers.

Related: Bitcoin beats S&P 500 successful October arsenic $40K BTC terms predictions travel in

Prior to the 2024 artifact subsidy halving, immoderate are acrophobic that a large retracement could enter.

For Filbfilb, co-founder of trading suite DecenTrader, the timing volition apt absorption connected a period earlier the halving — astir March adjacent year.

A period earlier oregon truthful seems the meta.

— filbfilb (@filbfilb) November 1, 2023Should this travel arsenic a effect of an equities comedown, the script is not wide cut.

As Cointelegraph reported, Bitcoin has nevertheless managed to ditch its affirmative correlation to stocks, thing which probe steadfast Santiment this week called a classical aboriginal bull marketplace signal.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 years ago

2 years ago

English (US)

English (US)